Welcome to our February Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

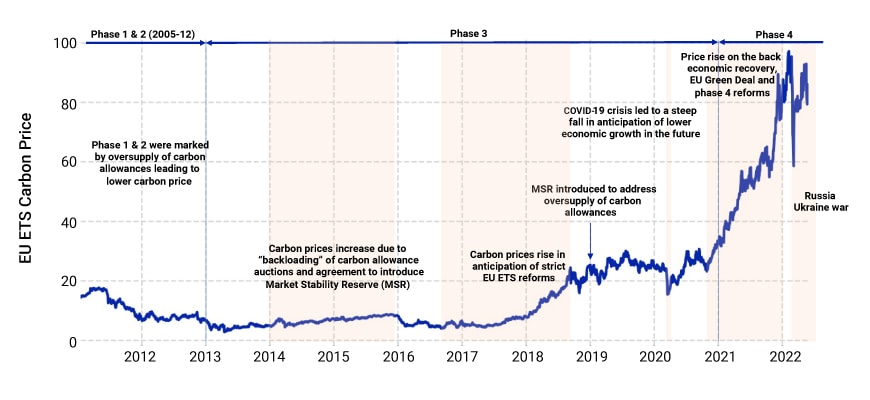

I Speak For The Trees

Early this month JPMorgan Asset Management acquired 250,000 acres of land (about 2x the area inside the 270 loop around Columbus) in the southern pine belt for $500 million. And they’re not the only ones. A group of several businesses led by T. Rowe Price, purchased 1.7 million acres of forest for $1.8 billion at the end of 2022. These businesses plan to use the forests as a carbon offset asset for themselves and by selling the tradable carbon offset certificates to other companies needing to stay compliant in an era of sustainability. Only 10%-20% of revenue is expected to come from harvesting wood, down from 80%-90% under the previous ownership. (Source: WSJ & WSJ)

A Bet is a Bet

Last Super Bowl Sunday was the first time the big game was played in a state where sports betting was legal. Expectations were high that gambling was going to be a big theme for the weekend and those expectations were met. FanDuel said they accepted an average of 50,000 bets per minute during Super Bowl 57. A separate company tasked with verifying bettor’s locations saw 100 million sports-betting transactions during the weekend – an all-time high. (Source: CNBC)

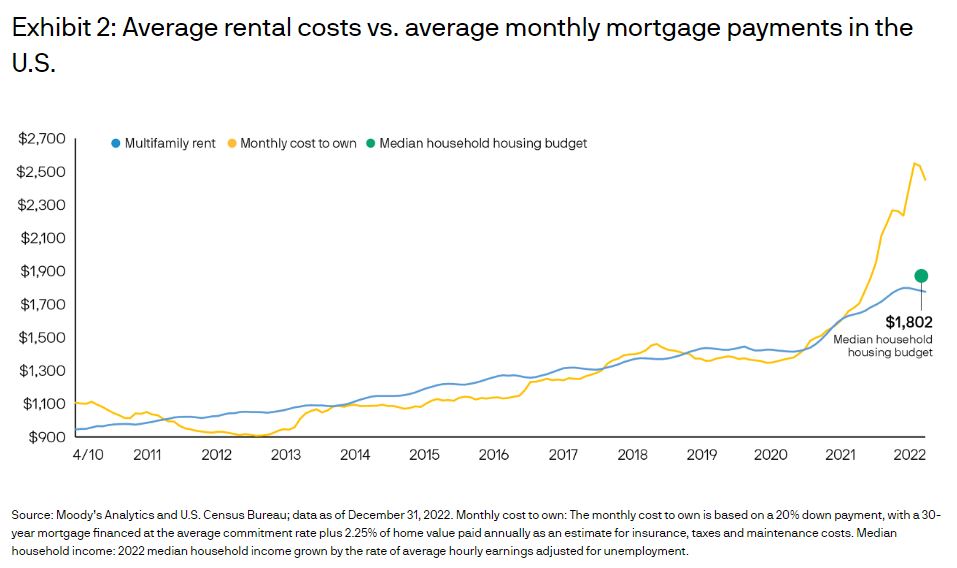

Cost of Living

The average monthly cost to own a home sits around $2,500. Home prices have not made any significant step back and mortgage interest for a 30-year loan is nearing 7% resulting in these high costs. And despite inflation pushing rents up nearly 8% year over year, it still remains the most cost-effective for the median household. (Source: JPMorgan)

New Year = New Tax Rules

Beginning in 2024 under the SECURE Act 2.0, rollovers from 529 plans into Roth IRAs will become available. You can roll up to $35,000 from a 529 into a Roth, but the transfer can only be made to the Roth IRA of the beneficiary, not the owner. The 529 plan must have been in existence for 15 years and the transfer during any given year is limited to no more than the annual IRA contribution limit for that year. Click here to read more on What SECURE Act 2.0 Means for You.

Importance of Investing Young

“Let’s say you started investing at 20 years old, and you invest $250 each month with an 8% annual rate of return. By the time you reach 65, over 50% of your total portfolio would have come from money that you invested in your 20s” says Sjoerd Tilmans in a recent post on Visual Capitalist. (Source: Visual Capitalist)

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.