Welcome to our May 2024 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

By Drew Potosky, CFP®,

Posted: 5/22/2024

GameStop Rollercoaster Ride

Roaring Kitty [Keith Gill] tweeted a meme on Sunday, May 12th and caused GameStop stock to vault from $17.50 to $36.70 overnight. Keith was the main holder and essentially the front man to the GameStop meme-stock craze of 2020. The short interest in the stock is still significant and the tweet and corresponding 200%+ price jump over the next three days cost short sellers an estimated $2 billion. Since then, the price has come down to a more normal ~$22.00; about 26% increase from pre-tweet prices. It goes to show how impactful the retail investor can be with a singular focus. Volatility across some fan-favorites may continue to show life in the short-term.

Rent or Buy?

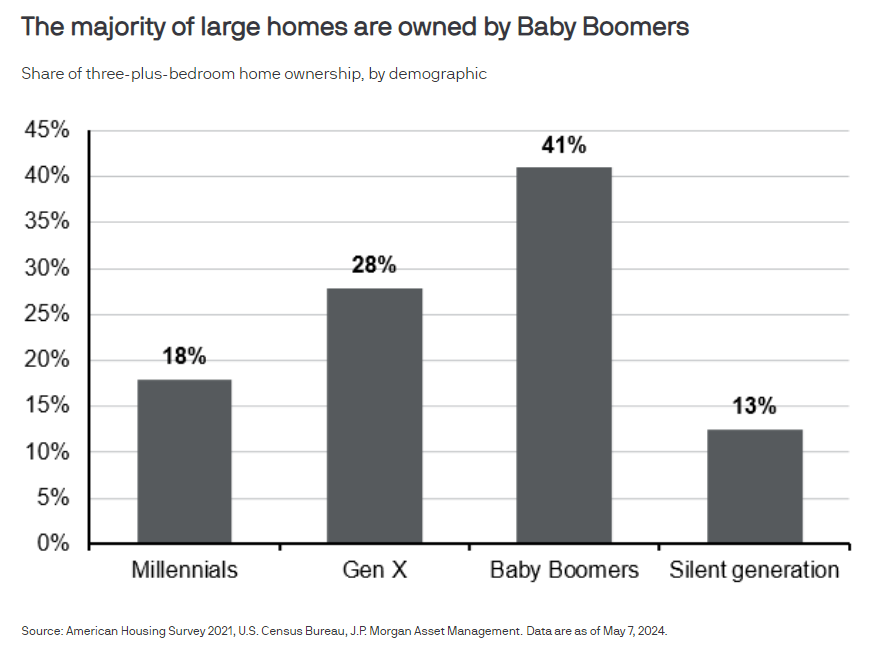

The luxury of choice between rent or buy is not something many younger people [millennials] have these days when thinking about their living situation. Home prices have fallen 12% since peaking in 2022, but affordability is still at multi-decade lows. Home prices are one piece of the puzzle. Even though they’ve fallen, the incredible surge post-pandemic means the median home price is still well above pre-2020. A second, potentially more impactful, piece of the puzzle is interest rates. You can run, but you can’t hide! The average 30-year fixed rate mortgage is above 7% today. This compared to 3.50% 4 years ago means mortgage payments on a $300,000 loan go from $1,347 to $1,996 per month. An $8,000 difference over the course of a year and the difference between renting and buying for many.

Excess Savings are Depleted

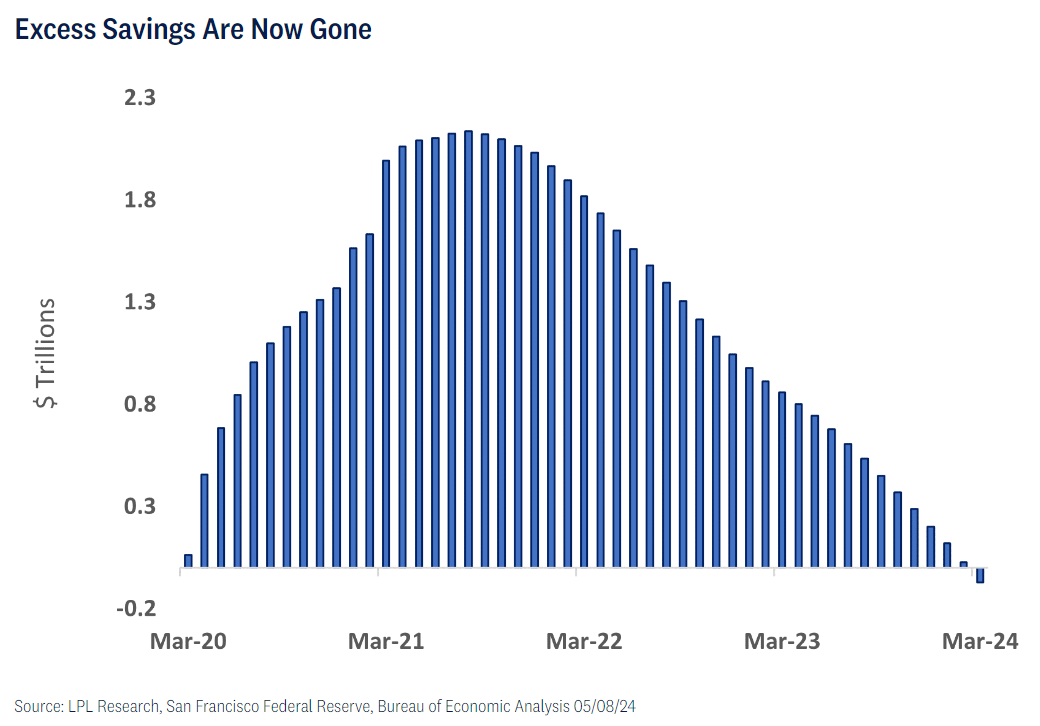

Since peaking in August 2021, excess savings have been steadily declining. It makes sense; the worst of Covid begins to fade and consumers want to consume! In March of this year, we saw the last of the savings fall away before turning negative in April. LPL Financial writes, “But as households made up for lost time and splurged on both goods and services, excess savings were drawn down.” This spending has been one of many reasons for a stronger than expected economy and sticky service industry inflation. In last week’s inflation report, data showed services inflation fell, which could be related to a slowdown in spending. For folks waiting for the Fed to start cutting rates, this may be another step in that direction. “As excess savings dwindle, there are potential risks to consumer spending. When households exhaust these accumulated savings, it could lead to a decline in discretionary spending. Additionally, if the depletion of excess savings is not met with a corresponding increase in income or economic growth, it could potentially dampen the pace of economic growth.”

Ohio Baseball

The Cleveland Guardians are on pace for 105 wins which would smash expectation. FanGraphs gives them a 62% chance to make the playoffs today. Slightly better than the 29% chance given to the team before the season started.

Shortstop for the Cincinnati Reds, Elly De La Cruz is on pace for 101 stolen bases this season. It may only be a matter of time before Ricky Henderson’s 130 stolen base season of 1982 is challenged!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.