Viewpoints: August 2020

Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Unfathomable Wealth: Jeff Bezos’ personal net worth is larger than the individual market capitalization of all but 31 companies in the S&P 500. The Amazon founder and CEO’s personal net worth, currently $190 Billion, is larger than the current market value of Exxon Mobil (XOM), which was the largest company in the S&P 500 in 2013. (Sources: Forbes, Financial Knowledge and Information Portal)

- The World is Turning Into “Junk”: Fitch Ratings provides credit ratings and analysis for financial markets. In the 1st half of 2020, they downgraded more countries’ debt than in any prior full calendar year. Currently, more than one-third of rated countries are on “Negative Outlook”, another record high. They anticipate speculative-grade ratings (i.e. “BBB- or below”, aka. “junk bonds” or “high yield”) will soon outnumber investment-grade ratings (i.e. “BBB+ or above”) for the first time ever. (Source: FitchRatings)

- Unemployment Improving: For the first time since March 21st, first-time claims for unemployment insurance fell below 1 million (963,000). New jobless claims had exceeded 1 million per week for the last 20 weeks. The last time the total was below 1 million was March 14th with 282,000. About half the jobs lost during the pandemic closures have been recovered, bringing the unemployment rate down to 10.1%. Pre-pandemic, the unemployment rate was 3.5%, the lowest in 50 years. (Source: CNBC)

- Beige Gold: In Spain, recycled cardboard trafficking gangs are making a fortune selling stolen used cardboard that was left out to be recycled. The theft is rarely reported by companies as the theft actually saves them money by not having to pay a recycling company to haul it away. In the capital city of Madrid, it is estimated that almost half of all cardboard put into recycling bins is being stolen. The estimated 67,000 tons of waste per year being collected by thieves has a value of $11.8 million dollars. Since 2015, it is estimated that the city of Madrid, which receives a portion of legitimate sales, has lost nearly $19 million in revenue. (Source: BBC)

- Alphabeticity Bias: Investors tend to select funds at the top of an alphabetically organized list of funds. This tendency increases with investment menu complexity. Moving a fund from the bottom of a list to the top would increase investments in it by roughly 20%. A more strategic ordering of funds, for example lower cost funds listed first, could result in better outcomes. (Source: The Financial Review)

Thought for the Month

“A happy person is not a person in a certain set of circumstances, but rather a person with a certain set of attitudes.”

– Hugh Downs, American radio and television broadcaster (1921-2020)

Commentary – Education During COVID

CBS Sunday Morning featured a segment on college and university campuses preparing for the return of students for the fall semester. In the 8-minute video, a variety of interviews from educators, students, and parents provide an outlook for college life during the pandemic. A university professor shares, “The fall experience on campus will be some combination of a monastery and a minimum security prison. It may not be the most fun thing. Is it better than living at home with your parents? Maybe. Is it safer than some other alternatives? Maybe. Is it going to be what students think of the college experience? Absolutely not.”

In an article focused on elementary, middle, and high school students, CNN’s Chief Medical Correspondent Dr. Sanjay Gupta provides insights into his family’s decision-making process when determining whether his children would begin the school year learning virtually or by returning to the classroom. His thoughtful piece ends with the acknowledgement “None of this is easy, and some families may arrive at a different conclusion after looking at the same data. In the age of Covid-19, it seems we are all forced to become amateur epidemiologists, while also being the best parents we can be.” The full article is available HERE.

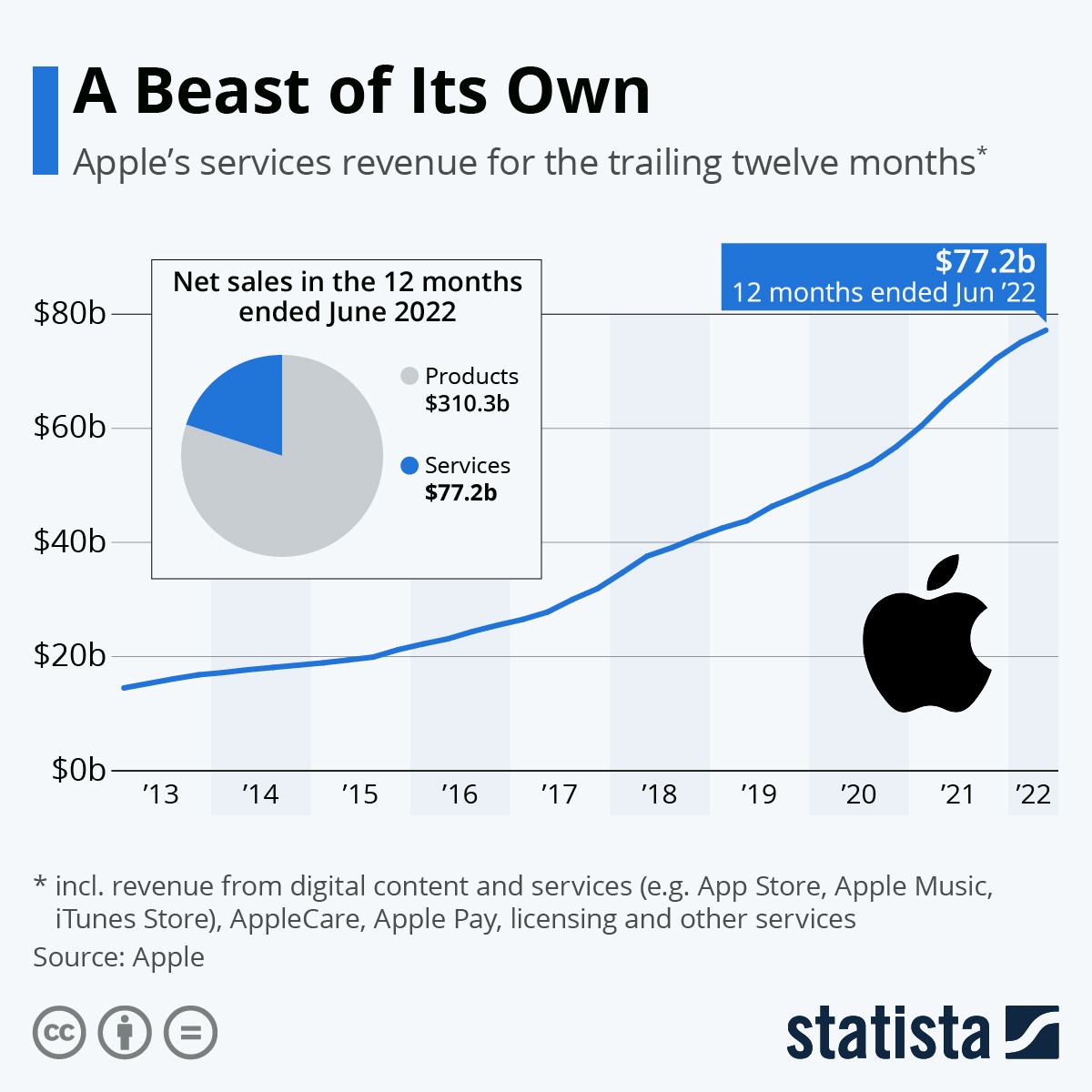

Chart for the Month – Apple’s Services

Primarily thought of as a hardware company (iPhone, iPad, MacBook), Apple’s services segment continues to increase revenues at a steady pace. While iPhone sales make up nearly 55% of Apple’s total revenue, services (iTunes, App Store, Apple Music, Apple TV+, Apple Pay, iCloud) increasingly represent a larger share of revenues, nearly 18% currently. Since 2013, Apple’s services revenue increased more than 3x. Currently accounting for $51.7 billion over the previous 12 months, Apple’s services revenue alone is similar to Pfizer’s entire company revenue.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.