Economic and Investment News Bits

- Retirees considering a big move after they stop working have a lot to consider. According to WalletHub, there are a number of cities that rank near the bottom when considering five categories of retirement living: affordability, activities, quality of life, health care, and jobs. Cities with the worst rankings were Providence, RI; Newark, NJ; Philadelphia, PA; New York, NY; Chicago.

- “Our view is that it will be easier to make money in US. and emerging market stocks than European stocks going forward. Obviously this is a generalization, with plenty of room for specific issues and sectors to out or under-perform,” (Source: Marketfield Asset Management).

- Mexico is becoming a global leader in auto production, including models from Nissan, Honda, Mazda, and Volkswagen. Expectation is for 3.2 million vehicles to be built in 2014. Mexico is now the eighth-largest auto producer and expects to be number six by 2020. The auto industry makes up 20% of its manufacturing and 26% of its exports. (Source: Wall Street Journal)

- “With slack still present in the labor market (wage growth is slow, and involuntary part-time employment is high) – the Fed will be willing to let inflation pressures build before raising interest rates, which means easy credit, faster growth, and a market where forward P/E is in average territory,” (Source: Ned Davis Research).

- 58% of California is currently experiencing an exceptional drought, up from 25% just three months ago. (Source: U.S. Drought Monitor)

- Undoubtedly the most highly-anticipated IPO of 2014, Alibaba is an e-commerce juggernaut that plays on China’s shift to a more consumer-driven economy. With nearly $300 billion of sales in the past year, Alibaba represents about 80% of all online shopping in China. It could be the largest IPO ever and is expected to go public in late September. The price swings on this stock could be enormous.

- HubPages has named Columbus the #1 High Tech City in America. Batelle Memorial Institute is the largest research institute in the state and the catalyst in the massive growth of technology start-ups in Central Ohio during the last 10 years.

Thought for the week

“You never know what is enough, unless you know what is more than enough.”

-William Blake, English poet (1757-1827)

Wealth Idea of the Week

A typical American couple may be leaving up to $250,000 on the table in Social Security earnings, because they do not know the best strategy for when to take benefits, according to a study done by Financial Engines. Three-fourths of the 1,000 survey respondents said they felt very comfortable about their ability to make decisions about Social Security. However, that confidence is misplaced, since 75% of those taking the survey were given a grade of C or lower. Social Security is extraordinarily complex, but most people still take retirement benefits at age 62, or within a month or two of retiring. Benefits, however, increase about 8% a year for each year they are delayed to age 70. Social Security is one of the best deals in town, but the message is still not out there about how to take advantage of it.

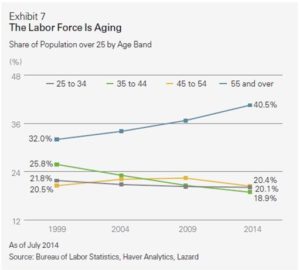

Graph of the Week (CLICK TO ENLARGE)

“Over the last fifteen years there has been a major shift in the demographic profile of the U.S. population and the U.S. labor force.” The percentage of the population older than 55 increased from 32% to over 40% in just fifteen years. Going even further, “the absolute growth in the population of those over 55 during the last five years has been 11.1 million. This is equal to the entire increase in the U.S. population since 2009.”

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved..