Economic and Investment News Bits

- “Markets historically price in rising rates ahead of the first Fed rate hike. Yellen has said she will go slowly. I believe it will be ‘One and Done’, as in the target rate will reach 1%, then the Fed will stop to assess,” (Source: Steven Auth, Federated Investors).

- 76 million baby boomers are retiring, 10,000 per day for the next 17 years, and they could live 30+ years in retirement. They will need income. With interest rates likely to stay near historic lows for some time, and with bonds no longer providing long-term growth, some kind of dividend-income strategy seems logical for at least a part of most retirees’ plans. Don’t count out stocks for the long haul. (Source: Wall Street Journal)

- China was responsible for 51% of the consumption of coal globally in calendar year 2014. (Source: International Energy Agency)

- The average value of U.S. farm real estate is $3,020 an acre in 2015, including land and buildings, an increase of 7% per year over the last 14 years. Farmland prices average $8,000 an acre in Iowa but just $2,030 an acre in Kansas. (Source: Department of Agriculture)

- Foreign stocks (such as Europe and Japan) have some good tailwinds in their favor. The combination of good valuations, positive earnings growth, and stimulus from their central banks have allowed them to out-perform U.S. stocks this year to date. (Source: Strategas Research)

- The top 10 careers (big growth, great pay, satisfying work) as ranked by CNNMoney and PayScale are 1. Software Architect, 2. Video Game Designer, 3, Landman (negotiate oil & gas leases between producers and folks that own the land), 4. Patent Agent, 5. Hospital Administrator, 6. Corporate Improvement Manager, 7. Clinical Nurse Specialist, 8. Database Developer, 9. Information Assurance Analyst, and 10. Pilates/Yoga Instructor.

- It’s been almost four years since the U.S. stock markets have seen a true correction. The long-running bull market is long overdue for a pullback of 10-15%. Does the current market weakness portend an imminent correction? Perhaps not, but investors should not be surprised when it happens.

Thought for the week

“I always wanted to be somebody, but now I realize I should have been more specific.”

Lily Tomlin, American actress (b. 1939)

Perspective on Potential Global Flashpoints

Stratfor Global Intelligence says “there are two countries that stand out as high-risk targets for significant social unrest in the coming months. Not surprisingly, both are oil producers terrified at the sight of falling crude prices.” Both countries are burning through their oil reserves at a dizzying rate, and given their heavy dependence on oil revenue, their financial situations are approaching the untenable level. Both countries have essentially dictatorial central governments, but it may only be a matter of time before still-fragmented opposition organizes mass protests. Unlike Venezuela, where the government has lost much support, Russia’s Putin still has an approval rating in the 80s. While Venezuela large cities are the source of opposition, Russia’s indebted and less-populous regions are smoldering. “Unless these countries get an economic lifeline from a willing sponsor or the price of oil rebounds significantly, they are heading toward a period of unrest and subsequent crackdowns in the months ahead.”

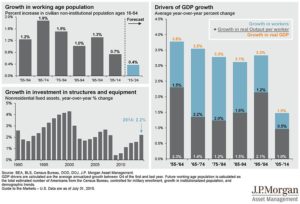

Chart of the Month (CLICK TO ENLARGE)

The US economy has significantly improved over the past six decades. The right hand side of this chart shows the GDP growth broken into growth in workers and growth in real output per worker. We averaged over 3.4% GDP growth over this time period with just under 2% coming from the growth in the number of workers. However, as these baby boomers age and leave the workforce, this puts real pressure on the GDP going forward. This is evident in the measly 1.5% growth over the past decade.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.