Viewpoints: July 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Best Quarter for Stocks in 20+ Years: Up nearly 20% in the second quarter, the S&P 500 had it’s strongest quarterly return since the dot-com boom (the fourth quarter of 1998). The 30-stock Dow gained +17.8% in the second quarter, the biggest quarterly rally since the first quarter of 1987. The Nasdaq’s +30% gain was the best quarter since late 1999. (Sources: Reuters, CNBC)

- Tech Mega Caps: FAANGM stocks (Facebook, Amazon, Apple, Netflix, Google (Alphabet), and Microsoft) currently represent 24% of the S&P 500’s market capitalization, more than double the 10% they accounted for just 5 years ago in 2015. Since 2013, FAANGM stocks have returned a cumulative 442.8%. The S&P 500, excluding these stocks, has returned 71.8%, 371% less. In 2015, FAANGM stocks’ Forward P/E was ~20. Currently, their forward P/E is 39.1, nearly double. (Source: Yardeni Research)

- Retail Bankruptcy Record: Last year, 17 major retailers entered bankruptcy proceedings. In the first half of 2020 alone, 16 major retailers have filed bankruptcy, a record for any 6-month period. Familiar names include Neiman Marcus, J.C. Penney, GNC, and Pier 1. Only July 8th, Brooks Brothers, founded in 1818, was the latest retailer to file for bankruptcy. (Sources: Bloomberg, Retail Dive, CNBC)

- Record Low Mortgage Rates: The 30-year fixed mortgage rate reached an all-time record low of 2.98%. At the beginning of 2020, it stood at 3.72%. In the early 1980s, it peaked above 18% after the Fed raised rates to fight runaway inflation. (Source: The Wall Street Journal)

- Get Ready for Political Ads: For the 2020 Federal election campaign cycle (White House, Senate, and House), spending for advertisements is projected to reach a record $6.7 billion. Over half of the spending historically occurs in the last 10 weeks before Election Day, from the end of August until the first Tuesday in November. (Source: Advertising Analytics)

- Record Low Marriage Rate: The share of Americans getting married has fallen to its lowest level since data collection began in 1867. Strained finances are most commonly cited as the top reason couples are avoiding getting hitched. Additionally, only around half of adults were living with a spouse in 2019 compared to about seven in 10 in 1970. Non-spouses living together has increased dramatically with 7% living with a partner last year, up from less than 1% in 1970. (Source: The Wall Street Journal)

Thought for the Month

“First thing in the morning, before I have coffee, I read the obits. If I’m not in it, I’ll have breakfast.”

– Carl Reiner, American actor, comedian, director, screenwriter, and author (1922-2020)

Commentary – College to Career Planning

Educate to Career, a college and career planning resource, wrote a guest contribution post to Advisor Perspectives, a financial advisor industry publication. In it, they expose how student lenders are targeting children of upper-income families to pay hefty commissions to obtain or consolidate student debt. One source of new business for student lenders is paying financial advisors a $750 “finder’s fee” for referring someone who takes out a student loan using their network of lenders. That’s right, some “advisors” are being paid handsomely to put college kids (or their parents) into debt rather than providing sound financial planning advice to avoid making costly mistakes.

As a fee-only fiduciary advisor, PDS Planning has attempted to remove all conflicts of interest so that we can be solely focused on giving truly objective advice. Because of our fiduciary obligation, the only compensation we receive is directly from our clients, with no compensation from commissions, performance-based fees, or referrals. As such, we would never consider participating in such a program.

We encourage you to remain vigilant while seeking and taking financial advice. By sharing this exposé, we remind you that, unlike a fee-only advisor such as PDS Planning, some advisors may not have your or your family’s best interests in mind. Please let us know if you or a friend or family member would like to discuss college to career planning or you have other questions or concerns about securing a successful financial future. Additionally, there are numerous free resources on Educate to Career’s website with sections dedicated to students & families, counselors, and job seekers.

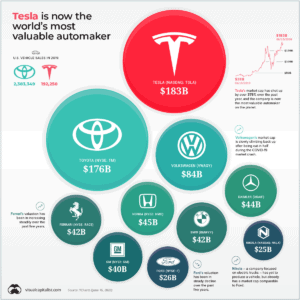

Chart for the Month – Tesla

Measured by stock market capitalization (the value of a company’s outstanding shares of stock), Tesla is now the world’s most valuable automaker. With Tesla stock increasing 675% over the last year, the 15-year-old company is more valuable than Honda, BMW, GM, and Ford…combined. By the end of 2017 (less than 3 years ago), Tesla made headlines by overtaking Ford alone in market value. Today, Tesla is valued 7x more than Ford.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.