March 2022 PDS Market Commentary

With Russia’s invasion, the world is clearly in a different position than it was at year-end. Markets were already struggling in 2022 as investors grappled with record inflation and the Federal Reserve’s plan to consistently raise interest rates, but Russia’s invasion sent shockwaves throughout markets. As of today, oil has topped $100 per barrel and gold has spiked over +7% this year, while the S&P has declined by (-10%), developed market international stocks by (-9%) and emerging market stocks by (-5.5%). The NASDAQ index swung by 6.8% on Thursday, the largest intraday change since the start of the coronavirus pandemic. We will continue to experience wide swings in the market as this unfolds, but we urge clients to read the following from Vanguard to put this current situation into perspective.

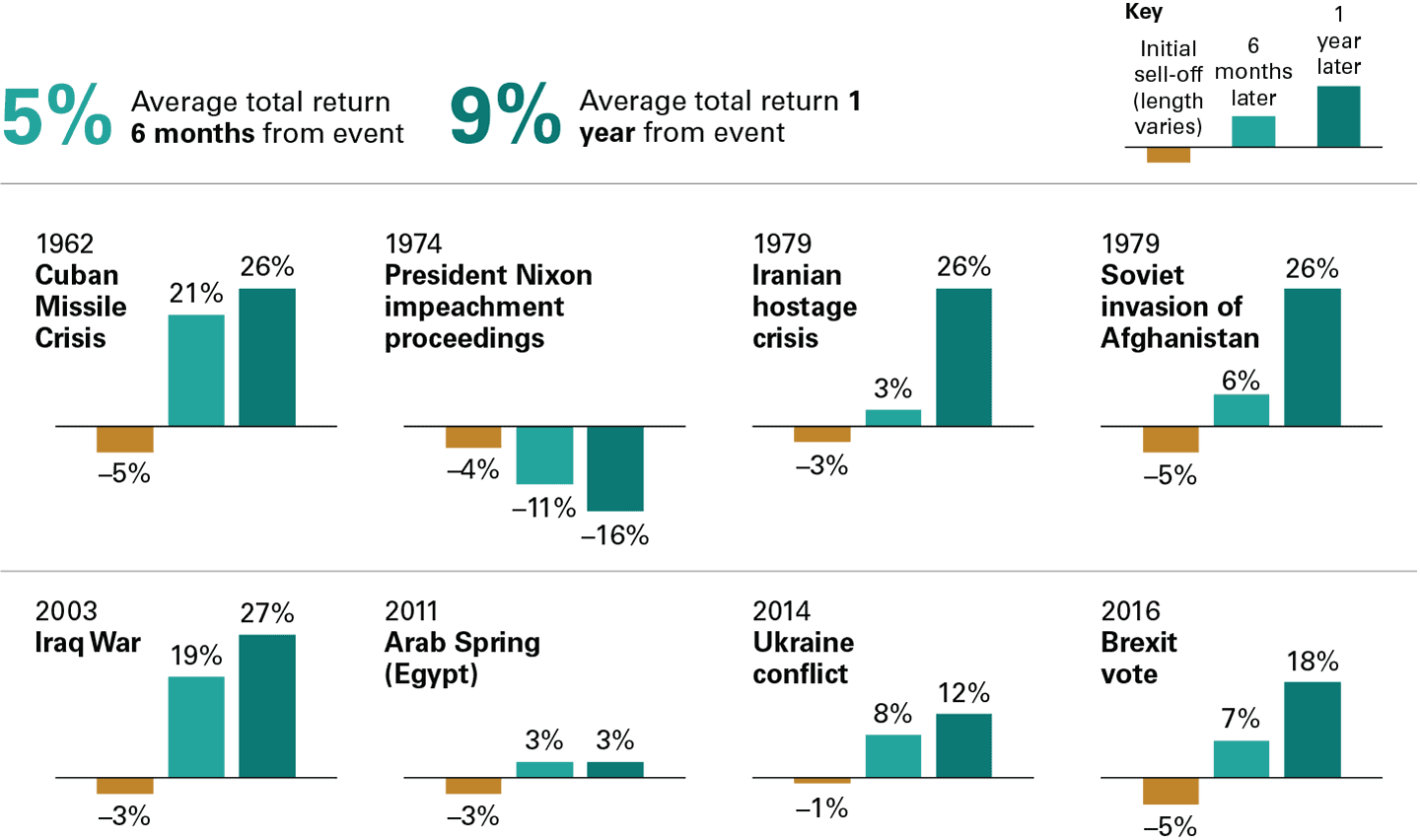

“With geopolitical tensions such as the conflict between Russia and Ukraine, investors often ask whether a link exists between current events and financial market performance. However, when we examined major geopolitical events over the past 60 years, we found that while equity markets often reacted negatively to the initial news, geopolitical sell-offs were typically short-lived and returns over the following 6- and 12-month periods were largely in line with long-term average returns. On average, stocks returned 5% in the 6 months following the events and 9% in the 12 months after the events as shown below.

Even with that backdrop in mind, it’s clear that a new dimension of risk has entered the financial markets with Russia’s attack on Ukraine. We know this, however, about equity markets in the context of geopolitical risks: They’ve been resilient, much as markets have always been resilient in the face of various risks. We expect the markets to work themselves out, reaching new heights over time and at varying paces. These rises will sometimes be punctuated by sharp declines.”

The takeaway for investors is to avoid getting caught up in dramatic events as they unfold. While staying the course and continuing to invest even when markets dip may be hard on your nerves, it can be healthier for your portfolio. Our prayers go out to all of the Ukrainian citizens during these difficult times.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

-4.2% |

14.7% |

13.1% |

12.3% |

| S&P 400 Index – Mid-Size Companies |

-1.7% |

6.6% |

9.0% |

10.5% |

| Russell 2000 Index – Small Companies |

-6.9% |

-6.9% |

8.1% |

9.7% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

-3.7% |

6.7% |

11.2% |

9.8% |

| MSCI EAFE Index – Developed Intl. |

-1.7% |

2.8% |

7.2% |

6.1% |

| MSCI EM Index – Emerging Markets |

-3.0% |

-10.7% |

7.0% |

3.3% |

| Short-Term Corporate Bonds |

-1.5% |

-1.4% |

1.9% |

1.7% |

| Multi-Sector Bonds |

-3.5% |

-2.6% |

2.7% |

2.5% |

| International Government Bonds |

-3.7% |

-8.2% |

0.7% |

-0.9% |

| Bloomberg Commodity Index |

19.6% |

34.4% |

6.6% |

-1.9% |

| Dow Jones U.S. Real Estate |

-4.0% |

19.6% |

8.4% |

9.6% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.