Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Critical Recession Indicator: The Fed’s recession tracking model showed a 32.9% probability of a U.S. recession in the next 12 months, the highest level since the Financial Crisis in 2009. A measure of 30%+ has occurred before every recession since 1960; however, it should be noted that even during the Great Recession of 2008, the probability never rose above 40%. (Source: Business Insider)

- Magic Number: On average, Americans believe they need $1.7 million to retire; however the average 401(k) balance for those in their 60s is less than $200,000. Even so, two-thirds of workers are confident they will be able to live comfortably throughout retirement, yet only 42% have done any retirement calculations. (Source: CNBC)

- The Rich Keep Getting Richer: The wealthiest 10% of American households own 84% of stocks, up from 77% in 2001. Middle class wealth remains predominantly tied to homes, while the richest Americans’ primary residence represents less than 8% of their total wealth. (Source: National Bureau of Economic Research)

- Millenials Are Ruining Divorce: The U.S. divorce rate declined 18% from 2008 to 2016, suggesting marriages today have a greater chance of lasting than they did 10 years ago. Fewer people are getting married and are waiting to tie the knot until education, finances, and careers are on track. (Source: Bloomberg)

- EAT MOR CHIKIN: Chick-fil-A is now the 3rd largest restaurant chain in the U.S. behind McDonald’s and Starbucks after surging from #7 last year to pass Wendy’s, Burger King, Taco Bell, and Subway. The average Chick-fil-A location generates $4.6 million in annual sales compared to $2.8 million for McDonald’s. (Source: Business Insider)

Thought for the Month

“Never think you’re better than anyone else, but don’t let anyone treat you like you’re worse than they are.”

– Rip Torn, American Actor (1951-2019)

Commentary – Americans’ Retirement Savings (or lack thereof)

The Motley Fool recently presented a sobering look at Americans’ retirement savings. While most people plan to retire at the traditional retirement age of 65, few have actually planned to ensure this dream can become a reality. Nearly half of all workers acknowledge they were guessing at how much they needed to save for retirement, and only 12% had used a retirement calculator to provide an estimate. Although having reached the age they anticipated retiring and being mentally prepared to do so, many come to the realization they are not financially prepared and are forced to make the difficult decision of whether to remain in the workforce or scale back their retirement dreams.

After a decade of positive market returns and the longest bull run of all-time, many people feel better about their financial stability; however, you must have money invested in the markets to achieve these gains. One in three Americans has less than $5,000 saved for retirement, and 21% have no retirement savings at all. For those eligible for an employer 401(k) match, many are choosing not to take advantage of this “free money” leaving an estimated $24 billion unclaimed every year. Further hampering retirement savings growth, 29% have taken early withdrawals from their retirement accounts. It really is as simple as it sounds: The only way to achieve the compounded returns the market has historically provided over the long-term is to continually grow your retirement savings by…saving.

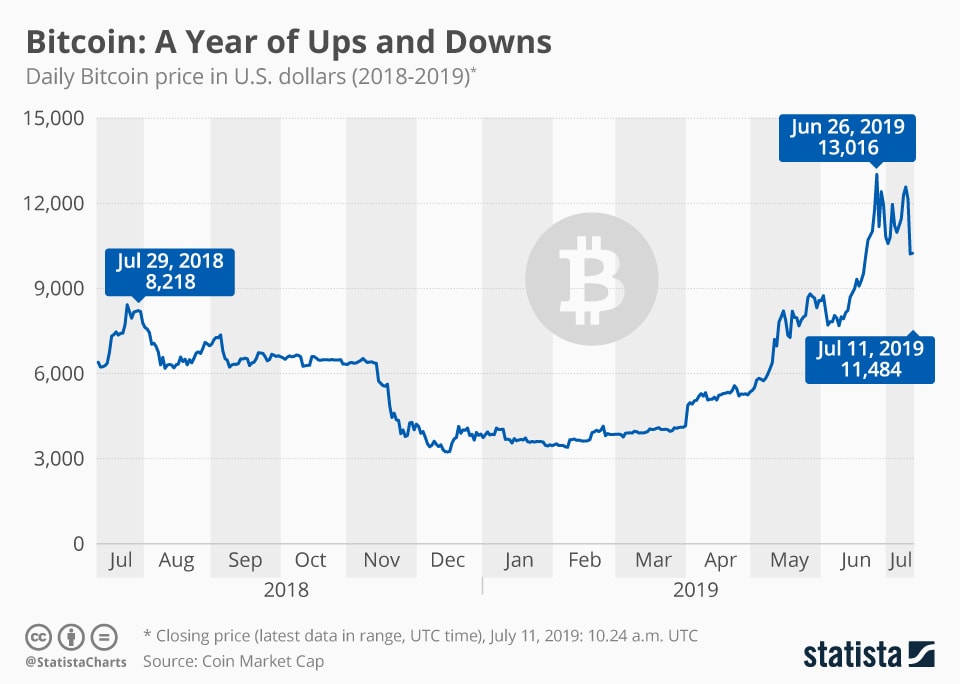

Chart for the Month

Surging to $19,700 in December 2017, Bitcoin’s volatile price plummeted to nearly $3,000 a year later. After a prolonged period of losses and stagnancy, the price has recently rallied back to above $10,000. With Facebook announcing their own cryptocurrency, the hype appears to be back around digital currency.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.