Market March Madness

This is typically one of my favorite times of the year as we see the start of spring, the Masters and the famed NCAA March Madness. I’m glad to see the trees budding and the grass greening, but the sporting events have been replaced by the coronavirus and Market Madness.

Volatility

Markets around the world continue to quickly react to the ever-changing coronavirus and energy crisis. To put it into perspective, the S&P 500 experienced only seven trading days with a 2% or more change in all of 2019 with the strongest single day at 3.4%. Just in the past 22 trading days, the S&P 500 experienced eighteen days with a +/- 2% move, with thirteen exceeding +/- 4%, and six of those exceeding +/- 6%.

Avoid Market Timing

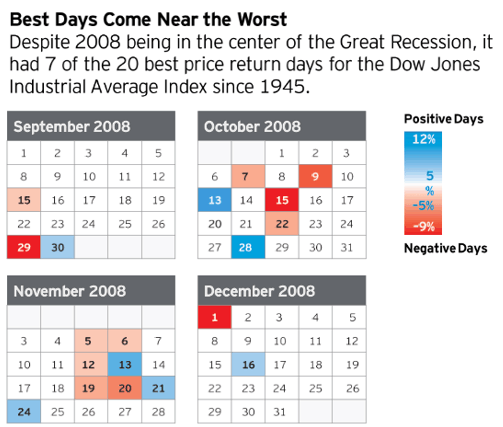

We often see the best and worst days of the markets cluster together just like we are experiencing now (see chart below for 2008 comparison). This makes it an almost impossible proposition to time the market by avoiding the worst days, while still participating in the best. We continue to recommend weathering this market madness with a diversified portfolio.

Uncertainty

How many people will get infected or unfortunately pass away? What are the details in Congress’s recent stimulus package? How long will we be forced to work from home? What will this do to the unemployment rate and consumer spending? How long until we can start to operate as normal? All of these questions, and many more, create a significant amount of uncertainty in markets. We would expect markets to continue experiencing wide swings and volatility until more of these questions are answered.

Yesterday and today’s strong returns are caused by significant measures from the Federal Reserve and Congress. The Federal Reserve has thrown everything including the kitchen sink at this issue by cutting the Federal Funds rate to 0%, restarting their unlimited quantitative easing (QE) programs that were first initiated in 2008, and establishing a Main Street Business Lending Program to support eligible small and medium-sized businesses. Congress also seemed to overcome their differences and agree on a stimulus package late last night. These programs will not be a panacea or prevent us from entering into a recession, but they should help dampen the total impact.

While the shock of this is of unknown depth and duration, what we do know is that the containment measures and social distancing mechanically bring economic activity to a halt. The impact of the economic activity will likely be sharp. BlackRock suggests that “the shock is akin to a large-scale natural disaster that severely disrupts activity for one or two quarters, but eventually results in a sharp economic recovery.”

These are trying times when daily market movements are so extreme, but panic is not an investment strategy. We recommend maintaining discipline around diversification and periodic rebalancing. We may not have experienced the market bottom with this yet, but this too shall eventually pass. It wouldn’t be March without a little madness!

We hope you and your families stay healthy and safe during this environment. Please call or email your advisor with any thoughts or questions.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.