November 2020 Financial Markets Summary

2020 has been a year for the history books that we will all remember. For all that has taken place this year, we should have expected a tumultuous election season. As of early November 6th, mail-in ballots are still being counted to determine the Presidency. It appears that former vice-president Joe Biden is extending his lead and will likely become the next President of the United States. But what does this mean for investors?

For as important as the Presidency is, many economists would argue that the balance of power between the Senate, House of Representatives and Presidency is more impactful to markets today. The domestic stock markets struggled in the last month leading up to the election as they grappled with a potential blue wave where all three bodies would be controlled by the same party. As of today, it appears that the Senate will likely stay with a Republican majority. State Street Global Advisors’ Altaff Kassam attributed “this week’s rally to a “goldilocks scenario,” where a Republican Senate dilutes the power of a Democratic president, limiting his ability to enact tax increases or antitrust regulation against big tech companies.” CFRA’s Sam Stovall also suggested that “the likely reason that Wall Street likes gridlock is that it reduces the possibility that any major policy changes will take effect.”

Markets have spiked 5-6% in the days following the election likely due to this gridlock. However, we would expect to continue experiencing wide swings on both the upside and downside in the months ahead as the final results are tabulated in a potential contested election, Congress works to pass another stimulus package and the world fights with the coronavirus pandemic.

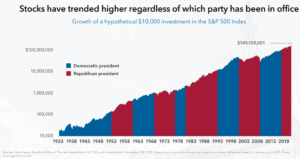

We understand that it’s difficult in times like these, but we encourage investors to maintain a long-term perspective and not get caught up in the moment and make an emotional decision with their portfolios just because of their political biases. We remind clients to maintain a diversified allocation and to keep their next 7-10 years of income needs from their portfolio in stable assets such as cash, CDs and short-term bonds.

| Asset Index Category |

Category |

Category | 5-Year | 10-Year |

| 2020 YTD | 1-Year | Average |

Average |

|

| S&P 500 Index – Large Companies |

1.2% |

7.6% | 9.5% |

10.7% |

| S&P 400 Index – Mid-Size Companies |

-7.9% |

-2.8% | 5.7% |

8.7% |

| Russell 2000 Index – Small Companies |

-7.8% |

-1.5% | 5.8% |

8.2% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

-1.7% |

4.3% | 7.9% |

7.8% |

| MSCI EAFE Index – Developed Intl. |

-10.8% |

-6.8% | 2.9% |

3.8% |

| MSCI EM Index – Emerging Markets |

0.9% |

8.2% | 7.9% |

2.4% |

| Short-Term Corporate Bonds |

2.8% |

3.1% | 2.4% |

1.9% |

| Multi-Sector Bonds |

6.3% |

6.2% | 4.1% |

3.6% |

| International Government Bonds |

4.6% |

3.6% | 3.6% |

0.4% |

| Bloomberg Commodity Index |

-10.9% |

-8.7% | -2.7% |

-6.3% |

| Dow Jones U.S. Real Estate |

-14.6% |

-14.7% | 4.7% |

7.9% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.