Economic and Investment News Bits

- Due to energy sector weakness, a still-strengthening U.S. dollar, and worries over global growth, corporate earnings estimates for the quarter have come down sharply. Some analysts expect total earnings in the recently-ended first quarter to be down 4% or more over the same period last year because of lower corporate revenues. Historically, bad numbers are released early on. The first big reports will start this week. (Source: Direxion Investments)

- “While consensus opinion suggests a further slowdown of GDP growth in China in 2016 compared to 2015, we believe that progress in public reforms and a bottoming out of the housing market will lead to China’s continued strong growth of 6.8%,” (Source: Deutsche Bank).

- “A beautiful wall of worry (a good sign for market gains) is clearly intact, because of oil prices, the stronger dollar, rate uncertainty, and very low inflation. Most bear markets are caused by tight money policies leading to recessions. These are notably absent, and there really is no sign of a pending recession,” (Source: Federated Investors).

- “Russia will watch nervously as the S. continues building an arc of allies along the European borderland with Russia. Evan as Russia is pushed into a tighter corner, we do not expect Moscow to take the risk of making a major military push in Ukraine this quarter. Intensifying economic stress will widen fissures within the Kremlin, while Russian President Putin’s ability to manage this power struggle will visibly erode,” (Source: Stratfor Global Intelligence).

- AreaVibes reveals the best places to live in Ohio by combining scores from several quality measures. Top cities for education are Upper Arlington, Dublin, Hudson, Shaker Heights, Solon, Avon Lake, Westerville, Gahanna, Rocky River and Beavercreek. Not surprisingly, the same cities are included in the list for worst cost of living.

- S. News & Special Report’s recent listing of best-paying construction jobs for 2015 shows Cost Estimator at the top, with Construction Manager, Plumber, and Sheet Metal Worker completing the top four.

Thought for the week

“No matter how busy you are, take time to make the other person feel important.”

Mary Kay Ash, American businesswoman (b. 1918)

Generational Commentary for the Week

By 2020, it’s estimated that millennials (persons born in the 1980s and 1990s) will account for about 40% of retail sales, as boomers downsize into retirement with increased spending dedicated to travel, leisure, entertainment, and health than “stuff”. This process of shifting from the boomer to the millennial customer can be difficult, Renaissance Macro says. The millennial consumer and technology have opened the door to many new forms of discounting. Millennials are more focused on experiences and look than volumes. Ostentation living is giving way to more understated living, and millennials are rent-based consumers. Investors now should be aware of this long-term trend. Ignore it at your own risk.

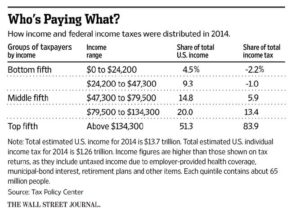

Graph of the Week (CLICK TO ENLARGE)

As the April 15th federal income tax deadline approaches, here is a look at how income and taxes are allocated. According to the Wall Street Journal, the bottom 40% of earners, on average, pay no federal taxes, due to earned income credits, extremely low wages, and various deductions allowed. The top 40% of taxpayers will account for about 97% of all federal income taxes paid. The top 1%, or only 3 million people, will account for almost 48% of the federal income tax paid.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.