Economic and Investment News Bits

- “Patience can be tough, especially in investing, but that is what is needed at the present time. While a sharp upward move in equities seems unlikely, and the risk of pullbacks is elevated; a grind higher is not something most investors should miss on. Economic data and the Fed will continue to be in the spotlight, and we expect improvement that will lead to both a Fed rate hike and increased equity volatility – so be prepared,” (Source: Liz Ann Sonders, Charles Schwab).

- “While Europe abounds in world-class companies, macro concerns in 2014 obscured compelling opportunities for price appreciation and earnings power that we believe will surprise to the upside in 2015. Investors have woken up to the opportunity in the first two months of 2015 and many European exchanges are off to a fast start,” (Source: Derrick Tzau, Rainier Funds).

- “Lower oil and commodity prices as well as changes in currency rates continue to be the main drivers of economic trends in the Americas. The weak export outlook for energy and commodities have hurt the prospects of large economies such as Brazil, (Source: Thomas White International).

- The old adage of “Sell in May and GO AWAY” still remains generally true. Historically, the time from the beginning of May through Halloween underperforms. Since 1951 stocks have only averaged an annualized 1.6% during this time. By contrast during the “Buy” months of November through April (inclusive) the stock market typically advances a more robust 13.4% annualized. Certainly there are exceptions. The previous two years are examples of this, but generally these lackluster months are more challenging, (Souce: James Investment Research).

- “Of the 116.2 million households in the United States in the first quarter of 2015, 74 million (64%) were homeowners and 42.2 million (36%) were renters,” (Source: Census Bureau).

- Forbes recently released their list of largest U.S. charities for 2014. The United Way topped the list at $3.87 billion in donations. Salvation Army ($2.08 billion), Feeding America ($1.86 billion), Task Force for Global Health ($1.57 billion), and the American National Red Cross ($1.08 billion) rounded out the top five.

Thought for the week

“The best thing about the future is that is comes one day at a time.”

Abraham Lincoln, 16th President of the United States (1809-1865)

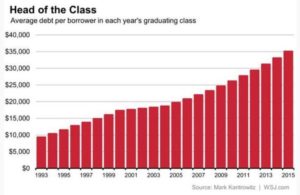

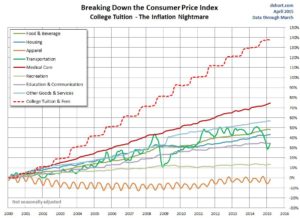

Graphs of the Week (CLICK TO ENLARGE)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.