Markets & Presidential Elections

With recent volatility the past few days, and a likelihood the election results are not finalized next Tuesday night, we expect continued volatility for a period of time. This is to be expected with such unknowns floating out there as we head to the polls. Therefore, we’d like to remind you of this earlier post that speaks to the long-term implications of elections, or lack thereof. We all have a heightened sense of concern today about the outcome next week – but we should not let this (ultimately) short-term outcome persuade our logical long-term thinking.

Stock market performance is influenced by many factors, which makes it all but impossible to interpret past performance or predict what may happen as a result of this year’s presidential election. Still, while “past performance may not be indicative of future results”, we can use history to provide insights into how the markets may react. Keep in mind macroeconomic factors such as interest rates, inflation, economic outlooks, changes in policies, and wars may have more impact on market returns than the President.

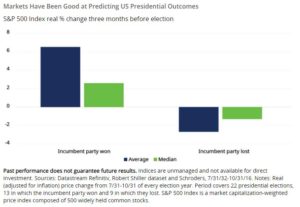

Short-Term: Market Performance Prior to U.S. Presidential Election

From research provided by Hartford Funds, over that previous 22 presidential elections, in the 3 months leading up to the election, short-term market performance has been good at predicting whether the incumbent party would win or lose: “Stock prices have on average fallen in the final three months leading up to an election whenever the incumbent political party lost, but rallied if the incumbent party won. This is irrespective of whether the president was a Republican or Democrat.”

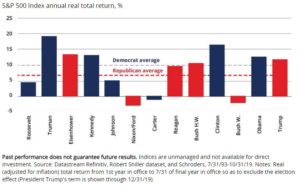

Long-Term: Market Performance and Party Affiliation

However, as shown in the charts below, neither party is exclusively good or bad for markets. In fact, from 1928-2016, the market has produced positive calendar year returns in 19 of the last 23 election years. Stocks have done well in the long-term regardless of which political party the President represented. Of course, past market performance when a particular political party is in power does not mean the same results will occur in the future, but it’s reasonable to expect that markets will continue to increase over the long-term (or else why would anyone invest in stocks?).

Going back even further (since 1933), adjusted for inflation, the stock market has averaged +10.2% under Democratic presidents versus +6.9% under Republicans. As we covered in a recent blog post, even this data can be misconstrued or manipulated to fit a desired narrative. Nearly all of the outperformance assigned to Democrats can be explained by the Tech Boom under Bill Clinton (a Democrat) and the subsequent dotcom bust and Global Financial Crisis under George W. Bush (a Republican). Maintain your healthy skepticism.

Stay the Course

While history suggests elections may impact market performance, other factors muddy any implied direct effects. As during any other time, the unpredictable short-term nature of markets makes trying to time them nearly impossible. Remaining invested in a diversified portfolio, suitable for your risk tolerance, time horizon and goals, while periodically rebalancing, has consistently resulted in beneficial long-term financial outcomes.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.