July 2021 Financial Markets Summary

The first 6 months of 2021 have fortunately been much less eventful than the first 6 month of 2020. Stock markets around the world have been performing quite well with the S&P 500 up 15%, developed international 10% and emerging markets 8.5%. The unemployment rate has dropped significantly from the 15% peak in April, 2020 down to just under 6% today. And, the number of new COVID-19 cases per day has plummeted from a daily average of over 200,000 cases this winter down to about 15,000 as more have become vaccinated.

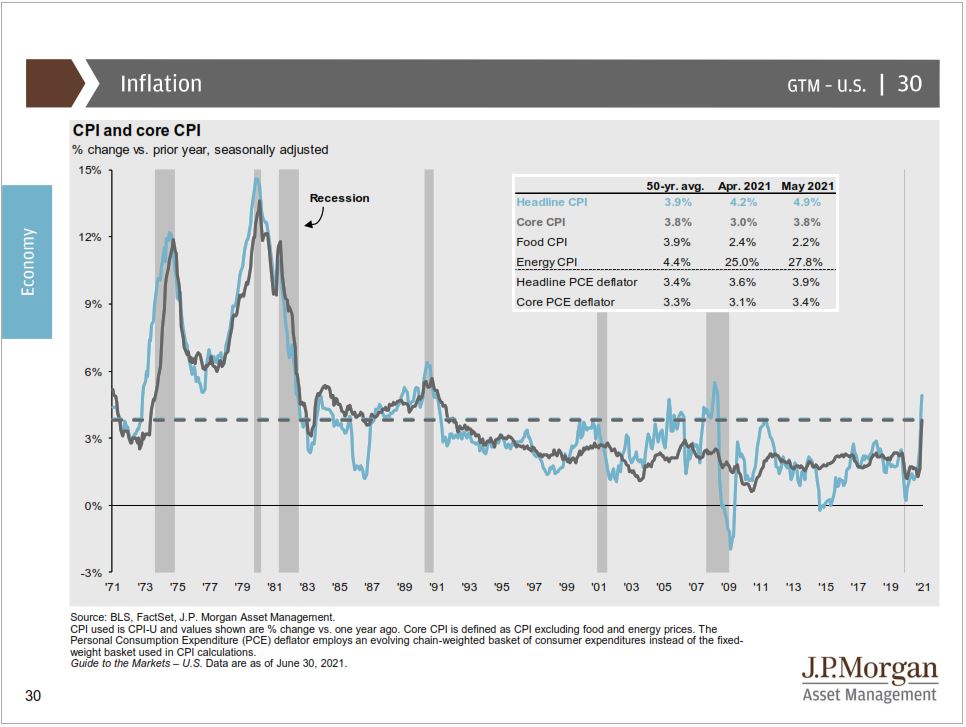

However, inflation has started to creep into certain areas of the economy. Oil has spiked from $12 per barrel ago a year ago up to around $73 per barrel today. Home prices have soared to record levels. Rental cars have become so expensive that some are even renting UHAUL trucks for their vacations. The days of negotiating for a good deal on new cars are gone as many new car lots are empty. The chip shortage has caused major supply issues, especially for the automotive and electronic industries.

According to Centerstone Investments, “part of the explanation is that the global economy is built on an intricate and interlocked chain of inventory supplies that work on a “just-in-time” system. In this system, inventory is the hot potato no one wants to hold because it requires space and is a drag on cash flow. Goods are manufactured as close in time as possible to that order. The system has worked almost flawlessly since it was widely adopted decades ago but those efficiencies depend on the predictability of orders. Many economies these days are stop-and-start based on local COVID infections, not an optimal environment for a “just-in-time” supply chain.”

Federal Reserve chairman Jerome Powell believes this recent bout of inflation will be transitory and short-lived. He recently said, “These effects have been larger than we expected and they may turn out to be more persistent that we expected. But the incoming data are very much consistent with the view that these are factors that will wane over time and then inflation will then move down towards our goals.” We have already seen this in the lumber industry with prices falling 60% from the spring highs.

Inflation is certainly the hot topic around the country, but we remind our readers of the time tested belief that “today’s headlines and tomorrow’s reality are seldom the same.”

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

8.2% |

38.6% |

14.9% |

12.7% |

| S&P 400 Index – Mid-Size Companies |

3.3% |

51.2% |

12.8% |

10.5% |

| Russell 2000 Index – Small Companies |

4.1% |

60.3% |

14.5% |

10.2% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

7.2% |

41.4% |

14.1% |

10.0% |

| MSCI EAFE Index – Developed Intl. |

5.2% |

32.3% |

9.8% |

6.2% |

| MSCI EM Index – Emerging Markets |

5.1% |

40.1% |

13.9% |

4.2% |

| Short-Term Corporate Bonds |

0.6% |

2.7% |

2.5% |

2.0% |

| Multi-Sector Bonds |

1.8% |

-0.3% |

3.3% |

3.4% |

| International Government Bonds |

0.4% |

0.3% |

1.4% |

0.1% |

| Bloomberg Commodity Index |

13.3% |

45.6% |

2.9% |

-4.9% |

| Dow Jones U.S. Real Estate |

11.7% |

32.2% |

9.0% |

9.9% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.