Interest rates have increased at a historic pace to slow inflation and high interest rates remain a hot topic during any economic conversation. We tend to focus on how high interest rates impact people negatively, but forget one of the biggest positives; cash yields are now attractive.

Money Market/High Yield Savings

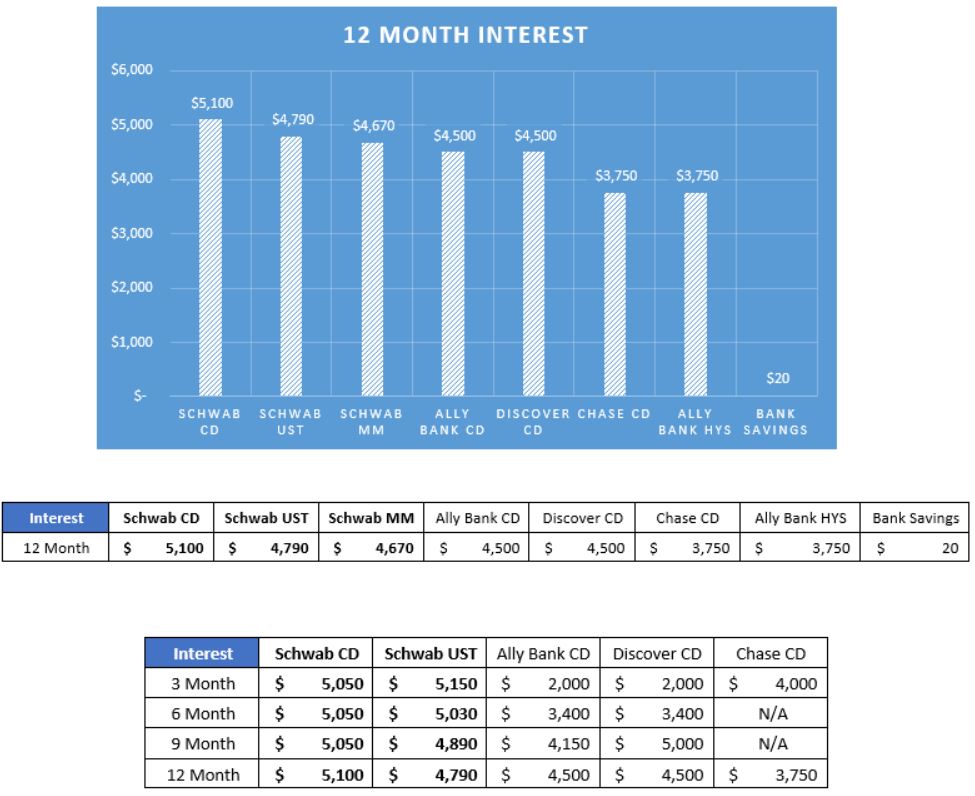

At the start of 2022, the stated annual yield for money market funds was about 0.07%. On $100,000 invested over the course of a year that would equal $70 in earned interest. Today, our clients and investors at Schwab can purchase the Schwab Value Advantage Money Market [SWVXX] and earn an annualized yield of 4.67%. On a $100,000 investment, the one-year earned interest is now $4,670.

This Schwab money market is much like the high yield savings accounts advertised and offered through online banks. Back when interest rates were low, the online banks were able to offer a more attractive yield due to lower costs and less overhead. Ally Bank was, and still is a popular choice. While these online banks were great options a few years ago and certainly still a good place to hold extra cash, they simply aren’t matching the rates offered through Schwab’s money market funds. Currently, Ally is touting a 3.75% annual percentage yield. That’s almost a full 1% less than the money market rate at Schwab, or a near $1,000 less earned in annual interest on a $100,000 investment.

CDs

From Investopedia, “a certificate of deposit (CD) is a savings product that earns interest on a lump sum for a fixed period of time. CDs differ from savings accounts because the money must remain untouched for the entirety of their term or risk penalty fees or lost interest. CDs usually have higher interest rates than savings accounts as an incentive for lost liquidity.”

According to Chase Bank, a 3-month CD actually varies by amount invested. $10,000 would earn 3.50%, whereas $100,000 would earn 4.00%. But what’s more surprising is their savings rates were a whopping 0.02%. In this rate environment that is absurdly low, yet many people contine to park their cash in these low yielding checking and savings accounts.

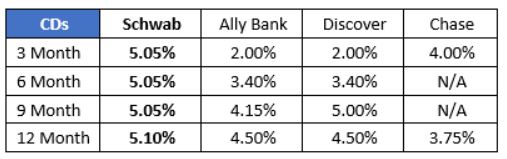

Schwab acts as a dealer for banks CDs from around the country and can offer usually better yields than what may be available locally. This comes at no additional cost to the client (PDS client or Schwab client). The chart below outlines the best rates available (annualized) at Ally Bank, Discover, and Chase compared to what inventory looks like at Schwab today.

For those with extra savings and no short-term anticipated cash needs, CD rates through Schwab look to be much more appealing than what’s available online and locally. CDs are also subject to FDIC insurance, up to $250,000 per person per bank.

US Treasuries

Treasuries offered by the US government are similar to CDs where they have a stated maturity date, but sometimes the yield is calculated differently. Where CDs have a stated coupon rate denoting the expected yield, US Treasuries are usually issued at a discount to par value. The yield is earned at maturity when the dollars are paid back to the investors at the bonds par value. A 3-month T Bill has a buy price of $98.748 per unit, but will pay $100.00 per unit at maturity, resulting in a ~5.14% annualized yield to maturity.

While these holdings aren’t subject to FDIC insurance, they are backed by the full faith of the U.S. Government. We view the risks of investing in CD and Treasuries to be similar. Therefore, as rate and coupons fluctuate for CDs and Treasuries, we can simply find the security offering the best yield for the target time frame.

Interest Earned

Looking at 12-month and annualized yields for the money markets, investing through Schwab makes the most sense. There tends to be great inventory and better rates available across securities and maturity dates.

PDS Planning and our Clients

Since 1985, PDS has worked with clients to eliminate the stress often associated with planning their financial future. With over 35 years of experience helping clients plan their investments, we’re experts at optimizing retirement and investment plans to each individual’s highly specific needs. We’ll work to understand your vision for the short and long term. And we will provide objective guidance on the proper path to help reach your goals. By charging our clients a flat, fixed dollar fee, we avoid the inherent conflicts of asset-based pricing models, which is the industry norm. It has been our experience that the compound effect of this savings over time can be substantial.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.