Economic and Investment News Bits

- In the past year, Slovakia has become increasingly important in the ongoing conflict between Russia and Ukraine over Ukraine’s strategic alignment with the West. One of Russia’s key levers over the Ukrainian government has been the threat of limiting or cutting off natural gas supplies. Ukraine has countered this by working with Slovakia’s leaders in Bratislava to re-route natural gas back into Ukraine through pipelines that usually flow in the opposite direction. Because of its strategic geographic location, Slovakia is beholden to neither Russia nor the West. (Source: Stratfor Global Intelligence)

- California farmers are drilling wells and pumping billions of gallons of water from the ground, depleting a resource that was critically endangered even before the four-year drought began. In some places, water tables have dropped 50 feet or more, and land surfaces are sinking as much as a foot in some places, causing roads to buckle and bridges to crack. Shallow wells have run dry, depriving some communities of water. 80% of the water used in California goes to agriculture. (Source: NASA)

- “The March job gains were bad. But a lot of the weakness is attributable to the awful winter weather in the East, the West Coast shipping port shutdowns, and other seemingly one-time factors.” Nevertheless, the report is still “indicative of a strong labor market as reflected in last week’s plunge in jobless claims to near 15-year lows. As far as the Fed and markets are concerned, the focus going forward will be on wage growth,” (Source: Linda Duessel).

- Government spending during fiscal year 2015 is projected to be 69% mandatory spending and 31% discretionary In 1962, it was 32% mandatory and 68% discretionary. (Source: OMB)

- In 1995, Angela Hicks started knocking door-to-door in Columbus to create Columbus Neighbors, signing up 50 members to start. The next year, the company’s name was changed to Angie’s List, and the rest is history. The company now has almost 2 million members and more than 1,500 employees and is headquartered in Indianapolis.

Thought for the week

“Unless someone like you cares a whole awful lot, nothing is going to get better. It’s not.”

Dr. Seuss, American writer (1904-1991)

Planning Commentary for the Week

In a recent article titled “7 Financial Mistakes You Shouldn’t Make for Love”, writers Zara Green and Alfred Edmond list some money-related areas unmarried adults should never make. 1) Don’t lend money casually without a written agreement that lays out repayment terms. 2) Never co-sign a loan. Three out of four times, you, not the borrower will end up repaying the loan. 3) Don’t blow your cash flow budget to bankroll a lavish lifestyle for a significant other. 4) Never assume financial responsibility for an adult dependent. Don’t pay the mortgage, rent, utilities and other bills of a healthy, able-bodied adult. 5) Never give your PIN, bank account numbers, ATM passwords, Social Security numbers, or other personal information to a love interest. This should be reserved for married couples. 6) This goes for all couples – don’t assume you can change someone’s financial habits and behaviors. It rarely ever happens. 7) Also important for couples about to marry – don’t be ignorant about your partner’s financial history. Know it and treat it seriously. The writers add, “No matter how in love you are, protect yourself at all times.”

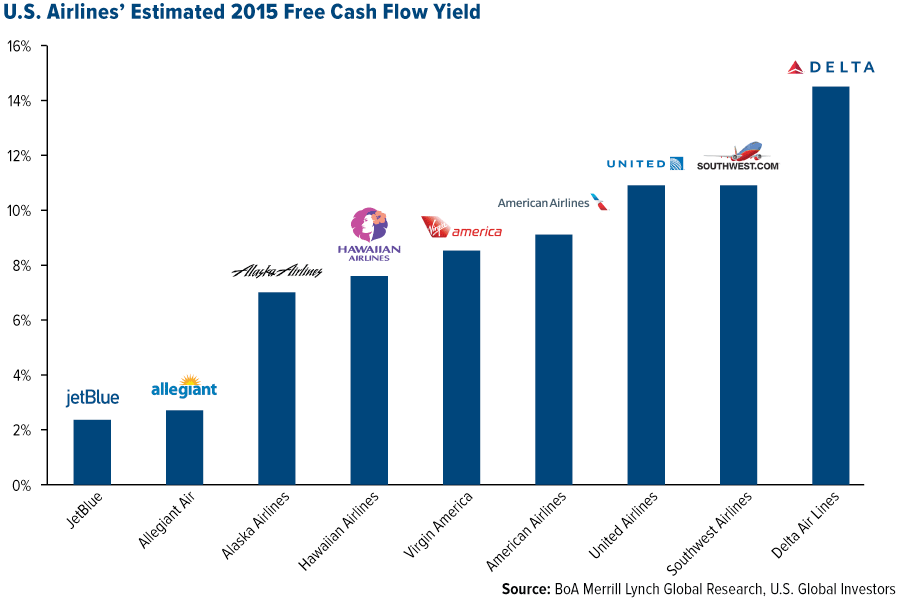

Chart of the Week (CLICK TO EXPAND)

Surprising to many, the airline industry has been the best performing sector in the S&P 500 industrials for the last one, three, and five-year periods. Stocks for the four leaders – Delta, Southwest, United, and American – began their ascent even before oil prices began to plummet 50-60% starting last summer. Consolidation, new sources of revenue, better fuel efficiency, and more seats per plane have helped airlines excel. Revenue alone may not provide information on a company’s strength. Sometimes a more precise metric is free cash flow, which tells how much cash the company actually has to spend. Free cash flow is expected to continue growing the next three years.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.