Welcome to our September 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Interest Rates Stay a Hot Topic

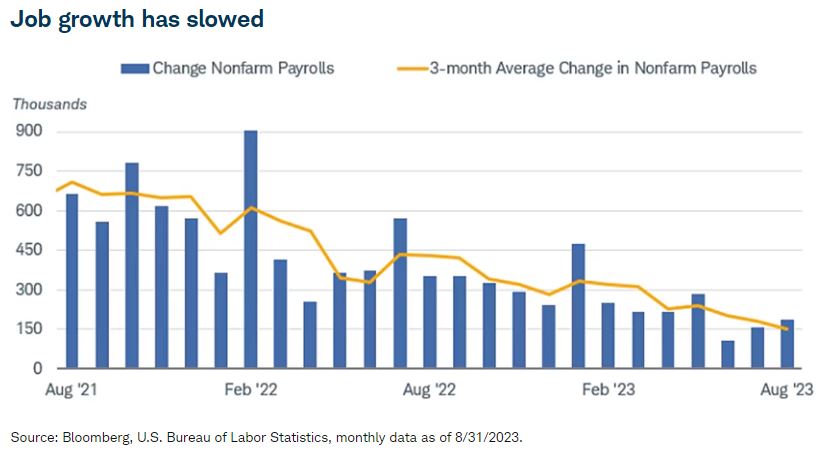

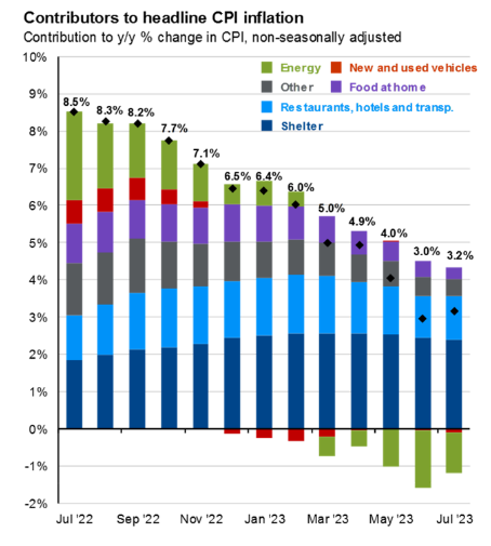

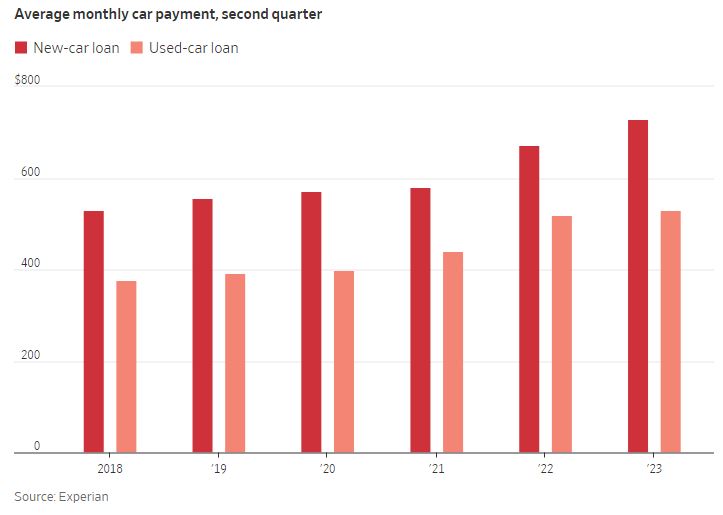

The Federal Reserve met earlier this month to discuss interest rates, again. It was a planned meeting and the meeting and the minutes that come after remain highly scrutinized by experts (and everyone else) looking for any indication on where rates might be going. Most recently, they’ve landed on a rate hike pause with the possibility of another quarter point hike (0.25%) before year end. Jeffrey Kleintop at Charles Schwab provided some context that supports the pause in hikes; “policy tightening is showing up in economic data and lower inflation.” The labor market is showing a particular softness month to month which is a key factor for the Fed. The first chart below makes it easy to see the gradual but steady decrease in hiring. And as mentioned, inflation continues its gradual but steady trend lower, nearing the Fed’s long-term 2% year-over-year target. In the second chart below, you can see energy costs falling and the new and used car market being a big reason for the return to normalcy with inflation. Unfortunately, it doesn’t mean prices at the grocery store will fall, but hopefully they won’t keep going up!

High Interest Rates for the People

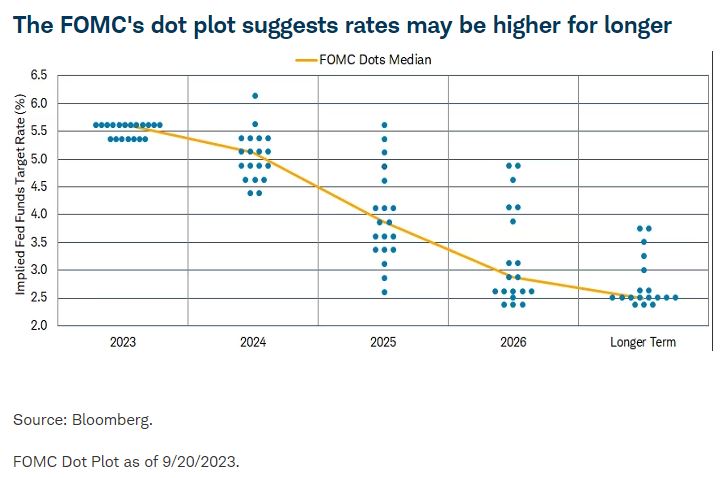

Many of us have already been feeling it, so it comes as no surprise when the Wall Street Journal reports these “higher-for-longer rates are starting to exact a toll on households that need to borrow now, especially for major purchases such as homes and cars.” The dot plot below is a great way to visualize long term expectations on interest rates.

Each dot represents one FOMC member’s interest rate projection and the yellow line is the median of all. This can and will change as the markets and economy changes, but for now the committee is expecting rates to stay above 5% for the better part of 2024. These elevated rates likely means mortgage rates near 7.50%, new and used car rates around 8% and 10% respectively, and credit card debt up around 25% are here to stay. According to this Wall Street Journal article, the number of people taking out short-term payday loans (usually with ultra high interest rates) is up 35% since last year and “the percentage of people with credit-card and auto-loan balances that became past due rose above prepandemic levels for the first time in the second quarter.”

Hi! Do You Have Any Plans to Sell Your Home?

To answer the 5th spam call of the day, no. In 2022, investors paying cash accounted for nearly 10% of home purchases. These are primarily in middle-income neighborhoods where many people would normally be looking for their first home, or one to raise a family in. Instead, large investment companies are swooping in and renting them out. Depending on who you ask, this is either a great idea or a detriment to neighborhoods and affordability. On the one hand, renting out homes with yards allows more people the opportunity to move in to these areas – whether they couldn’t afford to part with a down payment or couldn’t be approved for a mortgage, renting can create an opportunity. On the other hand, the deep cash pockets of large investment companies may be completely shutting people out of the home-buying process, pushing prices even further from affordability. Across the nation, institutional investors own 3.8% of the country’s 15.1 million single-family rentals (574k), but if the number of spam texts and calls I get is any indication, this number may push even higher.

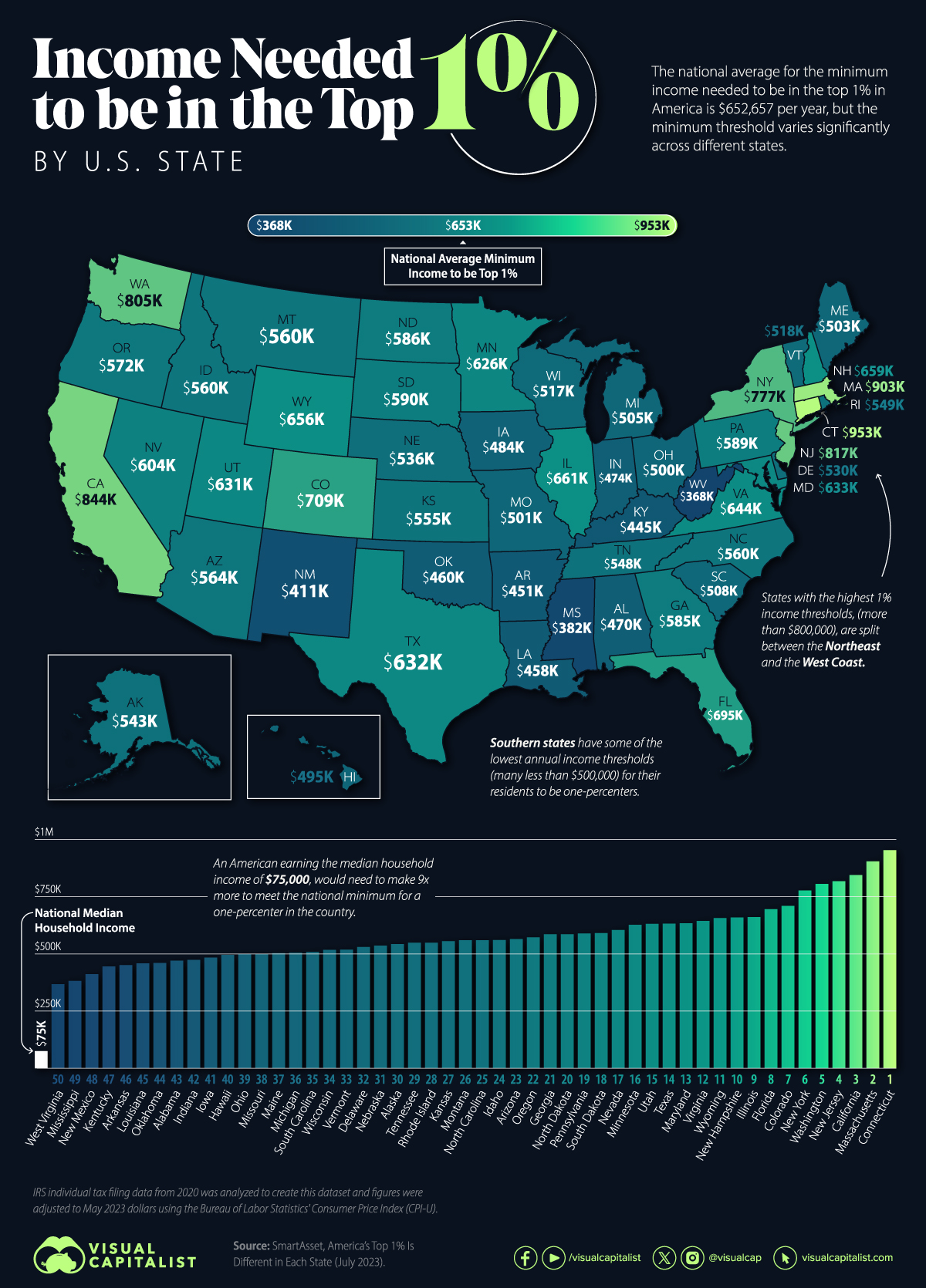

1 Percenters

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.