Economic and Investment News Bits

- Scotland separating from England cannot be minimized. If that centuries-old union can be revised, then anything can be revised. If Scotland has the right to be its own state and no longer choose to be in union, why shouldn’t others in Europe or America enjoy the same right? For example, Catalonia would like to leave Spain. The eastern part of Ukraine appears to want to secede and join Russia. And there has been talk of Northern California forming its own state, separate from the rest of California. (Source: Stratfor Intelligence)

- Americans filed 145 million tax returns in 2012. 64% of those returns paid federal income tax, while 36% of the returns (52 million) did not pay any federal income tax. (Source: Internal Revenue Service)

- The U.S. and China are the top two oil consuming countries in the world (a combined 28.4 million barrels consumed per day), more than the next ten countries combined. (Source: Energy Information Administration)

- “Are we on the verge of another bubble? We don’t think so. History shows bubbles are associated with excessive leverage and lofty stock valuations. That is not the case now,” (Source: U.S. Global Investors).

- According to a report from CNN, more American families own cats than they do stocks. In 2001, 21% of families owned one or more individual stocks. The number of stock owners is now only 14%. By comparison, 30% of households own at least one cat. PDS leaves any interpretation of this important factoid up to our readers.

- Columbus ranks #3 in a list of 10 Coolest Cities in the Midwest. MSN.com notes “America’s heartland too frequently gets labeled as flyover country. But the Midwest has come of the coolest places to live and visit.” Chicago and Cleveland were rated #1 and #2.

- Through September 12, the hottest stock market sectors year to-date have been health care, commercial real estate, and technology. Three worst are commodities, small cap stocks, and the major European stock index.

Thought for the week

“There cannot be a crisis next week. My schedule is already full.”

Henry Kissinger, American statesman (b. 1923)

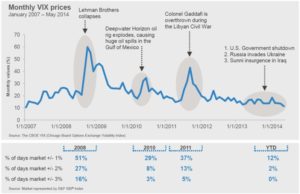

Graph of the Week (CLICK TO ENLARGE)

The U.S. stock market has been on a tremendous rally, in part due to the very accommodative Federal Reserve. The S&P 500 has increased about 42% since January 1, 2013 and 190% since the March 2009 low. However, volatility, measured by the VIX, has been quite low the past year. The S&P 500 has increased or decreased by more than 1% just 12% days through May of this year. Compare this to 2008, when 51% of the days experienced a change of more than 1%. Surprisingly, even though many headlines are circling around in the news, the stock market has not destabilized, and volatility has not increased. (Source: Russell Investments)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.