Power of the Retail Investor

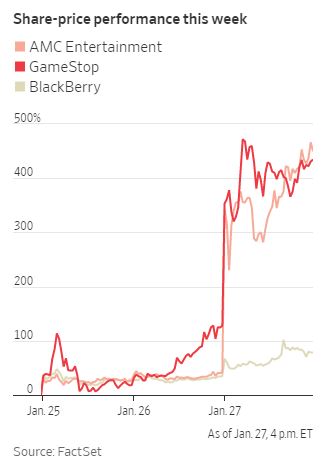

In recent weeks, and more notably recent days, shares of GameStop [GME] and AMC Entertainment Holdings [AMC] have been gobbled up hordes of retail investors. So much so that prices have gone up 320%, and 161% just since Monday, respectively. In “GameStop Mania Reveals Power Shift on Wall Street—and the Pros Are Reeling”, a recent article published in the Wall Street Journal, journalists Gunjan Banerji, Juliet Chung, and Caitlin McCabe explain how this has been happening and the culprit behind these mammoth price movements.

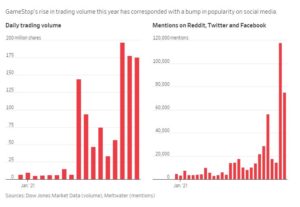

What started as a general conversation about the potential value of GameStop on popular platforms like Reddit, Facebook, Twitter and Discord has turned into an all-out war “between professionals losing billions and the individual investors jeering at them on social media.” So much so that regulators within the SEC are beginning to look into the potential of market manipulation.

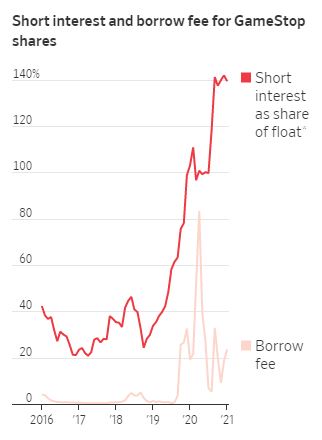

GameStop and AMC alike have been struggling for some time. Many large institutional investors and hedge funds started betting against these companies survival by opening short positions (benefiting when the share prices goes down). Shorting a stock is when the investor borrows shares that are immediately sold at the current market price. To close the position, the investor has to buy back the number of borrowed shares. The net gain comes from the profit of selling the shares, minus the expense to buy them back, minus any interest charged to borrow. The biggest threat to short sellers is the stock price rising quickly resulting in a short squeeze, “a phenomenon that occurs when a stock’s price begins rising, forcing bearish investors to buy back shares that they had bet would later fall to curb their losses.” Forcing the short sellers to buy creates even more demand for the stock pushing the price higher and higher.

The biggest threat to short sellers is the stock price rising quickly resulting in a short squeeze, “a phenomenon that occurs when a stock’s price begins rising, forcing bearish investors to buy back shares that they had bet would later fall to curb their losses.” Forcing the short sellers to buy creates even more demand for the stock pushing the price higher and higher.

Many of the individual retail investors view the current situation with an “us vs. them” mentality. After being at the hands of the large hedge funds and market makers for years, they finally seem to have taking control. Even if only for a short time. “They are encouraging each other to pile into stocks, bragging about their gains and, at times, intentionally banding together to intensify losses among professional traders…” note the authors at the Wall Street Journal. In fact, since the start of 2021, short positions in GameStop have lost a total of $23.6 Billion with over half coming from yesterday alone.

In fact, since the start of 2021, short positions in GameStop have lost a total of $23.6 Billion with over half coming from yesterday alone.

What Next?

It’s certainly fun to watch the share price skyrocket, but it’s only a matter of time before the individual retail investors run out of new money and begin to take their astronomical profits. When it happens, the price will begin to fall. Fast. The company has had a negative net income for the last few years and began closing their stores around the country. Fundamentally, they appear to be on their last legs. But, “fundamentals do not apply to retail traders. It’s all about sentiment.”

While all of this is happening, it’s paramount to remember the importance of investing with a plan. Over short periods of time, asset class returns and individual stocks can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification. While we may experience continued seemingly random sprints of price volatility, rest assured the future is always the same. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, and has consistently resulted in beneficial long-term financial outcomes.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.