Economic and Investment News Bits

- The current six-year bull market, among the longest of the past century, could be celebrating more birthdays before it’s over, according to Schwab’s Liz Ann Sonders. While she thinks 2015 could continue to be rocky and “a tough year”, she suggests the market is firmly rooted in fundamentals. She notes “there is no euphoria or enthusiasm, which is positive for more gains.”

- “At the Federal Reserve Board meeting on March 18, the Fed may abandon its commitment to be “patient” in rising short-term interest rates. This would remove the last impediment to a summer increase in the federal funds rate,” (Source: David Kelly, J.P. Morgan Asset Management).

- “The new Apple watch could revive the allure of gold for young consumers. Calling its gold watch ‘uniquely luxurious’ in its advertising, Apple has a history of swaying consumer tastes. Apple’s status as the arbiter of cool means its new $10,000 gold watch and yellow iPhones and MacBooks may entice consumers to buy gold wearables and ornaments again,” (Source: U.S. Global Investors).

- There is a “predatory financial services industry that feeds on the elderly. It’s insane that we allow people to sell [high commission] products that are not in the best interest of older consumers, without any fear that they are going to be sued,” (Source: Michael Finke).

- After peaking at 909,000 employees in 1999, the U.S. Postal Service workforce has fallen to 595,000; about where it was in 1964. (Source: Department of Labor)

- The cost of tuition, fees, and room & board at an “average” in-state public college has increased 5.6% per year over the last 30 years, reaching $18,943 for the 2014-2015 school year. If college costs had instead risen only by the rate of inflation over the last 30 years (2.8%), a year of college would cost $8,381 during 2014-2015. (Source: College Board)

Thought for the week

“The world is full of magical things patiently waiting for our wits to grow sharper.”

Bertrand Russell, British philosopher (1872-1970)

Investment Commentary for the Week

As we take a look at year to-date returns for various market classes, PDS has the following observations: 1) International stocks, especially those of developed economies, are outperforming U.S. stocks across all market segments. This is huge shift from last year. The stronger U.S. dollar is hurting U.S. exports, and the European Central Bank (ECB) is just starting its QE program. 2) Treasury bonds are lagging the broader bond market, which is an additional major change from 2014. 3) Top sectors include biotechnology and healthcare, while utilities, commodities and Latin America stocks are suffering. 4) While some years like 2014 may cause investors to question a diversified portfolio, 2015’s increased market volatility is a reminder of its virtues.

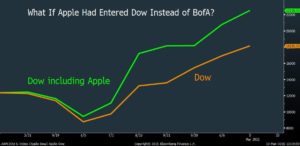

Graph of the Week (CLICK TO ENLARGE)

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip domestic stocks. Many people use this as a barometer for the U.S. stock market. However, these 30 stocks only represent a small portion of the market. This chart above shows how much of an impact one stock can really make on this index. Bank of America was added to the Dow in 2008. If they would have added Apple instead of Bank of America at the time, the Dow would currently stand around 22,500 or almost 25% higher than it is today. (Source: Bloomberg)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.