March 2021 Financial Markets Summary

In times like today, the ancient Greek philosopher Heraclitus’s quote, “the only constant in life is change” couldn’t ring more true. We have just gone through a year of incredible change with COVID-19 and the countless things that it impacted. As the temperatures start to warm and the seasons change, many Americans are still working from home. We’ve changed our habits in this COVID environment but most are itching to get back to some normalcy.

Fortunately, not all change is bad as the pharmaceutical industry has come together with several viable vaccines. The new administration’s goal is to have everyone vaccinated by the end of the May. If this lofty goal is met, we will see unbelievable change this summer. There are clearly some areas of the economy that have really struggled because activity has stopped or slowed significantly. Think of movie theaters, cruise ships, theme parks, and other travel and leisure activities. But with consumers having amassed over $2 trillion in excess savings since the COVID restrictions started, you can bet that once they get vaccinated, they will be leaving their Netflix and Peloton to dine out, see a concert, fly to a beach or theme park. This rush of activity all at once this summer will likely cause further inflation spikes in many understaffed and capacity-constrained industries.

According to Blaine Rollins from 361 Capital, “Inflation is a concern for the markets right now because the economy is accelerating, and with the decline in COVID and potential return to normalcy, there is uncertainty that GDP growth could run into the high single digits. If the economic strength was spread evenly across the economy, then we might not see the many shortages and price spikes that are appearing today. Double-digit percentage accelerations are occurring in housing costs, meat, and grain costs, dining out costs, energy costs, new and used vehicle prices and several other areas of consumer spending.”

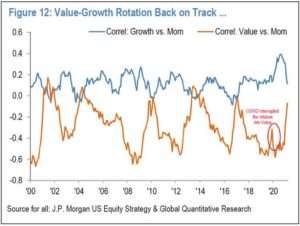

Interest rates were near record lows for most of 2020 with the 10 Year Treasury rate bottoming around 0.5% in August. Just think about that for a moment… the US Treasury was able to sell 10 year bonds and only pay 0.5% annual interest. Many of you likely recall when interest rates and inflation both jumped above 15% in the 80’s. We are by no means suggesting that we will return to these levels, but interest rates have more than tripled from these low levels with the 10 Year Treasury now around 1.54%. This interest rate jump has caused some concerns with the high flying growth companies that have been leading the markets. Growth stocks have been outperforming value stocks for the past five years, but we recently saw the pendulum shift where value has outperformed by 15% over the past month.

We will continue to experience volatility and change as markets grapple with the spread of COVID, the vaccine distribution and the new administration. We encourage investors to maintain a long-term perspective and not get caught up in the moment and make an emotional decision with their portfolios. We remind clients to maintain a diversified allocation and to keep their next 7-10 years of income needs from their portfolio in stable assets such as cash, CDs and short-term bonds.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

5.2% |

29.0% |

14.6% |

11.1% |

| S&P 400 Index – Mid-Size Companies |

15.1% |

37.6% |

13.4% |

9.9% |

| Russell 2000 Index – Small Companies |

20.9% |

49.1% |

16.3% |

10.3% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

7.7% |

31.7% |

14.3% |

8.9% |

| MSCI EAFE Index – Developed Intl. |

5.9% |

22.5% |

9.7% |

5.0% |

| MSCI EM Index – Emerging Markets |

11.5% |

36.1% |

15.2% |

4.4% |

| Short-Term Corporate Bonds |

0.4% |

2.6% |

2.8% |

2.1% |

| Multi-Sector Bonds |

-2.1% |

1.4% |

3.6% |

3.6% |

| International Government Bonds |

-2.4% |

1.9% |

2.3% |

0.6% |

| Bloomberg Commodity Index |

14.7% |

20.3% |

3.5% |

-5.9% |

| Dow Jones U.S. Real Estate |

4.5% |

2.2% |

8.1% |

8.0% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.