March 2023 PDS Planning Market Commentary

The bond market reached many new milestones last year, but not good ones. The Bloomberg U.S. Aggregate Bond Index experienced a (-13.1%) loss due to rapidly increasing interest rates by the Federal Reserve. Last year’s (-13.1%) loss blew the previous worst calendar year return of (-2.9%) in 1994 right out of the water. This also marked the first time the aggregate bond index lost money over any 5-year period and was the worst 10-year period ever. You might wonder if bonds even have a place in portfolios anymore. Last year was clearly very difficult for bonds, but we urge investors to maintain their exposure to the asset class.

While swift bond price declines like we experienced last year are upsetting, it’s important to remain focused on the long-term benefits of higher interest rates.

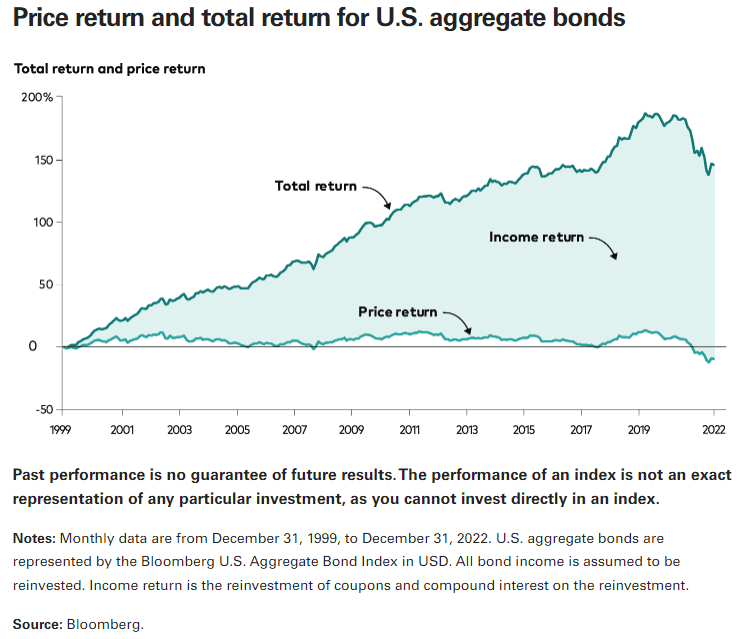

Vanguard recently released an article explaining how “bond total returns have two main components: price return and income return. The income return component includes compounding interest on bond coupon payments. Long-term investors should care more about the combination of these two rather than focusing solely on bond price returns. Changes to interest rates cause the two components to move in opposite directions, so although bond prices can be negatively impacted by higher rates in the short-term, long-term investors will be rewarded by reinvesting at higher yields in the future. In fact, as we show in the chart, the long-term performance of bond investments has come mostly from income return, not price return.”

The Federal Reserve provided wind to the bond market’s sales by generally lowering interest rates and keeping rates low from the mid-1980s up to 2021. But now that they’re rowing in the opposite direction by increasing rates, let’s review the last time they rapidly spiked rates.

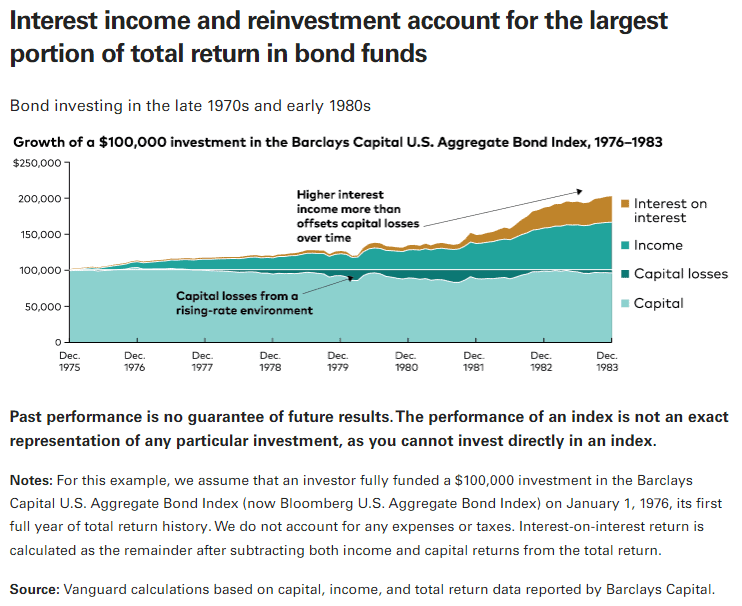

“Now take the bond bear market of the 1970s, which was seen as a rough time to have been invested in bonds as both inflation and nominal interest rates were soaring, but consider this: Bond investors who reinvested their income returns, and remained patient as compounding took hold, nearly doubled their capital from 1976 to 1983 in nominal terms. Over the longer term, bond total returns are driven much more by reinvestment of interest income and compounding than by price returns. Investors need to look beyond the immediate pain of losses appearing in their quarterly bond portfolio statements to the longer-term upside of rising interest rates.”

Even though the past year was quite painful, now is not the time to abandon your bonds. Over shorter periods of time, investment returns and volatility can vary widely; however, long-term investors are rewarded for their time in the market, not for trying to time the market. Maintaining a diversified allocation that is consistent with your long-term goals, combined with periodic rebalancing, has consistently resulted in beneficial long-term financial outcomes. We remind clients to keep their next 7-12 years of anticipated cash distribution needs in stable assets such as cash, CDs, and short-term bonds.

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.