Economic and Investment News Bits

- Apple Inc., already the world’s largest company, hit a new record value last week at $700 billion. Setting the new record put the iPhone maker’s valuation at more than 1.7 times that of the second largest company in the world, Exxon Mobil Corp. (Source: Bloomberg)

- “Solar power will prove to be an effective alternative, as plummeting costs are changing the game. Sharp declines in the price of solar materials and components, driven by manufacturing innovation, have driven the price of solar panels lower over the past five years. Solar energy will soon be competitive even without government subsidies. Commentators who have claimed that solar will never be more than an insignificant part of the total energy mix are wrong,” (Source: Guild Investment Management).

- “The current core inflation of 1.8% is at the low end of the range since the 1960s, while corporate P/E multiples remain well below the peaks of previous bull market cycles. With global inflation now in a slowing trend, long-term interest rates could remain subdued for a much longer time period,” (Source: Linda Duessel).

- “The [U.S. stock] market could easily be 20% or 30% lower from where it is now. We’re living on borrowed time. When this market breaks, you’re going to see many money managers and others washed out to sea who will never see land again. It will happen between now and 2018,” (Source: Robert Rodriguez.

- According to the American Farmland Trust, Ohio has 80,000 farms, averaging 186 acres each. Ohio produces more eggs and more Swiss cheese than any other state. It is ranked third in tomatoes, fourth in winter wheat, and fifth in sweet corn.

- Chinese stocks significantly out-performed last week, rallying on the back of interest rate cuts from the People’s Bank of China. The surprise rate cuts came in response to weaker economic data. The Shanghai Stock Exchange Composite Index rose almost 8%.

Thought for the week

“Never mistake motion for action.”

Ernest Hemingway, American novelist (1899-1961)

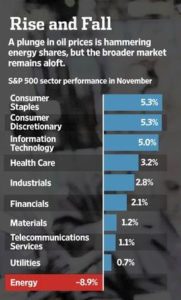

Graph of the Week (CLICK TO ENLARGE)

The S&P 500 ended the month of November with a 2.4% return. However, not all sectors experienced positive returns. Energy plummeted by almost 9% due to the rapidly falling oil prices. As of December 1st, oil was down to about $65 per barrel, or 36% from its high in June. This is a result of OPEC’s decision to try not to eliminate an oil supply glut. The U.S. is now producing oil at records levels which has drastically increased the global supply while the demand has been relatively unchanged. (Source: Wall Street Journal)

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.