Economic and Investment News Bits

- PDS Planning’s Quarterly Investment Webcast is scheduled for Wednesday, October 15 at 12 noon. Given the many financial and geopolitical items in the news, this review of the markets and outlook for the rest of the year should be timely and educational. We hope readers of The Weekly will put this on their calendars. Invitations will be sent later this week via email and will include a link to the webcast and the event’s call-in number.

- Private equity companies have invested $6.6 billion in the Middle East and Africa thus far in 2014, up from $141 million in 2013. Much of the investment surrounds the food industry, including deals for KFC and Pizza Hut (YUM! Brands) restaurants. The increase could be attributed to an improving Middle East economy and increased local government spending. By contrast, private equity investments in Europe have seen a 41% drop from 2013. (Source: Bloomberg)

- “An aging population is changing global market dynamics. Age may soon be more than just a number. For the first time in history, and probably for the rest of human history, people age 65 and over will soon outnumber children under age 5 worldwide. This will have a big impact on economies, financial markets, and the healthcare sector,” (Source: Natixis Global Asset Management).

- A new report from the National Association of Realtors shows that some housing markets are primed for first-time home buyers. The top-10 cities for millenials to buy a home are: Akron, Buffalo, Syracuse, Peoria, Harrisburg (PA), Indianapolis, Melbourne (FL), Charleston (WV), Grand Rapids, and Memphis.

- “September’s increase in payrolls easily topped consensus. Also, the year’s gains are being driven by full-time jobs, not part-time as had been the case, and by small businesses, which the National Federation of Independent Businesses says are hiring at their fastest pace in a year,” (Source: Federated Investors).

- “The dollar has been deflating since 2002 and is still well below its 20-year average value against other currencies. In fact the recent increase in the value of the dollar is a mere blip in a much more persistent trend of dollar depreciation,” (Source Bank of America).

Thought for the week

“It’s kind of fun to do the impossible.”

Walt Disney, American businessman (1901-1966)

Upcoming Educational Event

Investing in U.S. Energy Independence will be the topic of PDS Planning’s next client education event on Wednesday, November 5. Troy Shaver, from Dividend Assets Capital LLC, who also manages the Goldman Sachs Rising Dividend Growth Fund, is our featured speaker for the evening. Troy has more than 30 years of investment experience, and with a degree in geology from Dartmouth University, he is uniquely qualified to assess our nation’s coming energy independence. Troy’s knowledge of the many different shale energy regions of the world, but specifically here in the U.S. (he is well versed on eastern Ohio’s Marcellus Shale potential) is amazing. This will be a great opportunity for our clients to gain insight into the energy revolution that will shape the nation’s economy for years to come. Invitations will be sent as the event date gets closer, but please put this on your calendar. Join us at 6 PM for hors d’euvres, with the program starting at 6:30.

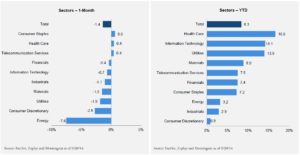

Graph of the Week (CLICK TO ENLARGE)

The S&P 500 has generated an 8.3% return through the first three quarters of 2014. As this chart from Eaton Vance shows, some sectors have performed much better than others. Healthcare has led the way with a 16.6% return, while industrials and consumer discretionary have lagged with sub 3% returns. However, as shown on the left, many of these sectors have negative one month returns.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.