Irrational Exuberance

There’s no question markets have been volatile this year. If we peel back the top layer, there are many different events we can blame it on: inflation, treasury yields, the Fed and interest rates, Covid vaccines, unemployment, even the colder than normal February. But, what if we didn’t peel back the top layer? Instead, we focus on a potential over-arching theme as a way to over-simplify what’s been happening in the stock market.

In a December 1996 nationally televised speech, then Chair of the Federal Reserve Board Alan Greenspan referred to the behavior of stock market investors as “irrational exuberance”. Since then, this term – irrational exuberance – has been used to in conjunction with speculative and instable markets.

In his bestselling book aptly titled Irrational Exuberance, author/economist/Nobel prize winner Robert Shiller defined it as,

“the psychological basis of a speculative bubble. I define a speculative bubble as a situation in which news of price increase spurs investor enthusiasm, which spreads by psychological contagion from person to person, and, in the process, amplifies stories that might justify the price increase and brings in a larger and larger class of investors, who, despite doubts about the real value of the investments, are drawn to it partly through envy of others’ successes and partly through a gambler’s excitement.”

One of the longer sentences you’ll see, but by breaking it down and providing some examples we can better understand what it means. And, how it might explain markets today.

GameStop

In a matter of weeks, even days, the price of the stock went up some 1,500%. During this time, it made headlines in all major news outlets and story after story was coming out about people making tens and hundreds of thousands of dollars. This spread like wildfire and more and more people started buying into it, gambling for the chance to hit it big. All of this despite the fact the company has been closing stores and losing money for years. “Which news of price increase spurs investor enthusiasm…. amplifies stories…. justify the price…. and brings in a larger class of investors… are drawn to it partly through envy of others’ successes and partly through a gambler’s excitement.”

If we back up, we can see this at work in other instances as well. AMC experienced similar movement. Hertz after announcing bankruptcy rocketed higher. Even the number of brokerage accounts and high risk option contracts hit all-time highs during 2020.

Global Clean Energy

Throughout the events leading up to the election in 2020, many investors were betting on Biden winning the election to become the next President. A part of his campaign was stressing the importance of developing renewable sources of clean energy, re-entering the Paris Agreement, and ultimately trying to reduce the United States’ carbon footprint. Thus, the prices of clean energy ETFs and solar ETFs grew upwards of 100%, some even 200% in just one year. Once the election was finalized, these funds grew even faster, spurred by the presidential confirmation, more investor exuberance, and by following the herd-like behavior of others rationalizing the idea that these risky assets will continue to just go up.

Overall Stock Market

Since the bear market correction reached its bottom last March, during a time of economic uncertainty, the market remained certain we would get back to normal in no time. Analysts and investors alike began pricing in a full recovery, the Fed confirmed they would not increase short term interest rates, and growth was still king. The price increases were fueling enthusiasm bringing more investors back to the markets even though the economy was partially shut down. Companies stopped releasing projections because of the constant changing environment – some weren’t sure they were going to make it – but the success of others and lack of sports to gamble on paved the way for more price growth and more risk.

Perhaps investors have been behaving with an irrational exuberance.

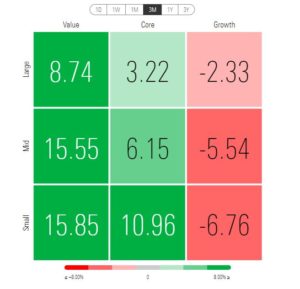

The Fed has remained accommodative, but the threat of inflation has many worried rates will need to be increased. Paired with the tripling of 10 year treasury yield, it appears a possible speculative risk bubble is slowly losing steam. The story this year has been one of de-risking, a rotation from growth to value. In years past, the high-flying tech stocks were the basis of the return in the S&P index (a blended approach). This year, however, large cap value (+8.7%) is significantly outperforming large cap growth (-2.3%).

The Value of a Professional Advisor

It is important to understand the connection between your investments and the long-term goals of your financial plan. One of the primary benefits of working with a professional advisor such as PDS Planning is our ability to provide discipline and guidance to manage our innate psychological biases. According to research by Vanguard, “Behavioral coaching may add 1% to 2% in net return”. As they explain, “Having emotions isn’t a “rational or irrational investor issue; it’s a human issue.” While most investors have the best intentions when making financial decisions, in the heat of the moment when emotions are elevated, they may have a hard time sticking to their plan. Being irrational may seem completely rational in the moment.

Since 1985, PDS Planning has worked with clients to eliminate the stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

To learn more about PDS Planning, please contact us.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.