Economic and Investment News Bits

- “We know that there is no country in the world that has meaningfully reduced poverty and spurred significant and sustainable levels of economic growth by relying on aid. History has shown us that by encouraging corruption, creating dependency, fueling inflation, creating debt burdens and disenfranchising Africans (to name a few), an aid-based strategy hurts more than it helps,” (Source: economist Dambisa Moyo).

- Six current myths about the U.S. 1) government is broken, 2) the Fed is divided, 3) we should not worry about deficits, 4) resurgent Republicans will fix everything, 5) Hillary Clinton will be bad for the markets, and 6) geopolitics does not affect the U.S. markets. (Source: Greg Valliere, Potamac Research Group)

- Schwab chief economic strategist Liz Ann Sonders believes “we are early in the optimism stage of a bull market”, referring to Sir John Templeton’s comment that “Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” But she also notes that “There are still a lot of skeptics out there.”

- Responding to a question about the potential for a falling U.S. dollar, Federated Investors Linda Duessel said “What falling dollar? The dollar is currently in a huge upsurge. What other currency will replace the dollar as the world’s reserve currency…the Japanese yen, the euro, the Chinese yuan, the Russian ruble, the Brazilian real? There is no option but the dollar at this time, and that means any chance of a recession is probably at least two years away, if that close.”

- As of today, the S&P 500 has gone 1,133 calendar days without a 10% or greater drop in the index, the fourth longest stretch in the last 50 years. (Source: BTN Research)

- When Medicare began in 1965, it provided health care coverage to 19 million elderly Americans. Today Medicare covers 52 million American seniors. (Source: Medicare)

- The highest U.S. national average price for a gallon of regular gasoline was in July, 2008 when the price was $4.09. Today, a station on 5th Avenue here in Columbus had gas for $2.59 per gallon.

Thought for the week

“Someone asked me if I had seen the 2011 movie Too Big To Fail. I told them I had not, since I had seen the original.”

Ben Bernanke, former head, Federal Reserve Board (b. 1953)

Economic Thought for the Week

Cash-strapped millennials are slipping into the red. According to a study by Moody’s Analytics, people younger than 35 are not saving money. In fact, their savings rate has dipped to negative 2%, meaning they are spending more than they take in. They are the only age group that has a negative savings rate. Wages for many millenials have remained stagnant, barely budging since the 1990s. Many have taken on large student debt to attain the skills they need to be competitive in the workforce, but a large number have been unable to find work in their areas of expertise. The study says that many college-educated millennials are able to find professional jobs, but that they have limited upward mobility. They are waiting for those above them to either retire or die, but those people (mostly baby boomers) are not giving it up that easily.

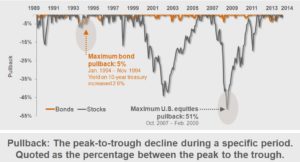

Graph of the Week (CLICK TO ENLARGE)

This chart from Russell Investments shows the significant difference in risk with stocks and bonds. The largest loss in bonds was only 5% over the past 25 years. This does not compare to the 51% pullback for stocks in 2007 – 2009. However, interest rates have declined during this 25 year period proving a tailwind for bonds. When rates rise, the potential loss will be higher for bonds, but it still won’t compare to the 51% loss in stocks. This is one of the main reasons why bonds are an important part of any diversified portfolio.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.