April 2023 PDS Planning Market Commentary

It seems there are hundreds of reasons why the market has a bad day, but the good days are glossed over – just another day. Despite a seemingly endless barrage of negatives lately, from the near bank crisis, weak jobs reports, inflation, higher interest rates, and continued talks of a recession, the stock market has been resilient. The S&P 500 is up nearly 7% through quarter 1 and 16% since October last year while the tech-heavy Nasdaq is up nearly 17% and 20% in the same time periods. In most [near] bull markets, the phrase, “a rising tide raises all ships” is thrown around often. However, this time, it’s different.

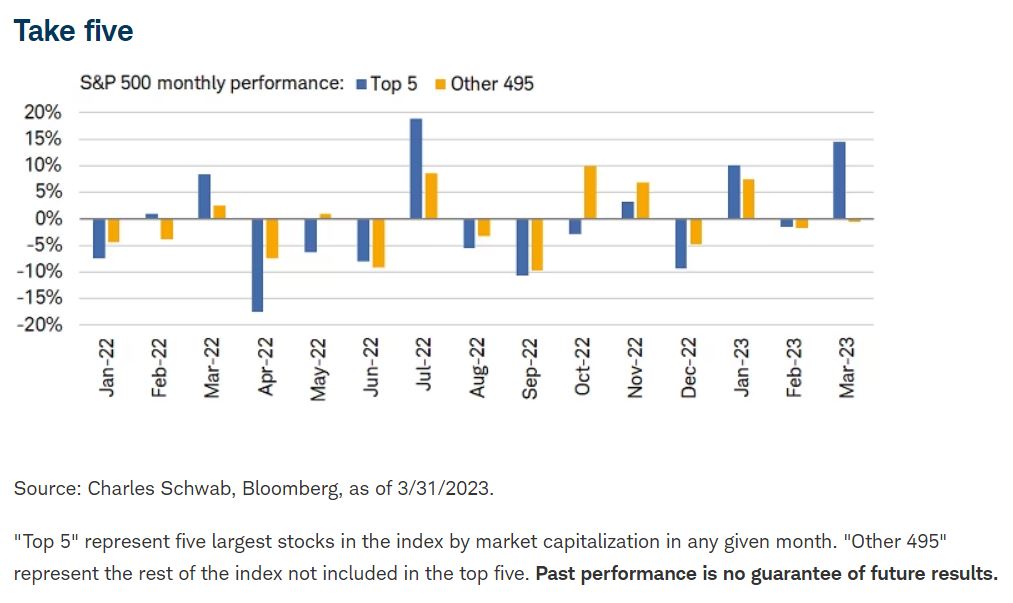

According to Schwab’s Chief Investment Strategist Liz Ann Sonders and Senior Investment Strategist Kevin Gordon and the accompanying chart, “the five largest stocks in the S&P 500 have dominated performance this year, with their average performance totaling +10.1% in January, -1.5% in February, and +14.4% in March. That is in stark contrast to the rest of the index, which saw an average move of +7.4% in January, -1.7% in February, and -0.5% in March.” If the data is expanded to the top 10 largest stocks which make up ~27% of the S&P 500 index, we’ll find these stocks attributed to 90% of the first quarter’s performance.

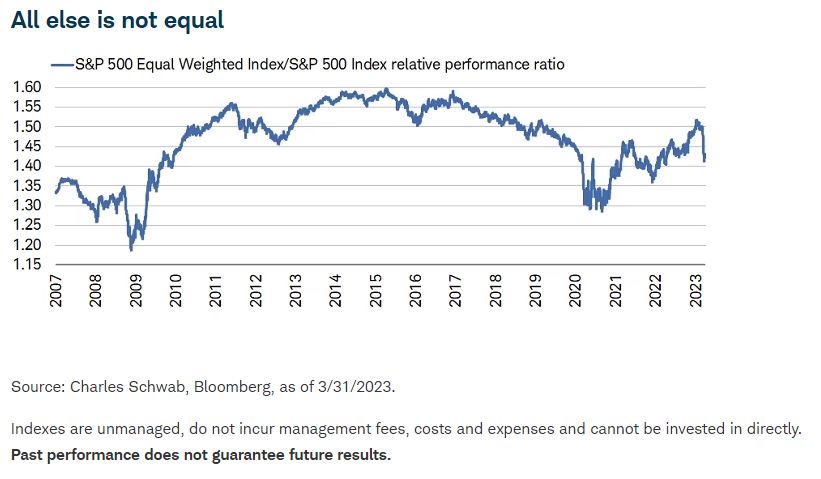

According to the chart, the market breadth is low; the amount of companies within the index performing well is paltry as evidenced above. When only a handful of stocks are contributing to index gains, it tends to indicate the market is weak with little optimism. This can be better understood using the visual below. The chart is tracking the performance ratio of the equal weight S&P 500 over the standard S&P 500 index. When more companies are participating in a strong market, the ratio will be higher. Today, when it’s only the largest companies who are responsible for most of the gains, the ratio will fall towards 1.00. Sonders and Gordon also wrote, “As you can see in the chart below, the ratio has plunged so far this year, eliminating much of the edge equal-weight had until recently. A short look back at the past two bear markets shows that a steep drawdown in this ratio is consistent with acute pain in the broader market. This time, it’s much more about the outperformance of larger members as opposed to massive losses for the rest of the crowd.”

With that, I’ll parrot my comment from a couple months ago; we remain cautiously optimistic markets will retain some of the resiliency seen year-to-date. However, without stronger performance from the rest of the market, the more cautious we may become. “Strong outperformance from the “generals” (largest stocks) can power indexes higher, but a healthier market would be characterized by greater participation by the “soldiers.””

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.