The Rise of Options Trading

Born from a perfect storm of zero fees, an economic shutdown, and high volatility, options trading exploded on the scene in 2020. At the end of June, we wrote about gambling on stocks and how it relates to behavioral finance ideas. In the same vein as stocks, there has been a record number of options contracts traded daily this year.

What are stock options?

An option contract gives the “investor” the right to buy or sell lots of 100 shares at a specific price within a specific period of time. A common way to utilize options is with a hedging/protection strategy. Or, they can be used to make bets on whether an index or individual stocks will go up or down. What makes these more appealing than simply trading the stocks or index is the small amount of money needed for a potentially enormous return. IF the bet turns out correct. The downside is a complete loss of principal – which happens about as often as those enormous returns.

For example as of writing:

- SPDR S&P 500 Index [SPY] is up 0.30% so far today. Yet, a call option (profit when the stock goes up) that expires on September 11, 2020 is up 6%.

- Invesco QQQ [QQQ] is down 0.57% so far today. This tracks the Nasdaq. A call option (profit when the stock goes up) that expires on September 11, 2020 is down 10%.

Relatively small price movements for the respective indices above can cause material swings to the upside and downside of the option contracts. Volatility has taken a step back in the recent months of trading, but think back to March and April. Markets were seesawing multiple percentage points every day. If a half percent move can take lower the portfolio 10%, what can a 2% drop do? But this is exactly why people are flocking to options trading. They have the small chance of guessing right and hitting it big. The ease at which a portfolio can be wiped out should keep people away, but the data shows it isn’t.

Record Number of Options Contracts Being Traded

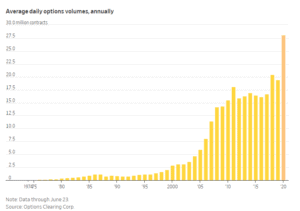

As reported by the Options Clearing Corp, a record 28 million options contracts are currently being traded during the average day. This is up 45% from just last year.

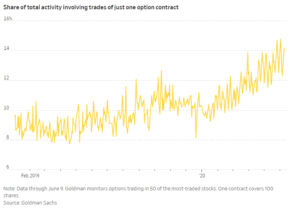

Even more telling is the rise of options volume containing just one contract, which has risen from around 10% to nearly 15% this year. Professional investors and institutions typically trade in larger transactions, so these single contract trades are most likely individual retail investors who may not fully understand the products they’re using or their accompanying risks.

A Tragic Outcome

Nothing is more apparent of this than the tragic suicide of Alexander Kearns in June of this year. He was a 20 year old student home from college, looking for things to do during the pandemic. Like so many others, he turned to stock investing on the commission-free platform Robinhood. Having no prior investing experience or net worth to speak of, he was approved for options trading on the app. From an article posted by Forbes, “Kearns apparently fell into despair late Thursday night after looking at his Robinhood account, which appeared to have $16,000 in it but also showed a cash balance of negative $730,165. In his final note, seen by Forbes, Kearns insisted that he never authorized margin trading and was shocked to find his small account could rack up such an apparent loss.”

What’s worse is the negative balance may have only been temporary. Based on the possible strategy, only one part of the trade had gone through, and after settlement the following Monday the negative balance may have been gone.

Working With a Professional Advisor

One of the primary benefits of working with a professional advisor such as PDS Planning is our ability to provide discipline and guidance. We will not place any unsolicited options or other derivative trades in any client or personal accounts. Understanding the investment types is imperative to understanding the risks associated with investing, and that can be stressful if it’s all on your shoulders. Since 1985, PDS Planning has worked with clients to eliminate that stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.