January 2022 Market Commentary

Now that 2021 has come to a close, we look forward to 2022. Many banks and investment companies release their “expert” opinions on what we should expect from the market and economy in the coming year. We note a few of them below. When it comes to “expert” opinions, please remember the Browns were predicted to make a deep playoff run with the Bengals keeping a strong hold to last place. Little did we know, the exact opposite would happen!

BlackRock’s key 2022 investment themes are:

- Living with inflation: we expect inflation to be persistent and settle above pre-COVID levels. Central Banks should kick off policy rate hikes but remain more tolerant of price pressures, keeping real interest rates historically low and supportive of risk assets.

- Cutting through confusion: a unique mix of events – the restart, new virus strains, supply-driven inflation and new central bank frameworks – could cause markets and policymakers to misread inflation. We keep the big picture in mind, but acknowledge risks – to the upside and downside – around our core view.

- Navigating net zero: Climate change is part of the inflationary story. We believe a smooth transition is the least inflationary outcome, yet even this still amounts to a supply shock playing out over decades.

Goldman Sachs suggests that, “Although the fastest pace of the recovery lies behind us, global GDP is likely to grow ~ 4.4% in 2022, more than 1% above potential. We expect the first half to be stronger, benefitting from improving virus conditions, economic re-opening, pent-up consumption, and inventory rebuilding. While most economies will remain above-trend in 2022, China and Brazil will be slower due to country specific factors. Also, we remain confident that both headline and core inflation will ease meaningfully in 2022, though price pressures are unlikely to subside quickly.”

Vanguard expects the “U.S. economic recovery to continue in 2022, though at a naturally slower pace. They also foresee inflation persisting above 2%, but broad wage gains taking hold could potentially push higher.

J.P.Morgan advises that “2022 should be a strong year for international equity market performance across regions, driven by solid fundamentals and reasonable valuations.”

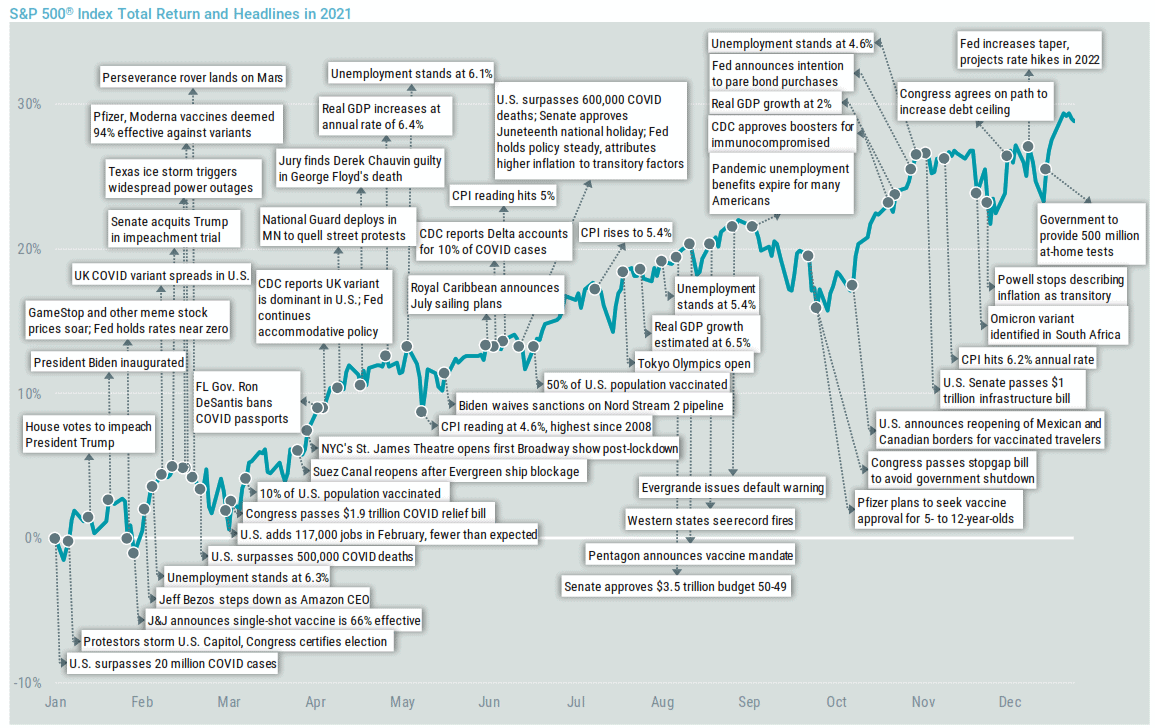

The consensus risk for 2022 seems to center around inflation and how the Federal Reserve and markets react. This is clearly something to keep in mind, but also remember that the past decade is certainly another example of our time-tested belief that “today’s headlines and tomorrow’s reality are seldom the same.” Markets will inevitably throw a few curveballs as shown in this chart, but we recommend sticking to the diversified allocation over time.

| Asset Index Category |

Category |

Category |

5-Year |

10-Year |

|

3-Months |

1-Year |

Average |

Average |

|

| S&P 500 Index – Large Companies |

10.6% |

26.9% |

16.3% |

13.9% |

| S&P 400 Index – Mid-Size Companies |

7.6% |

23.2% |

11.4% |

12.1% |

| Russell 2000 Index – Small Companies |

1.9% |

13.7% |

10.6% |

11.3% |

| MSCI ACWI – Global (U.S. & Intl. Stocks) |

6.1% |

18.2% |

14.1% |

11.6% |

| MSCI EAFE Index – Developed Intl. |

2.7% |

11.3% |

9.6% |

8.0% |

| MSCI EM Index – Emerging Markets |

-1.3% |

-2.5% |

9.9% |

5.3% |

| Short-Term Corporate Bonds |

-0.5% |

0.1% |

2.4% |

1.9% |

| Multi-Sector Bonds |

0.0% |

-1.5% |

3.6% |

2.8% |

| International Government Bonds |

-1.7% |

-9.5% |

1.8% |

-0.8% |

| Bloomberg Commodity Index |

-1.6% |

27.1% |

3.7% |

-2.8% |

| Dow Jones U.S. Real Estate |

14.6% |

39.0% |

12.3% |

11.2% |

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.