Welcome to Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Economic and Investment News Bits

- Fast Start: A 60% U.S. stock and 40% U.S. bond portfolio is up 9.4% YTD as of 3/31/19, the best start to a year for a balanced portfolio since 1991, and the 8th best start to the year in the last 94 years. (Source: BlackRock)

- Sell in May and Go Away?: The old axiom about selling your stocks in April and then buying back in November no longer seems to hold true. From 2003 to 2018, there were just two times (2008 & 2011) in which the S&P 500 posted a negative total return from May through October (and 2008 was during the financial crisis). The average total return during these time periods was +3.67%. (Source: FirstTrust)

- No Bear, Muted Returns: The S&P 500 has not experienced a drawdown of 20%+ in over 10 years. Since 1926, when U.S. stocks have not entered bear market territory in the previous 10 years, the average return over the next three years was +8.38%, versus +11.11% for all 3-year rolling periods. (Source: BlackRock)

- Longer than the Great Depression: With 2018’s +2.9% GDP growth, the U.S. has 13 consecutive years of “sub +3%” growth (2006-2018). The next longest streak in U.S. history of “sub +3%” growth was during 4 years of the Great Depression (1930-1933). (Source: U.S. Commerce Department Bureau of Economic Analysis)

- In Less than a Generation: The average cost of 1-year of college at an average 4-year public institution (including tuition, fees, room and board) has tripled over the last 22 years, rising from $7,142 for academic year 1996-97 to $21,370 during academic year 2018-19. (Source: College Board)

- Baby Busters: 45% of the 76 million “Baby Boomers” in the US have no retirement savings. (Source: Insured Retirement Institute)

- Shrinking Career: The number of United States Postal Service (USPS) employees peaked in 1999 at nearly 800,000. Since 2013, the number of employees has hovered around 500,000, a number not seen since the mid-1960s. (Source: USPS)

Thought for the Month

“Positive energy! Enjoy it! YEEESSSSS!!!”

– Brody Stevens, American stand-up comedian and actor (1970-2019)

Commentary – Spring Cleaning: Decluttering your Life

This video from CBS Sunday Morning, shares interesting and humorous advice on how to get rid of clutter, get organized, and maintain a structured living space. Americans are by far the world’s largest consumer culture, and the sheer volume of unnecessary “stuff” accumulated over time is staggering. Many feel the “thrill of the hunt” while purchasing items on sale, then regret buying things they don’t need because they didn’t conduct enough research beforehand.

It’s often difficult to break the cycle, and many feel overwhelmed and don’t know where or how to begin decluttering their lives. In comedian George Carlin’s bit about “stuff”, he suggests “The meaning of life is finding a place for your stuff. That’s all your house is: a place to keep your stuff while you go out to get more stuff.” One survey learned 25% of people with 2-car garages have no room to park a single car inside, and 32% only have room for 1 car. Which means vehicles worth tens of thousands of dollars sit outside while “stuff” sits in the garage. Some resort to using self-storage facilities, which comedian Jerry Seinfeld described as “paying rent to visit your garbage” (and that’s just for the things that don’t fit in your home). There are more self-storage facilities than McDonald’s, Subway, and Dunkin’ Donuts combined.

Marie Kondo’s Netflix show, “Tidying Up” provides many useful strategies encouraging you to consider “Does it spark joy?”. Many of us associate our things with how they make us feel, whether it be nostalgic reminders of what once was or an attempt to compensate for insecurities (i.e. keeping up with the Joneses). Andrew Mellen, author of “Unstuff Your Life!”, describes clutter as “nothing more than deferred decisions” and that you should “set yourself free, it’s just stuff”.

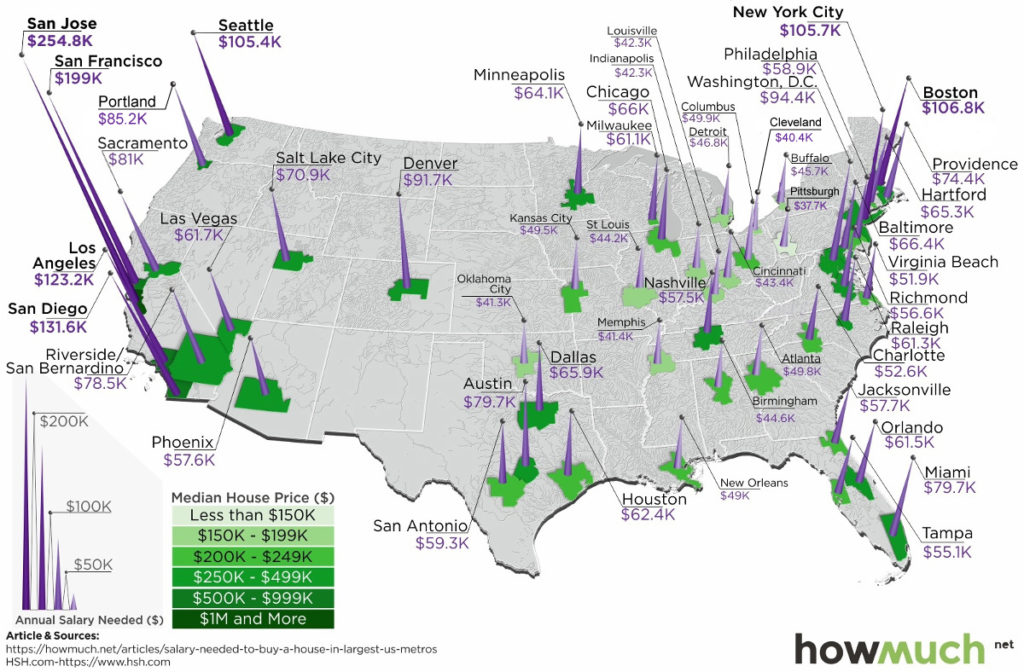

Chart for the Month – The Salary Needed to Buy an “Average” Home

Assuming a 20% down payment, prevailing mortgage rates, and taking into account what’s needed to pay principal, interest, taxes, and insurance, a prospective buyer would need a dramatically different income to afford an “average” house depending on where they choose to live. The four “most expensive” metro areas are in California, and nine of the top 10 are in coastal states. Ohio is well-represented in the “least expensive” metro areas with Cleveland (#3), Cincinnati (#7), and Columbus (#13) all landing near the top of the list.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.