Viewpoints: June 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Jobs are Coming Back, Still a Long Way to Go: Almost 40% of those with incomes below $40,000 were laid off during the current crisis compared to just 13% of households with income over $100,000. Recent data indicates the overall unemployment rate declined to 13.3%; however, it is still nearly 10% higher than the 50 year low rate of 3.5% from just three months ago. In May, the U.S. added 2.5 million jobs, by far the largest monthly jobs gain in U.S. history since at least 1939; however, a total of 20.7 million jobs were lost in April, meaning fewer than 10% of April’s job losses were added back in May. The March-May job losses are 2x larger than the total Global Financial Crisis job losses. (Source: CNBC)

- Prices are Lower…and Higher: Overall, consumer prices declined 0.8% in April (the largest monthly drop since the Great Recession in 2008); however, grocery prices increased 2.6% (the largest monthly increase since 1974, a time of double-digit overall inflation). The overall price decline was primarily driven by gasoline prices (down 20.6%) while the increase in grocery prices was due to increased demand as eating out was replaced with preparing meals at home and supply chain disruptions caused by the coronavirus pandemic. (Source: NPR)

- Personal Income is Up…and Down: Personal income surged 10.5% in April for the largest monthly gain since at least 1959; however, these large gains are likely to be temporary as they were primarily caused by a surge in unemployment insurance payouts and CARES Act stimulus payments. Outside of these payments, personal income declined 6.7% in April. (Source: First Trust)

- How We’re Using Stimulus Dollars: When asked how the majority of relief payments are being used, nearly 40% are adding to savings, 29% are paying down debt or current bills, and 14% are buying necessities. (Source: Civic Science)

- Record High Savings: The personal savings rate (how much people save as a percentage of their disposable income) spiked to a historic 33% in April, by far the highest since data began tracking in the 1960s. Up from 12.7% in March, this new record nearly doubled the previous one, 17.3% in May 1975. (Source: CNBC)

- Record Decrease New Housing Starts: US housing starts in April dropped 30.2% from the previous month, a record monthly decrease since the indicator began tracking in 1959. Despite the significant month-over-month decrease, a similar number of homes were started in April as compared to 2015, just 5 years ago. (Source: Business Insider)

- You Gotta Know When to Hold ‘Em: With no sports to watch live and bet on, sports fans are seeking new ways to gamble and are turning to the stock market. Three of the four largest brokerages in the U.S. reported record monthly new account openings in either March or April. (Source: Financial Times)

- #1…by A LOT: It’s no surprise that Amazon is the leader in online sales. With 38.7% of all online dollars spent at Amazon, they handily outpace the distant #2, Walmart, which accounts for only 5.3%. Amazon has been investing heavily in next day delivery, which should bode well for them as an increasing number of shoppers are buying groceries online. (Source: eMarketer)

Thought for the Month

“Serenity now!”

– Jerry Stiller, American comedian, actor, and author (1927-2020)

Commentary – The New Retirement Math

A recent article from the Wall Street Journal, “Over 60 With Decades Left on the Mortgage: The New Retirement Math” , shares personal stories of older Americans carrying mortgage debt. Since 2006, the number of 65+ homeowners still carrying a mortgage has doubled to 40% of older Americans, over 9 million homeowners nationwide, with a median debt still owed of $72,000. For homeowners aged 80+, the median amount owed is $43,000 with 11% still paying down mortgage debt.

As these homeowners moved to new (and typically more expensive) homes, they tended to stretch their mortgage payments back out to 30 years to make their monthly payments more affordable. As interest rates have declined over the last decade, many refinanced to lower their monthly payments, and, by doing so, stretched the payments back out to 30 years yet again. In addition to incurring significant additional interest expenses, many older Americans have been forced to delay retirement or use a substantial portion of their retirement savings or income to pay their mortgage. They are less able to weather job losses or cover unexpected expenses. This makes them particularly susceptible to medical expenses that are more prevalent as we age.

Whereas homeownership has long been viewed as a foundation for building wealth, many have ignored that this financial template presumes the mortgage is paid off. A key component for many to ensure they are able to enjoy a financially stable and rewarding retirement is to be free of mortgage debt. If you must carry debt into retirement, a plan to pay it off is of utmost importance.

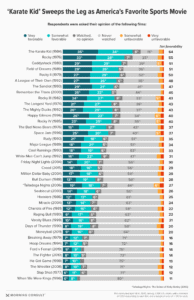

Chart for the Month – America’s Favorite Sports Movies

Released in 1984, “The Karate Kid” topped a recent survey by Morning Consult to find America’s Favorite Sports Movie. All five age ranges surveyed had it in their top three selections, proving its generational appeal. Rounding out the top three are Rocky (1976) and Caddyshack (1980). Many of the highest ranking films are unavailable on streaming services, so you’ll need to dust off your physical media if you want to watch them. I think I have a VHS of “Space Jam” to watch if my VCR still works.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.