Behavioral Finance: Gambling on Stocks

In theory, financial markets are efficient. All necessary information is available to the public and logical decisions can be made by rational, unemotional investors. However, theory and reality are often quite different, and investing is no exception.

The study of investor behavior is called Behavioral Finance. For more information on the basics, see our post “Behavioral Finance: Intro”. Research shows that people are not nearly as rational when making investment decisions as traditional finance theory suggests. Our decision-making is influenced by our own psychological biases.

Gamblers Turning to the Stock Market

As the NBA and MLB continue conversations to try and keep 2020 season hopes alive and NASCAR and F1 stay on track to move forward with their season plans to start within the next few days, will market volatility start dissipating?

Believe it or not, with sports sidelined many gamblers have turned to the stock market. The number of new retail trading accounts across online brokers skyrocketed during the coronavirus shelter in place orders. Many brokerage firms saw a 100%+ increase in funded accounts compared to the first quarter of 2019. Robinhood, the free stock trading app favored by younger generations, reported an increase of 3 million new accounts in the first quarter. Additionally, the total number of stock positions doubled from 15 million to 30 million in the span of 2 months.

As the Wall Street Journal noted, “…by shutting down the economy, the coronavirus unleashed a new generation of gamblers on the stock market: people, mainly young men, going stir-crazy from quarantine and the lack of professional sports to bet on. They’ve turned to trading stocks. To these thrill-seekers, the magnitude of moves matters as much as the direction; a big loss can be as much fun as a big gain.”

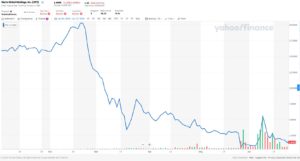

Hertz Stock

Many of these new accounts and subsequent stock purchases are for short-term gambles on companies. Look at Hertz Global Holdings (symbol: HTZ), the well known car rental company, as an example. In the last month, Hertz declared bankruptcy amid the economic shutdown, then announced a planned stock sale to raise cash to help it through the bankruptcy process. Hertz themselves warned the stock would likely be worthless at the end of its bankruptcy reorganization, then rescinded the planned stock sale after garnering the SEC’s attention. The speculative trading of Hertz’s stock throughout the last month has caused the stock price to fluctuate wildly. From it’s May 26th low of $0.40/share, the stock recovered 1,462% to $6.25 on June 8th, a span of less than 2 weeks. Extreme daily price fluctuations of HTZ have been as follows:

- May 26: -80%. The company announces bankruptcy

- May 27: +136%

- May 28-June 3: -30%

- June 4: +84%

- June 5: +71%

- June 8: +115%

- June 9: -24%

- June 10: -40%

- June 11: -18%

- June 12: +37%

- June 15: -34%

Recognizing Behavioral Biases

- Overconfidence: We know from a previous behavioral post the detriment overconfidence can have on investing. The same irrational impulses occur in sports gambling as well. Whether you’re confident the stock price will go up because “it has before” or “you know the company” or your favorite sports team will win because they’re your “favorite”, overconfidence leads to taking on more risk.

- Herding or Herd Behavior: This behavior is most easily explained as, where one person goes, they all go. After the intense price movement of Hertz shown above, the trading volume continued to increase as more and more investors/gamblers followed each other to the short-term trades.

- Action Bias: Feeling the need to act in order to gain some sense of control. In this case, we can look at trading frequency. Feeling the need to buy and sell incessantly just to do something, when doing nothing (aka. “buy and hold”) typically provides better long-term financial outcomes.

The Value of a Professional Advisor

One of the primary benefits of working with a professional advisor such as PDS Planning is our ability to provide discipline and guidance to manage our innate psychological biases. According to research by Vanguard, “Behavioral coaching may add 1% to 2% in net return”. As they explain, “Having emotions isn’t a “rational or irrational investor issue; it’s a human issue.” While most investors have the best intentions when making financial decisions, in the heat of the moment when emotions are elevated, they may have a hard time sticking to their plan.

Since 1985, PDS Planning has worked with clients to eliminate the stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

To learn more about PDS Planning, please contact us.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.