This week we received another flood of inflation data and saw a year-over-year increase in the CPI (Consumer Price Index) of 0.4%, twice the increase that was expected. The market reaction was, as expected with the news, poor that day. Both stocks and bonds took a dive because of the implication the 0.4% creates; inflation may not be as under control as economists thought and interest rates may need to go higher. However, there have been a few articles written and prominent global market strategists saying inflation has nearly disappeared! Markets have already reacted to this by recovering all of last week’s losses as of this morning.

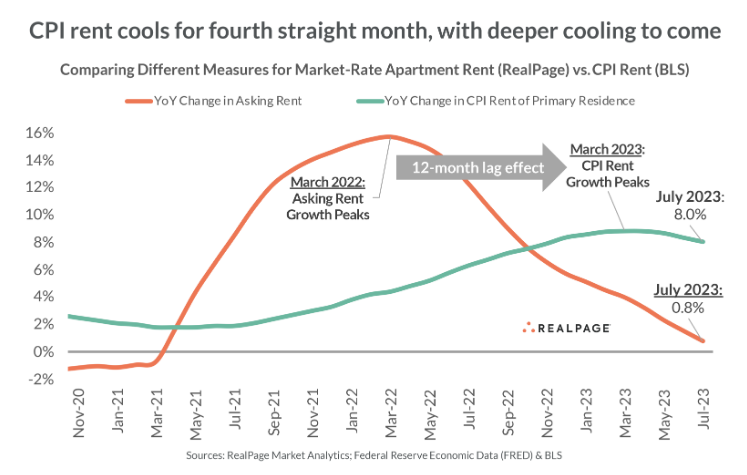

Jay Parsons of RealPage, a real estate and property management software company writes, “there’s a known 12-month lag between asking rents and CPI rents. And because of that known lag, we already know where this story is going.”

Dr. David Kelly, the Chief Global Strategist and Head of the Global Market Insights Strategy Team for J.P. Morgan Asset Management, spoke on CNBC on August 25th and said, “we’re going to be be in the low 3’s for inflation by the end of this year, and we’re going to be at 2%, at the fed’s target, by the end of next year…so they don’t need to push our luck here [with another rate hike].”

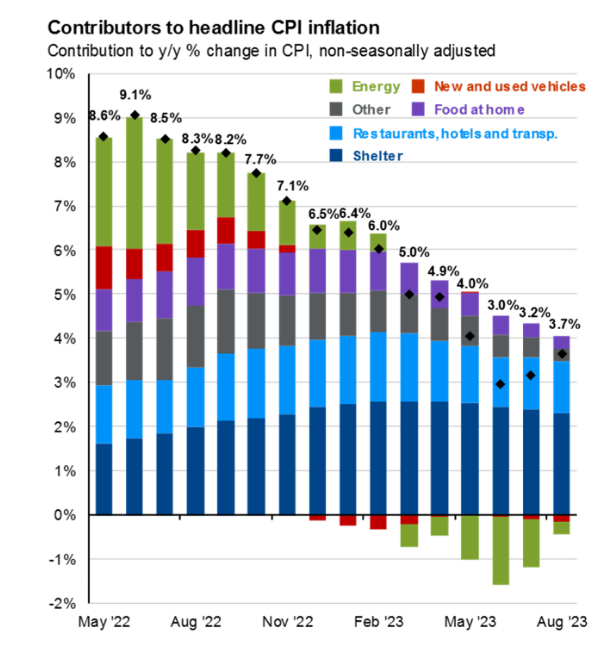

Dr. Kelly was very direct while Parsons was more ambiguous, but both had the same message; inflation is not and should not be a concern anymore. The chart below provides an excellent visual representation of what goes into inflation and what is impacting it the greatest.

A year ago, energy (gas prices, for example) was one of the biggest culprits to high inflation. Now, we see energy prices are actually negative. Prices for new and used vehicles haven’t gone up at all this calendar year. Even food at home (groceries) has shrunk considerably since May last year. As we look at the most recent bar – and what has been the stickiest across the time of the chart – shelter is the largest contributor to CPI.

According to Parsons at RealPage, there’s a 12-month lag between current asking rents and the rents reported in the CPI reading. Due to the lag, we can get a better idea of inflation by looking back about 12 months to see where rent is going. In the chart below, the red line is the current asking rent year-over-year change and the teal line is the year-over-year change in CPI reported rent.

The visual provides support to Dr. Kelly’s comments above about inflation being in the low 3% and meeting the Fed’s goal of 2% by 2024. All else equal, the shelter piece could start to shrink month over month.

As we look at the stock market, the bond market, interest rates, inflation, the Fed, and the different events pushing and pulling every which way, we firmly believe a diversified portfolio invested with a focus on the long-term will reward investors over time. We echo the importance of the old adage, “it’s not about timing the market, but about time in the market.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.