Welcome to our April 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

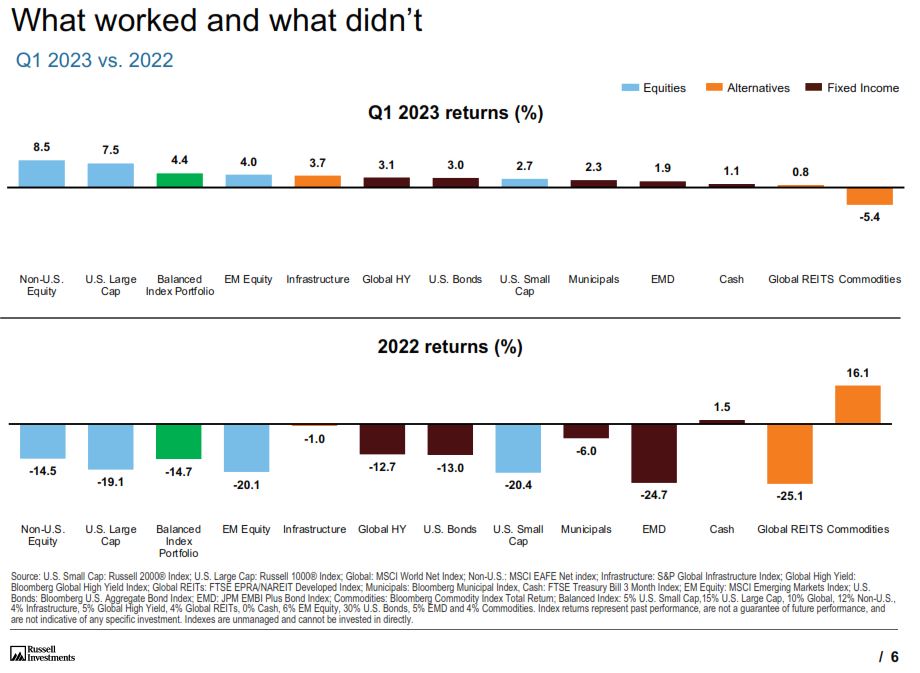

What Worked and What Didn’t

2022 was a historically difficult year where all asset classes – with the exception of commodities – were down. Q1 2023 has been a mirror image of last year where all asset classes – with the exception of commodities – are positive. From our April Market Commentary, “The S&P 500 is up nearly 7% through quarter 1 and 16% since October last year while the tech-heavy Nasdaq is up nearly 17% and 20% in the same time periods.” (Source: Russell Investments)

The S&P 500

In our April Market Commentary, we explained how the S&P 500 index returns have been the result of just a handful of the largest companies. This animated chart from Visual Capitalist does a great job showing this. (Source: Visual Capitalist)

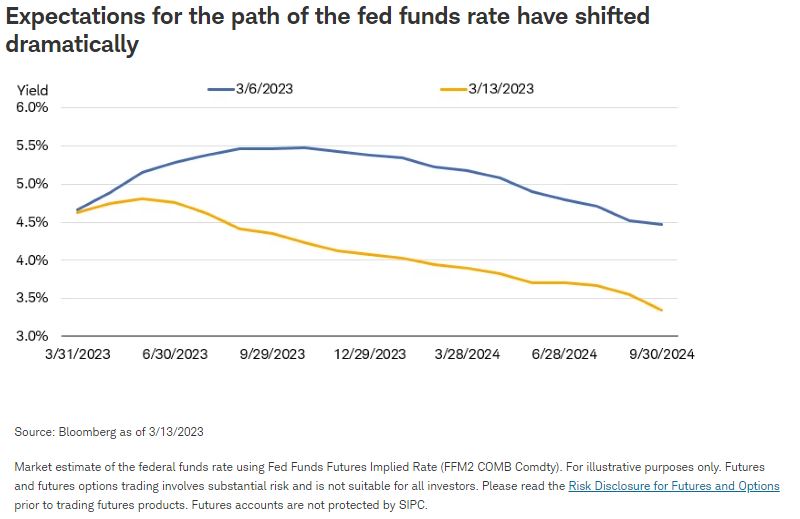

The Fed’s Updated Rate Expectations

The Federal Reserve have been under the microscope for the better part of two years as they worked to handle the fallout from Covid-19 and now continue to work to keep a handle on inflation. It’s well known raising interest rates has been their focus, and these higher rates have both been a blessing and curse for many. A blessing for those able to earn yield on their cash, but a curse for some banks who made outsized, longer term bond purchases and saw their value plummet. See Kurt Brown’s article on the Banking Industry for more info. With this new information, the Fed has altered their rate expectations for the year. Markets anticipated at least four more rate hikes with the first cut not taking place until 2024. Now markets are only expecting one more hike with the first cut this summer. This change boosted risk assets, especially growth stocks. But seeing how quickly things can change from the chart below, nothing is set in stone. (Source: Schwab)

2023 Major League Baseball

Opening day was March 30th and what a good few weeks it’s been!

- The pitch clock is working. 2023 is the first year Major League Baseball has implemented a pitch clock, limiting the time between batters to 30 seconds and the time between pitches to just 15 seconds (20 seconds with runners on base). So far, the average game time has been reduced from 3 hours and 3 minutes in 2022 to 2 hours and 37 minutes – almost 30 minutes faster! From my personal viewing experience, it’s a noticeable improvement with more things happening more often. (Source: MLB and Baseball Reference)

- The LA Angles Double-A team, the Rocket City Trash Pandas (awesome name) threw a combined no-hitter earlier this month and lost 7-5. In one inning, the Trash Panda’s had 5 walks, 4 hit batters, and a bases clearing error that lead to all 7 runs. (Source: ESPN)

- The Tampa Bay Rays became the third team ever to start a season 13-0. The 2023 Tampa Bay Rays join the 1982 Braves and 1987 Brewers as the only teams to start a season with 13 straight wins – the longest win streak to begin a season in history. (Source: ESPN)

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.