Economic and Investment News Bits

- “I am wary about advising people to pull out of this [stock] market, even though I believe valuations are at extreme levels”, (Source: Robert Schiller, creator of Schiller CAPE ratio).

- Comparing fracking wells in the U.S. Great Plains with Saudi Arabia’s conventional oil wells, Bloomberg notes “New wells in the best part of North Dakota’s Bakken field break even at $29 a barrel. Saudi Arabia can produce oil from existing wells for $5 a barrel, but the Saudis need an oil price of $89 to balance their state budget. (Editor’s note: July 13 oil price was at $51.80 this morning.)

- “Wi-fi first is coming to your cell phone. Just as internet telephone applications such as Skype took long-distance companies by surprise, we think that “wi-fi first” cell phones – phones that default to wi-fi for placing calls and only use the cell network as a backup – are poised to surprise and disrupt the traditional providers who rely on cell calls and texts as rich revenue streams. Look for upstart companies, and be careful of the traditional providers,” (Source: Guild Investment Management).

- “If you lived in western Washington during the 1980s, I may have very well interrupted your dinner with a can’t miss stock solicitation. I worked as a Merrill Lynch stockbroker then, and we had mandatory work nights, where everyone with less than five years of service placed cold calls to everyone in the best zip codes,” (Source: John Mauldin).

- History shows it takes two years on average for a recession to occur after wage gains reach 4%. Currently, average gains are up only 1.9%. And recessions start three to seven years after the Fed’s first tightening. No tightening yet. (Source: Linda Duessel)

- CnnMoney asks what bosses at top companies look for in a new hire. Among the findings are that many do not care where you went to college. Second, top grades do not necessarily make a leader. Third, passion means more than ability. Fourth, personality counts…being nice might be more important than an MBA. And fifth, the ability to collaborate is the most important trait.

Thought for the week

“We know what we are, but know not what we may be.”

William Shakespeare, English playwright (1564-1616)

Perspective on Retirement

After working with clients for 30 years, we at PDS have heard a lot of different views of what retirement looks like. One way to approach retirement planning, according to author Steve Covey, is to “consider what your life might look like if you used your discretionary time in a way that fully enacted your values: What are your deepest values? How do you want to be remembered? How are your current activities aligned with your values? What is one change you would like to make to strengthen that alignment?” Whether it is to continue working in retirement, doing more volunteer work, traveling, helping family members, or any other retirement goals, answers to these questions are a good way to vision what YOUR retirement might be.

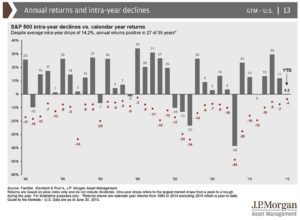

Chart of the Week (CLICK TO ENLARGE)

The above chart from J.P. Morgan shows once again that domestic stock markets are overdue for a correction. The average intra-year decline has averaged 14% in the last 35 years. This is not something to fear, but it is something to expect for your stock allocation. When will the next correction occur? Maybe it will start tomorrow or maybe next month, or maybe next year. But it will happen.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.