Viewpoints: December 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Covid-19 Stimulus Package: After months of gridlock, congress is hoping to pass a coronavirus relief deal worth nearly $900 billion. It’s expected to include another round of direct relief checks, increased unemployment benefits for the millions still out of work, funding for vaccine distributions, schools, and more. Lawmakers hope to pass the aid package before the week’s end. (Source: WSJ)

- Growth to Value: During the month of November, the S&P 500 rose 10.75%. A total return usually applauded when reached over the course of a year. Meanwhile, the Dow Jones gained an even more impressive 11.84%, possibly signifying the beginning of a shift from growth to value. (Source: CNN)

- Vaccine Distribution has Begun: In the US, government officials confirmed enough doses to vaccinate 2.9 million front line workers and nursing home residents against Covid-19. Ohio is expected to receive just under 100,000 vaccines. How the vaccines are distributed and who gets them first will ultimately be decided on a state level. (Source: New York Times)

- International Equities Outpace US: Since the beginning of December, the S&P 500 has underperformed the global indexes in Europe (Stoxx Europe 600) and MSCI Emerging Markets. But this isn’t new. The Stoxx Europe 600 performed impressively in November posting a return of 13.73%, higher than the S&P and Dow Jones Indices. (Source: Barron’s)

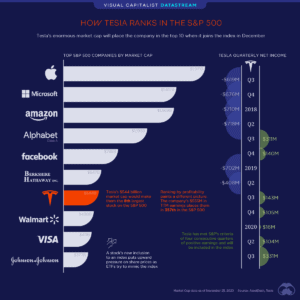

Tesla Being Added to the S&P 500

On December 21 just before markets open, Tesla will be added to the S&P 500 in one fell swoop. There was debate as to whether it would be better suited to add Tesla to the index in sections, but ultimately the market value and liquidity of the stock led them to elect to add all at once. Getting the boot and leaving the S&P 500 is Apartment Investment and Management Company, a residential REIT. With a market cap around $600 billion, Tesla is expected to account for roughly 2% of the index.

*Tesla has since surpassed Berkshire Hathaway in size

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.