Market Update from Kurt Brown

2022 has certainly started with a bang for the stock market… just not all on a positive note. Most of the domestic indexes were down almost -4% at one point today before finishing the day in the green as investors grappled with inflation risks, rising interest rates and geopolitical concerns with Russia’s potential invasion. The S&P 500 is down -7.5% YTD, while the tech heavy NASDAQ has fallen by -11.4% so far this year.

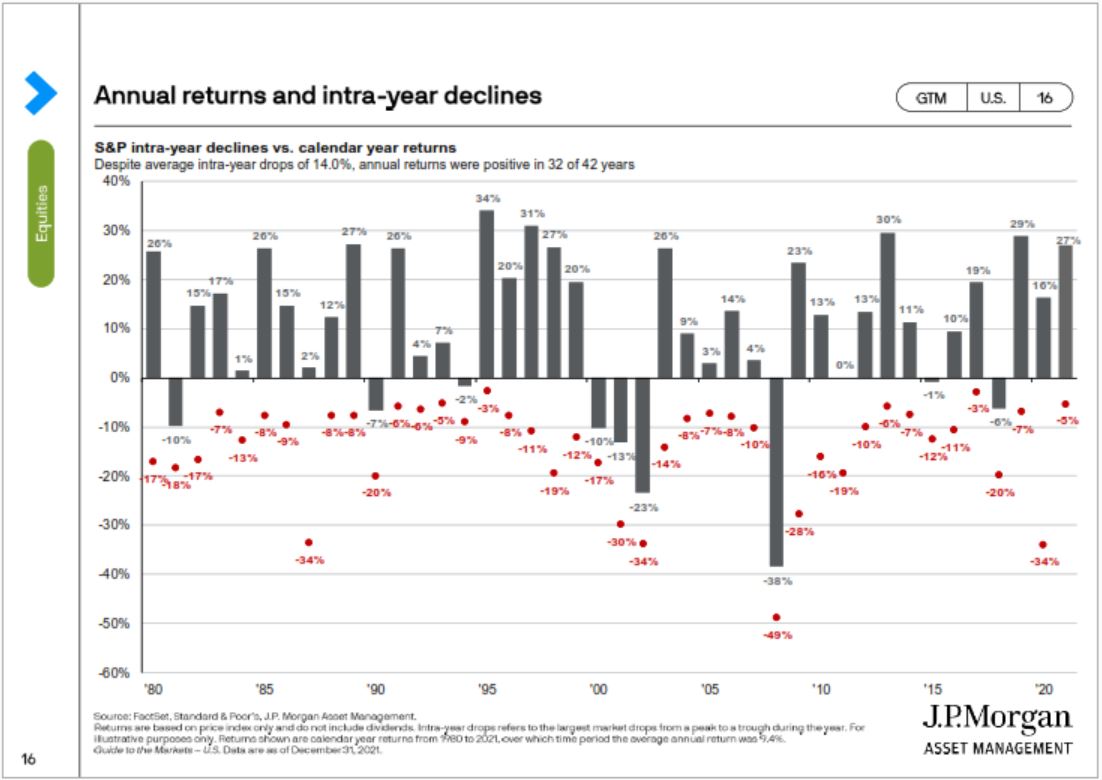

All of this volatility can play on investors’ emotions to make drastic changes to their portfolios, but we encourage investors to step back and look at the bigger picture. It has been easy to fall into this mindset of markets continually rising almost day-by-day. Even though the economy has battled through many issues in the past few years, markets have been resilient and continued to climb routinely without much resistance. Last year, we only experienced a -5% intra-year pullback. However, as this chart from JPMorgan shows, the S&P 500 has experienced an average 14% intra-year pullback since 1979. Despite these declines, markets have generated positive returns in 32 of these 42 years. Even though today’s volatility may seem extreme, these are normal market occurrences.

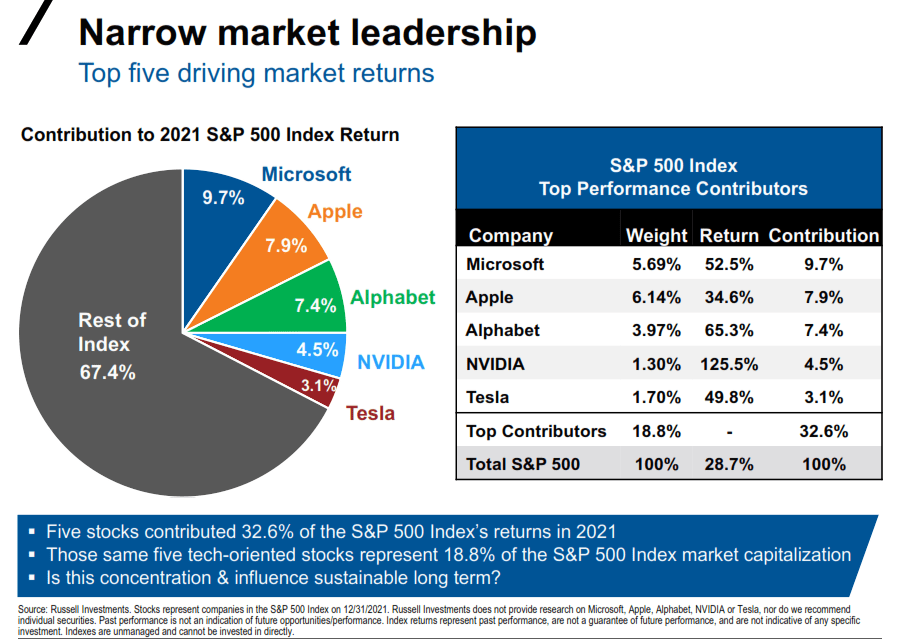

The S&P 500 had a great year in 2021, by any measure. However, just five of the largest stocks in the index generated almost one third of the total returns as shown from this Russell Investments chart. Investors all benefitted from this incredible performance, but this also left the index much more heavily weighted to these growth oriented companies. As rising interest rate and inflation concerns ticked up, this caused these growth names to pull back. All of them are down at least 10% this year with NVIDIA currently down over 20%.

Market volatility and corrections are natural occurrence within markets as they shift in favor of more value oriented companies. We expect markets to continue to be choppy as the economy navigates through these issues, but we urge clients to maintain their diversified allocations and rebalance when the market presents the opportunity. Because these are normal market occurrences, we can stick with our long-term portfolio strategy. We hope you have a great week!

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.