Welcome to our June 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®,

Posted: 6/21/2024

Benchmarking

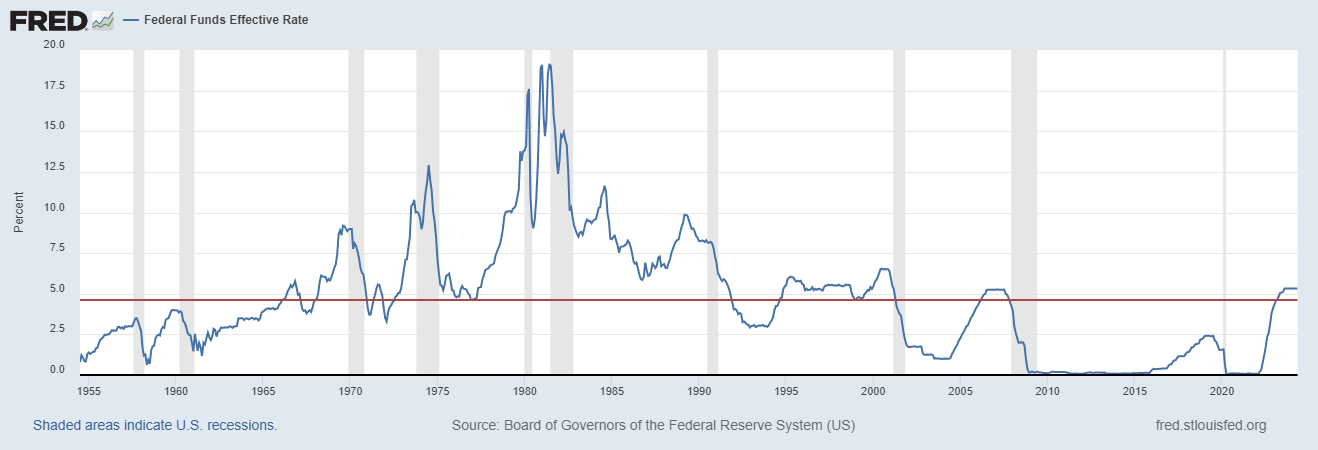

Benchmarking is defined as evaluating or checking something by comparison with a standard. When we think about investments, the benchmark is usually (right or wrong) the S&P 500 index. The trick to benchmarking is picking the right one. Investors with a lower risk tolerance with investments mostly in bonds and cash would likely be confused comparing the performance of their portfolios to the performance of the S&P 500. The same way an investor solely holding international stocks wouldn’t be wise to benchmark against the S&P 500. With the right comparison selected, we can better manage our expectations. I was catching up with a friend recently and he brought this up with interest rates. The idea is that, since interest rates were at or near 0% since mid-2009, 0% is the benchmark many are using now. Thinking that rates will eventually be cut from the current 5.25% down to 0% again. Bringing with it the idea that mortgages could move back down to the 3%’s and car loans to the same territory. But 0% may be the wrong benchmark. The average Fed Funds rate since 1955 is 4.61%, while the Fed has stated their long-run projection is 2.80%. Perhaps expectations for mortgage rates and bond price growth need to be tempered when a more realistic benchmark is used.

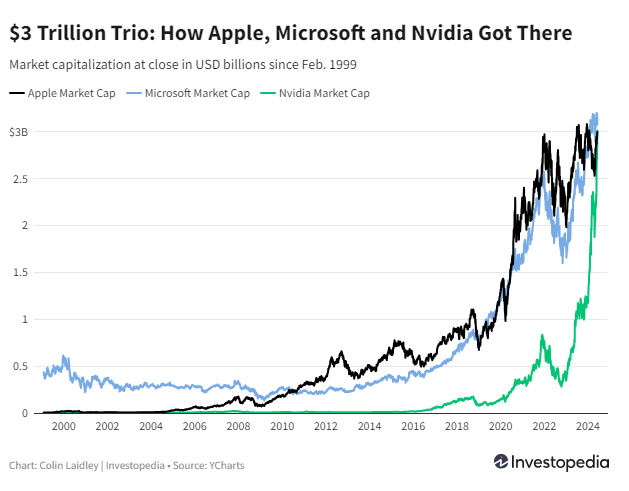

NVDA Market Cap Climb

What a few years it has been for Nvidia. The semiconductor stock has been in the right place at the right time and produced good products to take advantage of the push towards internet-of-everything (chips) and the recent AI push (more chips). As of market close yesterday, 6/20, NVDA sits as the second largest public stock just ahead of Apple and behind only Microsoft. In October 2022, Nvidia had a market cap of $280 billion. In less than two years, the parabolic returns have catapulted the value of the company up to $3.2 trillion, with a T. It’s one good day, or one bad day for Microsoft, away from being number 1.

Reading is Fun!

What’s better or more relaxing than sitting by the pool, the beach, on your porch or deck, the couch, with a great book? I’m sure we can come up with a list, but reading can be a great time. In case you missed it, earlier this month we posted a list of What We Are Reading at PDS. One could argue that some recommendations are better than others (mine rock), but a good book can be found anywhere and everywhere! Have you read anything good lately? We’d love to know!

survey – WHAT ARE YOU READING?

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.