Posted: 05/03/2024

Everyone says time flies, but I truly can’t believe May is here already! It seems like New Year’s was just a month ago, but our 7 and 4 year old kids will be out of school and ready for summer in a couple of weeks. We wish all of you the best this summer!

Markets were humming along nicely for the first 45 days of the year with the S&P 500 up over 10% and international stocks up 3-8%. However, we’ve seen an increased amount of volatility the past few weeks due to higher than anticipated inflation.

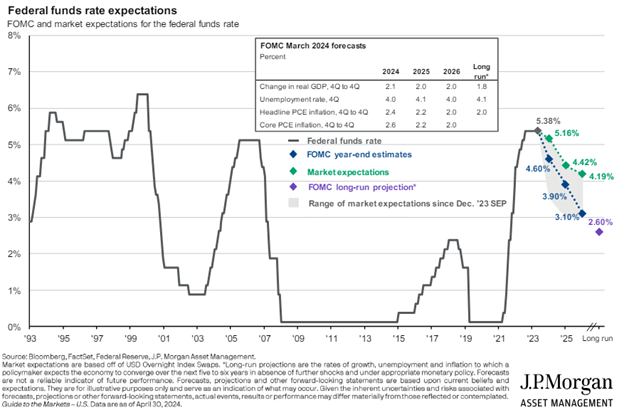

The Federal Reserve has a dual mandate to control inflation and for full employment. They are hitting the mark with employment as seen in the historically low unemployment rate. However, inflation continues to be sticky. Even though it’s come down significantly from the COVID levels, inflation is higher than the Federal Reserve’s 2% target. The Fed raised rates at an unprecedented pace from 0% to 5.25% starting in 2021 in an attempt to cool inflation and the economy as shown below.

Despite this restrictive policy of high rates, inflation continues to trickle through the economy. At year-end, the Fed announced their goals to no longer raise interest rates and hopefully start reducing rates throughout 2024. At one point, markets anticipated 5-6 interest rate cuts this year which helped fuel market growth. But now they are only projecting one or two expected cuts due to pesky inflation. This is the main reason why markets had a tough couple of weeks in April. Fortunately, we’ve seen a nice bounce back since the April 19th lows.

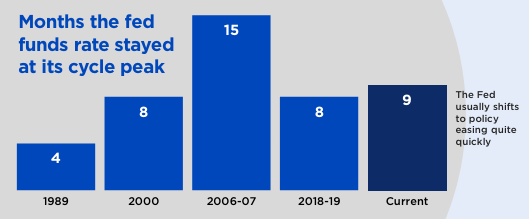

“Historically, the Fed has not kept monetary policy restrictive for long, realizing negative impacts on business and consumer activity from elevated interest rates. Over the past 40 years, the fed funds rates has only held at its cycle peak for an average of nine months, on par with the pause in rates since the last rate hike in July 2023.”

We may come close to the previous record of 15 straight months before reducing rates, but the silver lining to high rates is investors are finally compensated for cash. From 2008 to 2021 most banks were paying less than 2% for money market and short-term CDs. Now both money market and short-term CDs are paying over 5% interest. Please review your cash balances with your bank and/or advisor to make sure you are taking advantage of these rates.

It’s important for us at PDS to remain open to new information and be able to update our investment views along with the updates in the markets and economy. Getting stuck in the past doesn’t help anyone! With inflation and rates where they are today, we see short-term CD and US Treasury rates as still attractive for any excess cash. We still expect rate cuts to be a tailwind to bond returns, but maybe not as soon as most first thought. PDS will continue to monitor client portfolios for opportunities and wish everyone a great month of May!

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.