Welcome to our October Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

- I Bonds Projection Lowered: Despite inflation remaining elevated and the Fed funds rate increasing at a faster pace than we’ve seen before, the next 6 months of I Bond interest is expected to decrease. Starting in November, the updated estimate is 6.47%, down from 9.62% for the previous 6 months. Read more for what you need to know about I bonds (Source: Keil Financial)

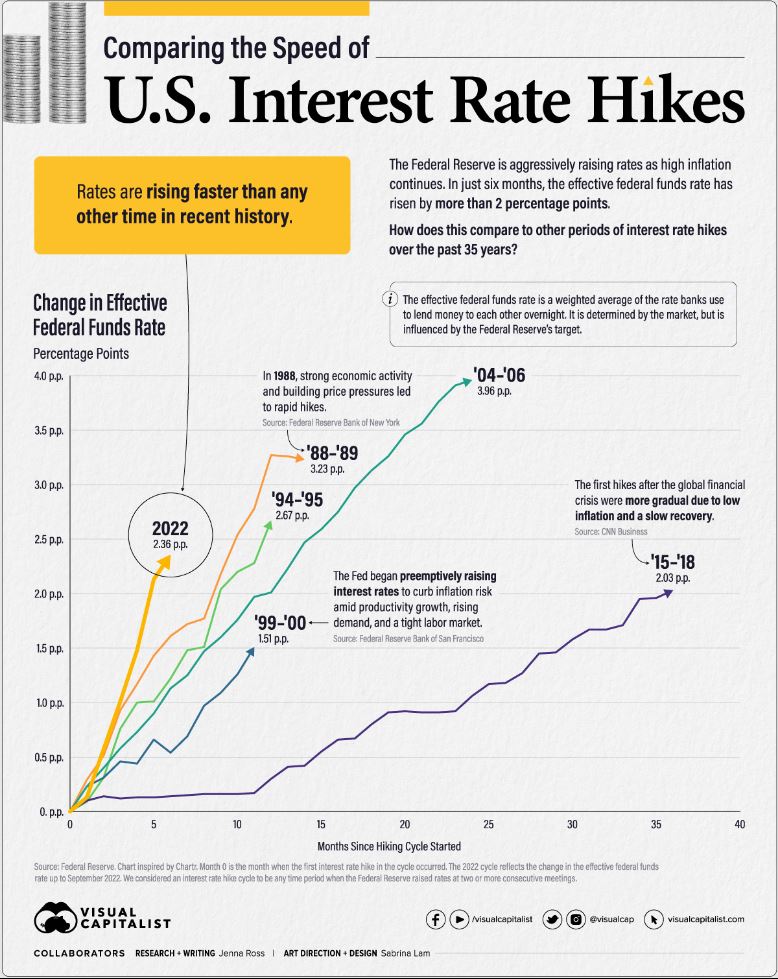

- Of All Time: After the most recent inflation data came in hotter than expected – something I’m sure everyone is tired of hearing – many expect the Fed to raise interest rates another 0.75%. Even without the next rate hike, rates are rising faster than any other time in history. The late 1980’s may exhibit a similar slope near the end of the hiking cycle, but in no other time period have we gone this high this quickly from the start. (Source: Visual Capitalist)

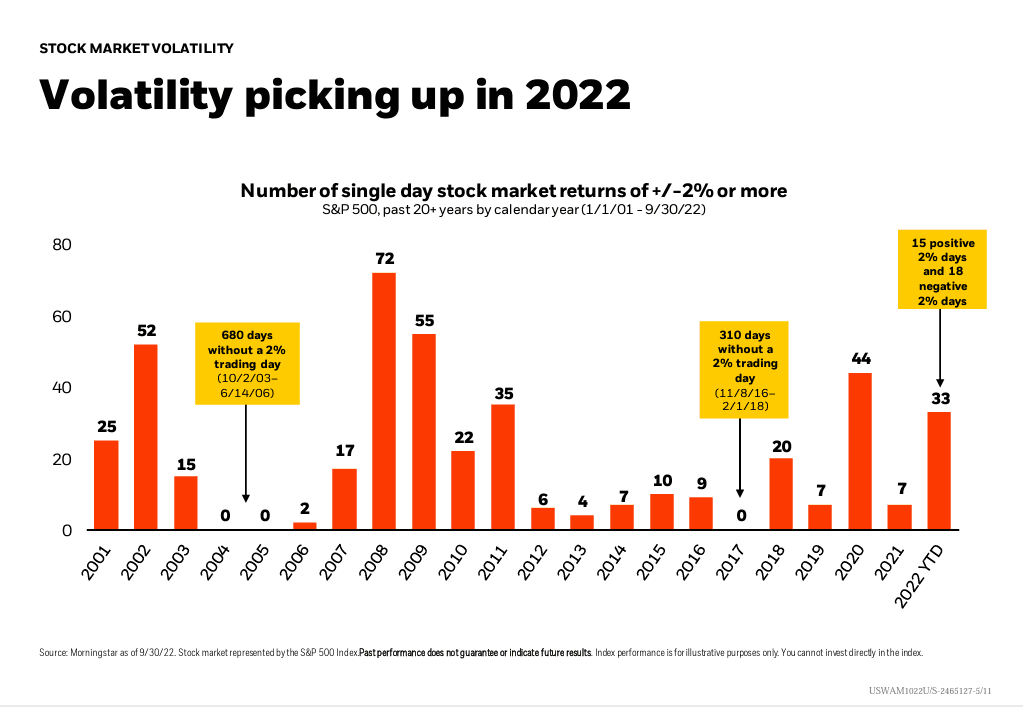

- Volatility Has Picked Up: Kurt wrote about it in the October Market Commentary, “Volatility has certainly picked up, with 25% of all trading days so far this year experiencing declines of 1% or more.” According to BlackRock, there have been 33 days of +/- 2% single day market returns, 18 of which have been negative as of the end of September. (Source: BlackRock)

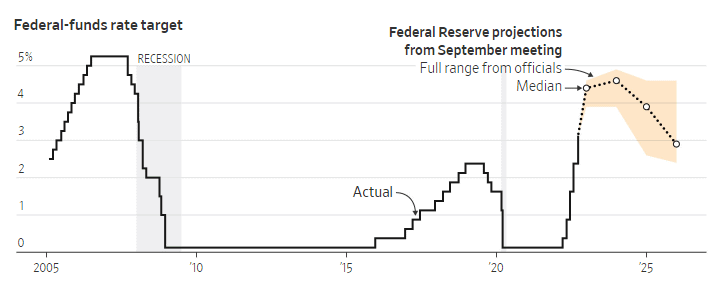

- Projected Interest Rates: We wrote about market predictions back in January, 2021. We began the post with a quote from economist John Kenneth Galbraith, “The only function of economic forecasting is to make astrology look respectable.” So with a grain of salt, below are the Federal Reserve projections through 2025. The expectation is the Fed rate will level out in 2023 and begin to tick down before the 2023 year end. (Source: WSJ)

- Anyone BUT the Phillies: The Philadelphia Phillies are fighting their way to win the 2022 World Series, but would that mean America is heading towards a recession? The last 4 times a Philly team has won the World Series was 1929, 1930, 1980, and 2008, we’ve experienced an economic recession. But, the answer is obviously no. It’s a classic example of correlation not implying causation, but skeptics may still want to root for San Diego… (Source: Morning Brew October 5)

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.