Diversification: U.S. vs. International Stocks

In the midst of the current market turbulence, many of our clients are paying more attention to financial markets and their investment portfolios than they otherwise typically might. Rather than allowing headlines to influence our emotions, at PDS Planning we rely upon longer-term data and historical context to put the current environment into perspective and allow us to make more informed decisions.

In light of clients’ rekindled interest and heightened awareness, we thought it would be helpful to review some investing basics through the lens of our time-tested belief that “today’s headlines and tomorrow’s reality are seldom the same.” By sharing our objective outlook, we hope to alleviate some of our clients’ short-term emotional anxiety while achieving better long-term financial results for them. Be sure to read our previous “Diversification: Stocks & Bonds” post for more information.

Diversification

Diversification means investing in a wide variety of assets within a portfolio. The goal of diversification is to limit exposure to any single asset or risk. An easy way to visualize diversification is the typical portfolio pie chart with each slice of the pie representing a different asset class (ex. U.S. Large Cap Stocks, International Stocks, U.S. Bonds). A diversified portfolio has more slices resulting in each slice being smaller, thus spreading out your risk.

Global Stock Diversification

In much the same way investing in both stocks and bonds helps to diversify your overall investment portfolio, including a mix of both U.S. and International stocks (or equities) helps to reduce risk and provide more diversified sources of return.

But what is the “right” mix of U.S. to International stocks in a portfolio? Many investors exhibit “Home Country Bias” which is the tendency to own a substantially larger amount of stock from their own country than from other countries. This is a worldwide phenomenon and not unique to U.S.-based investors.

We believe long-term equity investing should more closely reflect “how the world works” rather than an arbitrary global mix of stocks skewed by where you live. The trickier part is determining your view for “how the world works”, whether it be through economies, stock markets, or wealth.

“How the World Works”

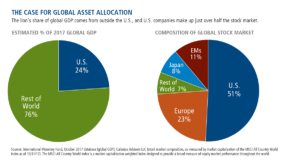

Global Economy: Measured by the total monetary value of goods and services produced (GDP), the U.S. accounts for less than 25% of the world’s total GDP (see left pie chart below).

Global Stock Market: Measured by market capitalization value of a country’s stock market, the U.S. represents just over half of the total value of the global stock market (see right pie chart below).

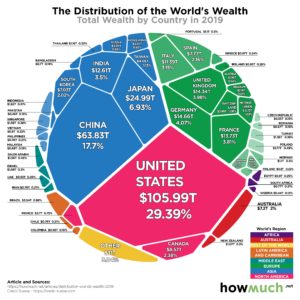

Global Wealth: Measured by total wealth (financial assets minus debts, or essentially a balance sheet), the U.S. is by far the richest individual country in the world representing slightly under 30% of the entire world’s net worth (see chart below). However, taken together, countries in Asia (blue) have a higher net worth representing 39% of the world’s total.

Invest Globally

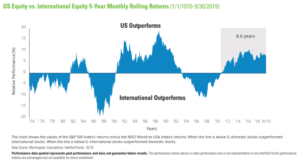

Regardless of your mix of U.S. to International stocks, periods of outperformance relative to one another is to be expected. As shown in the chart below, we are currently in an extended period of U.S. stocks outperforming International stocks. Of course, past performance may not be indicative of future results, but based on the last 50 years of stock market performance, it seems more likely than not that International stocks will come back into favor at some point. While no one can accurately predict when this will happen or to what level the tide will turn, we strongly believe in the importance of including a meaningful allocation to both U.S. and International equities in the stock portion of your diversified portfolio.

Time & Diversification

Over shorter periods of time, asset class returns can vary widely; however, long-term investors are typically rewarded for thoughtful portfolio diversification. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes.

PDS Planning continues to be available to both our existing clients and prospective clients who can benefit from the financial planning and investment management services we provide. Please contact us if you have any questions or would like to discuss ways we may be able to assist you in providing clarity during these uncertain times.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.