Welcome to our December Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

2022 Words of the Year

Oxford and Merriam-Webster released their respective 2022 word of the year. For the first time, the Oxford dictionary allowed the public to vote, and they chose Goblin Mode. It’s “a type of behavior which is unapologetically self-indulgent, lazy, slovenly or greedy, typically in a way that rejects social norms or expectations.” But, of course, you already knew that. Because we told you about it before. No, we did. You just don’t remember. By the way, Merriam-Webster’s word of the year is Gaslighting (the act of misleading someone). (Source: Smithsonian & Merriam-Webster)

FTX

Sam Bankman-Fried was arrested in the Bahamas at the request of the United States. More below.

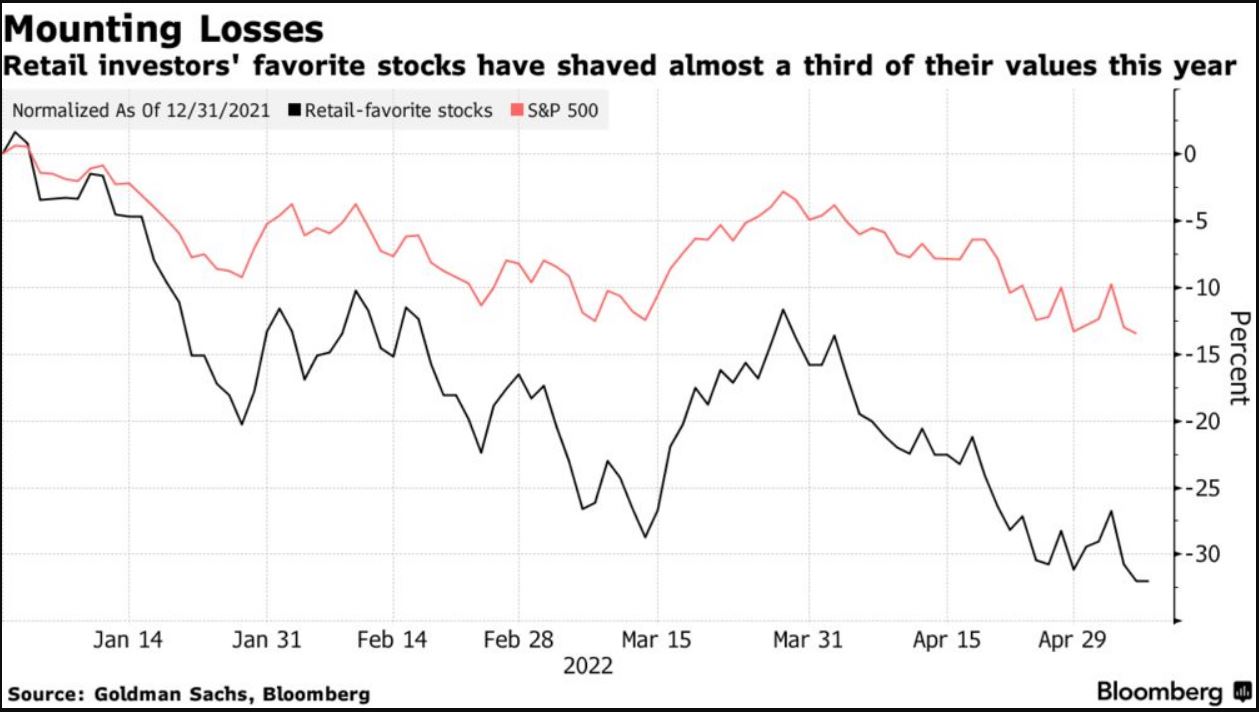

Downfall of the Retail Investor

In January of 2021, I wrote about a shift in power in the stock market, from ‘pros’ to the everyday retail investor. At the time, GameStop and AMC were blowing up and daily trading volume was touching new records. The amateurs were thriving. As inflation and interest rates have increased, the high-flying growth stocks have fallen. And the retail investors have been the big losers. According to Bloomberg, individual investors have lost a combined $350 billion this year, with an average loss of -30%, compared to a -17% loss in the S&P 500 (at the time). Average daily trades have nearly halved, and the once retail-darling Robinhood lost 1.8 million users between Q2 and Q3 this year. (Source: Morning Brew)

Gated

Earlier this month, Blackstone, the giant private real estate investment company, began limiting withdrawals from their flagship BREIT for the first time in its history. The fund’s quarterly redemption limit of 5% was reportedly met by the end of October, so further requests likely won’t be met. Some are worried the gating could spark fear in investors causing a run on the fund, then forcing Blackstone to come up with liquidity in a generally illiquid market (real estate). But, that’s exactly why the redemption limits are there – to avoid such runs. According to Blackstone, the redemption requests are largely due to rebalancing, not full account liquidation. (Source: Barron’s)

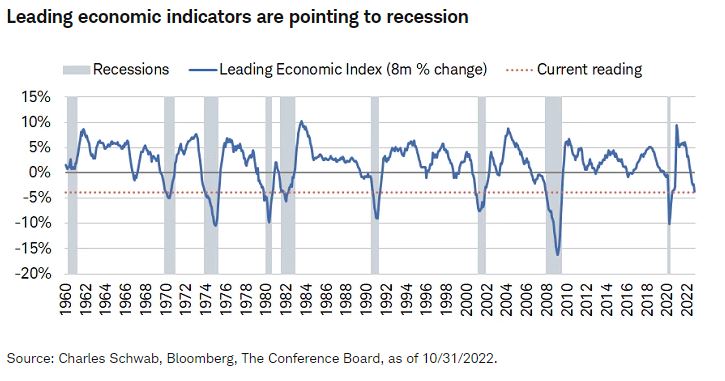

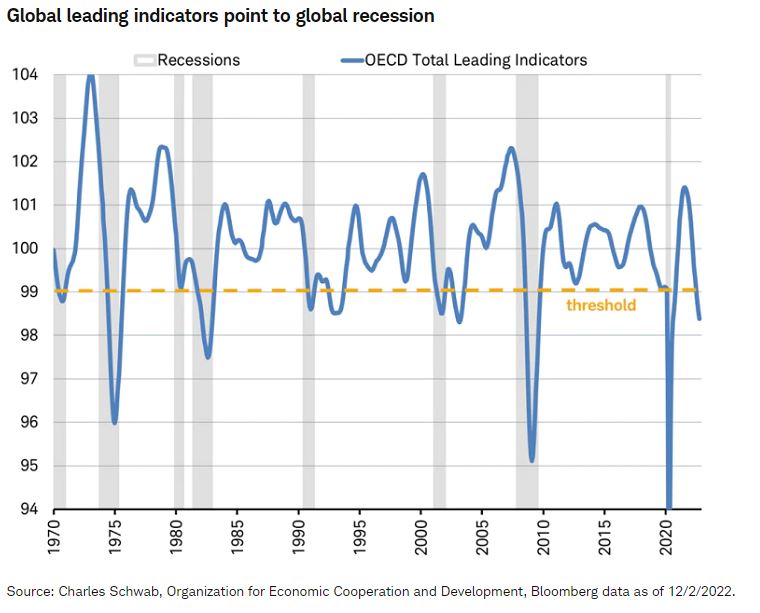

Recession Could be Looming

It’s not something any of us want to hear, but the leading economic indicators are pointing to a recession. Even the Fed in their latest report is forecasting a recession. Their 2023 unemployment expectation is 4.4%. That’s 0.7% higher than the current rate. In the second chart below, the Organization for Economic Cooperation and Development [OECD] produces a leading indicator for economic production. A drop below 99 “tends to happen right around the start of a global recession.” However, it’s important to remember one of the best forward-looking indicators is the stock market. “The market almost always bottoms well before a recession is over, and sometimes before we even know that we’re in a recession.” (Source: Schwab & JPMorgan)

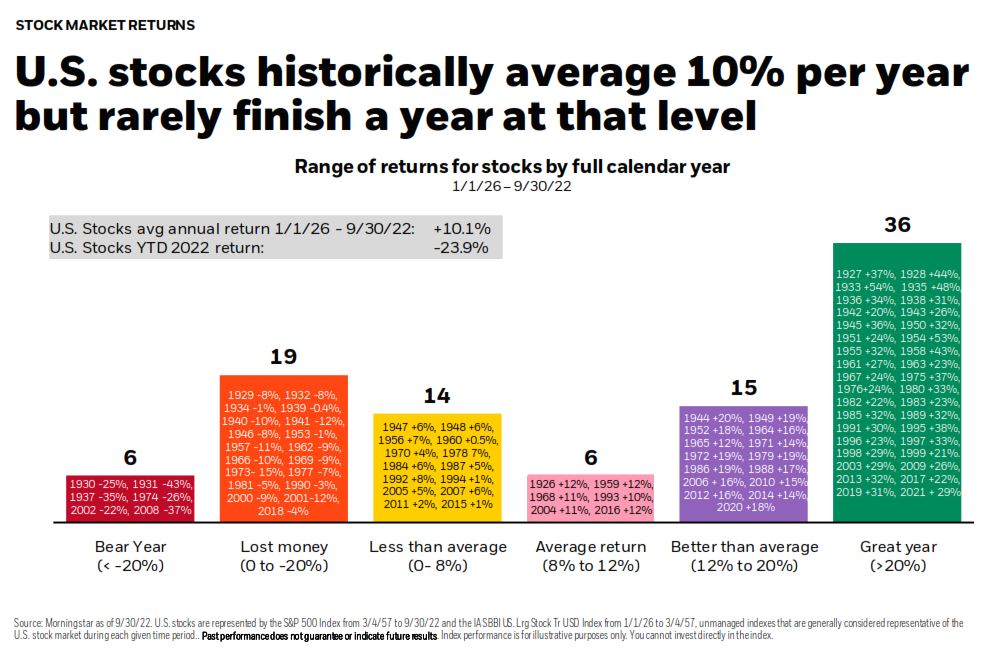

Market Averages, One More Time

Kurt wrote about this in the October Market Commentary and I mentioned it again in Viewpoints, but we feel this is an important idea to remember. The average annual return for US stocks since 1926 is 10.1%. Looking at the graphic below, the bracket containing the average has only occurred 6 times. This is further confirmation that the average isn’t necessarily normal. (Source: BlackRock)

ChatGPT

Research institute OpenAI has developed a highly advanced AI chatbot. Who better to explain what it is than the system itself? “GPT-3, or Generative Pretrained Transformer 3, is a large language processing model developed by OpenAI. It is a state-of-the-art model that uses machine learning techniques to generate natural-sounding text based on a given input. GPT-3 is trained on a massive amount of data, allowing it to generate high-quality text that can be used in a variety of applications, such as language translation, text summarization, and question-answering. GPT-3 is considered one of the most advanced language processing models currently available, and has attracted significant interest from researchers and developers in the AI community.” (Source: chat.openai)

More on FTX

The second largest cryptocurrency exchange, FTX, declared bankruptcy after a tumultuous 10 days in early November. The event is still unfolding, but enough has been uncovered to start to get an idea about what happened. About what brought a company valued at $32 billion down to $0 in a little over a week? The collapse of FTX can be boiled down to a good ol’ fashion ‘bank run’ with a side of alleged fraud.

In 2017, former CEO Sam Bankman-Fried [SBF] founded a hedge fund called Alameda Research after graduating from MIT. The fund found early success arbitraging bitcoin* across different markets. After building assets, the fund began expanding by investing in different crypto projects. The fund became a crypto market maker for bitcoin and other tokens, acting as the buyer and/or seller for investor’s transactions. In 2019, SBF founded the cryptocurrency exchange FTX off the back of his hedge fund Alameda Research. The timing was absolutely right for Alameda and FTX, as the bitcoin market cap ballooned from $16 billion in 2017 to $132 billion by the end of 2019. Over the same period, trading volume increased by more than 8,000%. It’s no surprise, then, by 2021 SBF had grown FTX into a crypto exchange valued at $18 billion dollars.

On November 2nd, CoinDesk reported the relationship between FTX and Alameda Research, both of which are SBF-led companies, have a much closer relationship than what was made public. The hedge fund’s largest asset was $3.66 billion of FTT coin. A cryptocurrency created and issued by FTX. They also had another $2.16 billion of FTT collateral. Essentially, nearly half the value of the hedge fund is comprised of assets created and distributed by his own company, not an independent asset like fiat currency (dollars or euros, for example). For investors in the token, like Binance CEO Changpeng Zhao [CZ], this cozy relationship came as a blaring red flag.

Binance is the single largest crypto exchange and rival to FTX. On November 6th, the Binance CEO tweeted he is planning to sell all of their FTT token investment, more than $500 million worth. The price of FTT quickly fell from $25 to below $22. Over the course of the next two days, FTX saw $5 billion in customer withdrawal requests but did not have the liquidity to meet them. By then, the price of the FTT token had fallen to $6. On November 11th, FTX, Alameda Research, and all other SBF subsidiaries filed for bankruptcy. Sam Bankman-Fried stepped down as CEO and was replaced by John J. Ray III, the same man who stepped in to oversee the liquidation of Enron.

In summary, a report was published implying excess leverage for Alameda Research, leading to the selling pressure of the FTT token. Because FTT was created by FTX, and because of the unusually close relationship between the two companies, FTX clients began trying to withdraw money from the exchange while simultaneously selling FTT. The exchange did not have enough assets to meet the withdrawal demands and was further run dry as the FTX token continued to plummet. All before finally declaring bankruptcy. It’s important to note, the Securities and Exchange Commission [SEC] does not regulate the cryptocurrency market, and these crypto companies do not have to follow the same regulations regarding customer funds that banks do. Crypto companies based in the US have stricter rules to follow than elsewhere, but still not to the extent of a publicly traded company on the stock market.

When John J Ray III took over as CEO, he began submitting documents to the court and some of his comments were startling. For example, Ray stated, “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.”

Alameda and FTX

At first, the only connection between hedge fund Alameda Research and FTX was the founder, Sam Bankman-Fried. Through his years as CEO, he told investors these were completely separate businesses. As we have come to find out, this was an outright lie. The initial discovery from CoinDesk that started the process only uncovered part of it.

Between 2019 and 2021, Alameda and FTX lost a combined $3.7 billion. It’s recently been uncovered that Alameda Research had special trading features. All other investors would be stopped and barred from trading if funds weren’t available and even force positions to liquidate. Alameda was exempt from these safeguards, allowing the fund to rack up losses and debt.

As losses and debt continued to pile up, the fund, courtesy of the SBF connection, began using customer funds. They used these dollars to pay off debt, make risky investments into illiquid crypto projects, buy real estate for FTX employees, donate millions to both political parties, and otherwise steal money for FTX/Alameda gain.

Current FTX CEO John J. Ray III testified before congress on December 13th and said it was, “really just old-fashioned embezzlement.”

On December 12th, SBF was arrested in the Bahamas at the request of the US. The unsealed criminal indictment is alleging wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.