Economic and Investment News Bits

- Overall, Vanguard’s outlook for global stocks and bonds remains “guarded given compressed risk premiums and an environment of low global interest rates. Given this backdrop, the importance of global diversification and a long-term perspective is critical.”

- Michael Hasenstab, the portfolio manager of Templeton Global Bond Fund, recently gave his perspective on oil. “It’s our assessment that the price of oil today is largely a function of change in supply due to political reasons, particularly driven by Saudi Arabia and OPEC. As a result, we believe investors should think about the changing price of oil as essentially a large global tax cut to the world of oil importers.”

- Schwab’s Liz Ann Sonders said, “Stocks are again near record highs after a dismal January, echoing 2014. But while we remain secular bulls, the risks to a correction and increased volatility appear elevated.”

- “The Fed seems philosophically inclined to raise rates even though the fundamentals do not justify such a move. Strong disinflationary pressure coming from the collapse in oil prices should caution the Fed against raising rates,” said Jeffrey Gundlach of Doubleline Capital.

- Warren Buffett’s recently released letter to shareholders shows his perspective on the United States. “The dynamism embedded in our market economy will continue to work its magic. Gains won’t come in a smooth or uninterrupted manner; they never have. And we will regularly grumble about our government. But, most assuredly, America’s best days lie ahead.”

- In 1883, Barney Kroger invested his life savings of $372 to open a grocery store in downtown Cincinnati. This gradually grew and became the first grocery store in the country to establish their own bakeries and sell meats and groceries under one roof. Today, Kroger has grown to employ about 343,000 Americans and almost 40,000 Ohioans.

Thought for the week

“History does not repeat itself, but it does rhyme.”

Mark Twain, American author (1835-1910)

Investing Commentary for the Week

“Monetary policy has become increasingly unconventional in the last six years, with central banks implementing zero-interest-rate policies, qualitative easing, credit easing, forward guidance, and unlimited exchange-rate intervention. But now we have come to the most unconventional policy tool of them all: negative nominal interest rates.”

“Such rates currently prevail in the eurozone, Switzerland, Denmark and Sweden. And it is not just short-term policy rates that are now negative in nominal terms: about $3 trillion of assets in Europe and Japan, at maturities as long as ten years now have negative interest rates,” (Source: Nouriel Roubini, Project Syndicate).

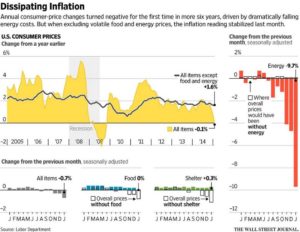

Graph of the Week (CLICK TO ENLARGE)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.