Economic and Investment News Bits

- An average of nearly 60,000 high-skilled agriculture and related job openings are expected annually in the U.S. over the next five years, with only about 35,000 graduates in food, agriculture, renewable resources, or environment available to fill them, according to data from the U.S. Department of Agriculture and Purdue University.

- China’s stock markets rebounded today after a losing week. The Shanghai Composite Index gained 4.7% the first day of June, recovering a good bit of the 6.5% loss last week. For the year to-date, the index has gained 49.5%.

- Economist John Keynes predicted in 1930 that by the year 2000 Americans would choose to work as little as 15 hours a week because the bulk of their material needs would have been satisfied, and a life of leisure would take precedence. As of April 30, 2015, the average American worker in the private sector works 34.5 hours a week (Source: Department of Labor).

- Mongolia has reached an agreement with Rio Tinto, a multinational metals and mining company, to develop an untapped copper and gold mine that will bring $9 billion in direct spending to the country. In 2013, Mongolia’s GDP total was $11.5 billion. By comparison, Ohio GDP is $466 billion. (Source: Bloomberg)

- More Americans are building homes this spring, and the price of lumber is increasing as a result. New home construction jumped 20% in April, the biggest monthly percentage gain since February 1991. Housing accounts for 40% of U.S. lumber demand. (Source: Wall Street Journal)

- Using the most recent Ohio census estimates, the largest cities by population are Columbus (809,798), Cleveland (390,928), Cincinnati (296,550), Toledo (284,012), Akron (198,549), Dayton (141,359), Parma (80,597), Canton (72,683), Youngstown (65,405), and Lorain (63,707). Cleveland and Toledo are two of the three biggest U.S. population losers since 2010, but they pale in comparison to Detroit, which lost another 5% of its population in just four years.

Thought for the week

“You wouldn’t have won if we’d beaten you.”

Yogi Berra, American baseball player and coach (b. 1925)

A Little Perspective

In 1926, oil was $2 per barrel. Today’s price is $60. The prime interest rate was 21.5% in 1981. Today it is 3.25%. In 1930, 5.5% of the U.S. population was over 65, and male life expectancy was 58 years. Today, 14% of the population is over 65, and life expectancy is 76 years (wonder why Social Security has problems?). The price of gold in 1927 was $20.67 per ounce, compared to $1,188 per ounce today. The top federal income tax rate was 91% in 1951. The top rate today is 39.6%. It cost 2¢ to mail a letter in 1925. Today a first-class stamp is 49¢. The average sale price for a new home in the U.S. in 1963 was $19,300, and the average size was about 1,200 square feet. The average price today is $377,800, averaging 2,700 square feet. At the height of the depression (1932) unemployment was at 24.9%. Today’s unemployment rate totals 5.4% of the population.

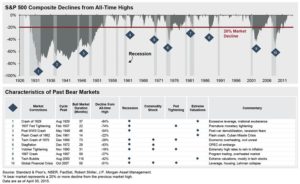

Graph of the Week (CLICK TO ENLARGE)

“This chart shows historical bear markets (a 20% market decline from the previous all time high), what caused them, and the magnitude of the drawdown. This is meant to illustrate that lofty valuations are not predictors of bear markets, but rather that bear markets are caused by external factors such as geopolitical conflict, monetary policy action and recessions.” (Source: J.P. Morgan Asset Management)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.