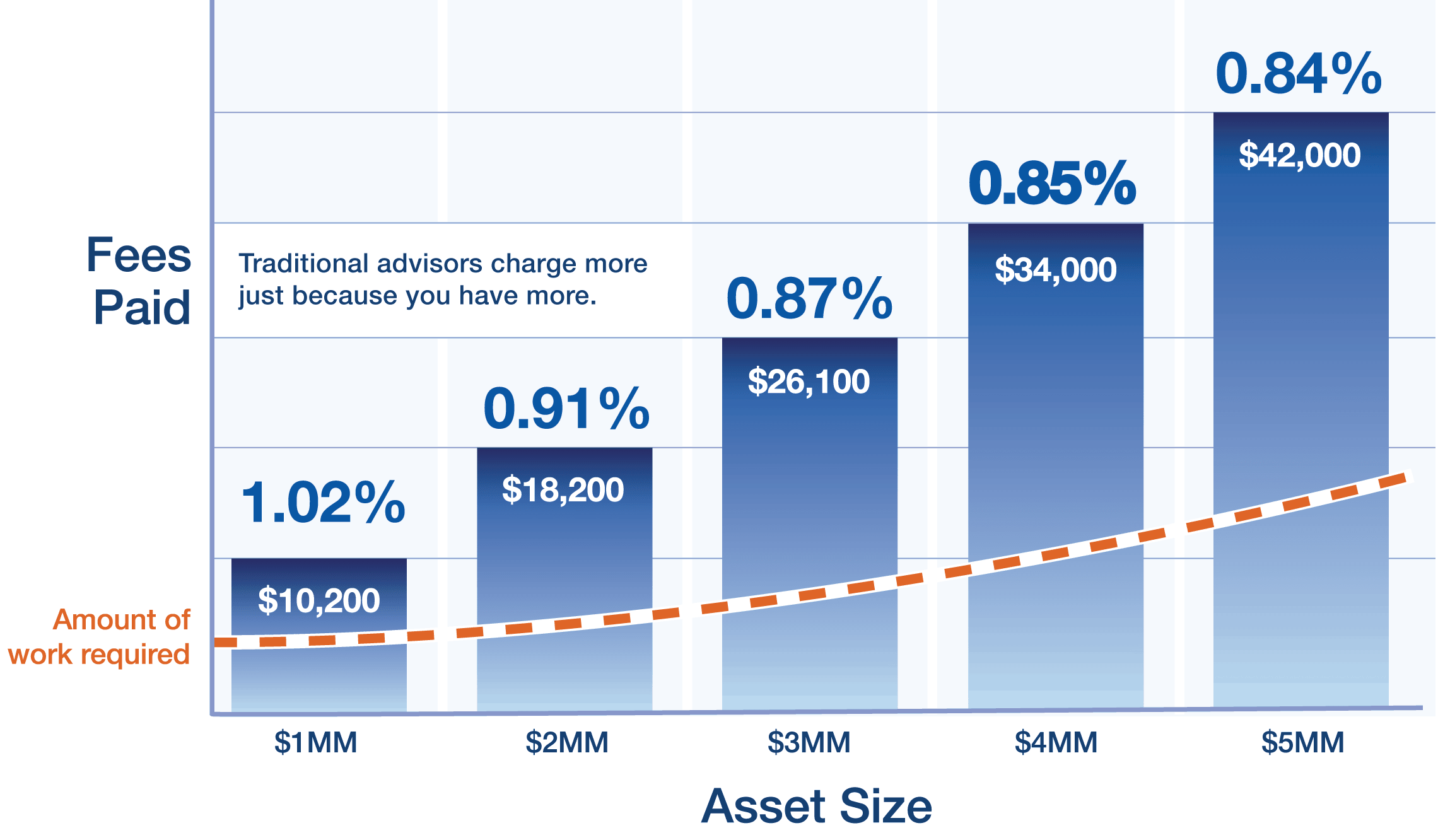

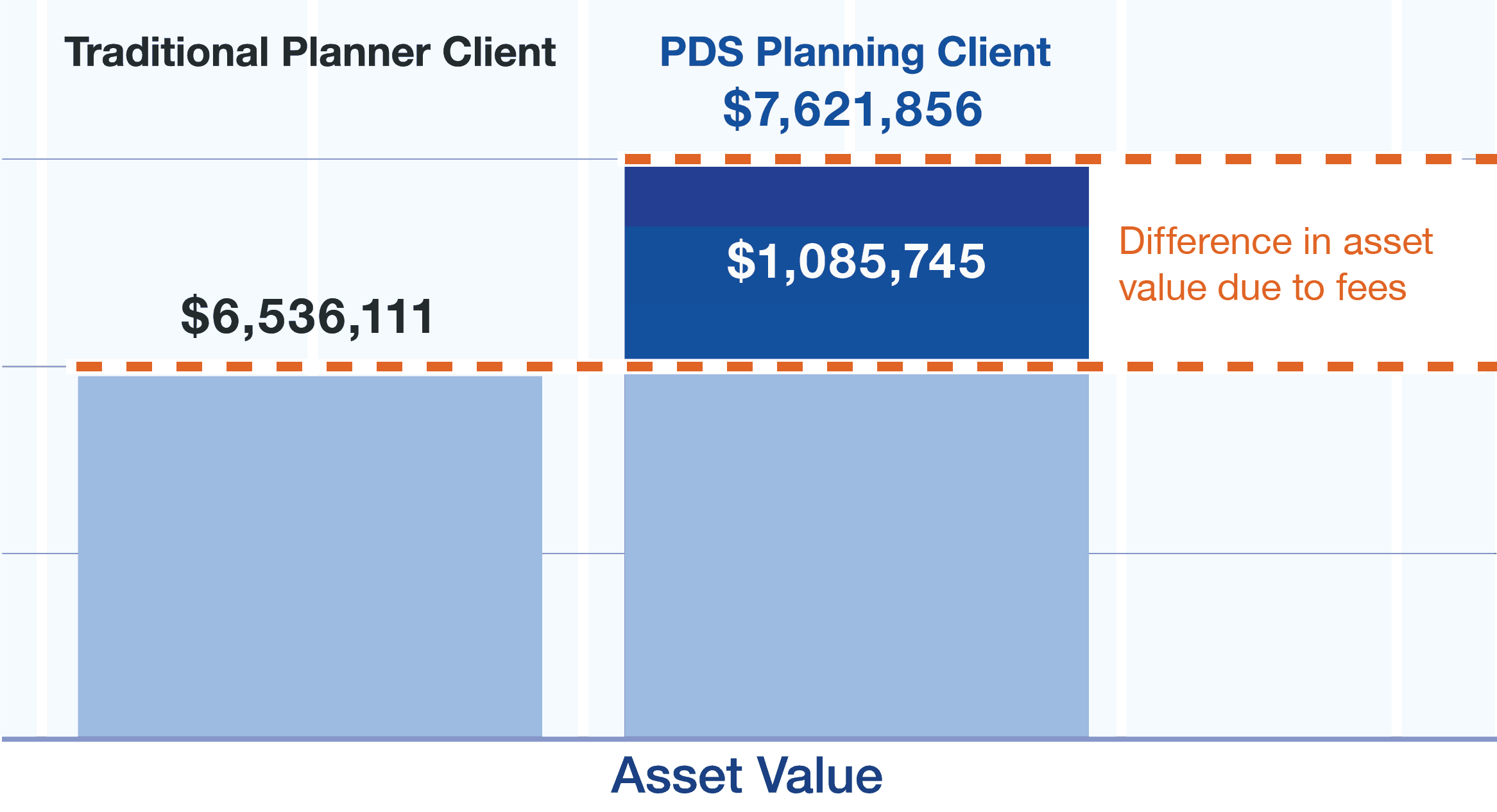

PLEASE NOTE: Limitations. The above is for illustration purposes only. This analysis assumes a $2,000,000 starting value, $25,000 of annual contributions for 25 years and 5% annual gross rate of return over a 25 year time period for both the projected Traditional Planner and PDS Planning Client. The Traditional Planner fee estimate is based on Advisory HQ’s independent 2021 average financial advisors fee report. This also assumes 1% annual inflation to the PDS Planning fixed fee. Although fees impact investment performance, no specific fee structure can produce positive investment returns. To the contrary, different types of investments involve varying degrees of risk, and it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by PDS Planning, Inc.) will be profitable.