Coronavirus Aid, Relief, and Economic Security Act (CARES Act) Update

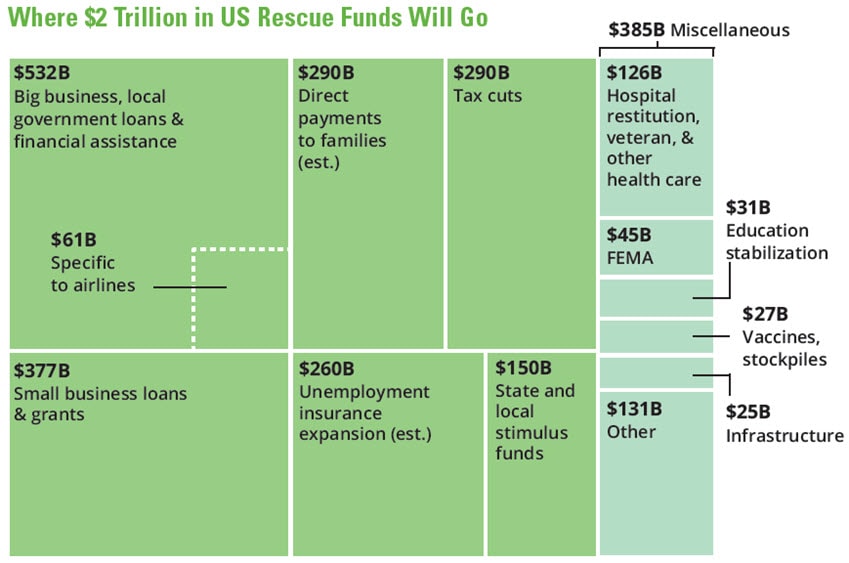

In response to the COVID-19 pandemic, Congress passed the CARES Act to provide economic relief across the economy. While the entirety of the CARES Act is lengthy, many of the provisions in the legislation likely have a direct impact on every one of us.

We at PDS Planning would like to highlight a handful of the provisions that may apply to you along with potential action steps to take:

Tax Filing Deadline

The tax filing deadline has been extended to July 15. There will be no penalties or interest owed if you file by July 15. This will allow tax filers more time to file their taxes and pay any owed tax liability.

Action Step – If you have not filed yet and are ready to file, and you are anticipating a refund, file as soon as possible. If you have not filed yet and will owe, consider delaying until July 15. Review the guidelines to see if you qualify to get a stimulus check to determine if it is better to hold off filing your 2019 return. (see below)

Stimulus Checks

The government is sending direct cash payments to tax filers. The amounts will be $1,200 for individuals and $2,400 for married couples (pending AGI from most recent tax return 2018 or 2019). In addition, those with children will receive an additional $500/child. This will not be considered taxable income. To determine if you qualify for a payment, CLICK HERE

Action Step – If you’ve had a loss of income due to this pandemic, use these dollars to supplement lost income. If you have not and you have sufficient cash reserves, consider funding your IRA’s, Roth IRA’s, 529 plans or any other investment vehicle that you would normally fund with excess cash. If you have high interest credit card debt, consider using paying those down (again assuming you have sufficient cash reserves).

Early Withdrawals from IRA’s and 401(k)’s

For those adversely impacted financially by the coronavirus, they can tap their IRA’s or 401(k) plans up to $100,000 penalty-free. For those under 59 1/2 , there would typically be a 10% early withdrawal penalty. Income tax would be owed on the amount withdrawn and can be paid over a 3 year period. In addition, individuals have up to 3 years to recontribute these dollars to the account.

Action Step – This would be a last resort, but if you have lost your job or income from your business, this would be an option to stay afloat financially in the near-term. Review all stipulations to make sure you qualify prior to requesting the withdrawal, and put a game plan together to recontribute once the economy recovers.

Required Minimum Distributions (RMD’s)

For those that are required to take them, all RMD’s for 2020 have been suspended. This includes inherited IRA RMD’s along with those 2019 RMD’s that were eligible to wait until April 1, 2020.

Action Step – If the distributions to satisfy your RMD are not needed to fulfill income needs, consider shutting them off for the year. If you do need income from investments, consider using dollars from non-qualified accounts to reduce taxable income.

Economic Injury Disaster Loans (EIDLs) and Paycheck Protection Program

The Small Business Administration (SBA) will approve EIDLs based on the applicant’s credit score. Additionally, loans of up to $200,000 will not require a personal guarantee. You must have been in business prior to January 31, 2020 and this includes businesses with less than 500 employees, nonprofits, sole proprietors, independent contractors and more. The terms of the EIDLs are 30 years at 3.75% interest, and payments are deferred for one year from the date of the loan. Additionally, the program referred to as the Paycheck Protection Program will provide potentially forgiveable loans if borrowers maintain their payrolls during the crisis or restore them afterward.

Action Step – If you own a small business that has been affected by the COVID-19 pandemic and require financial assistance to keep your business and payroll going, contact the SBA to review your options. Additionally review details about the Paycheck Protection Program.

Mortgage and Loan Relief

If you are a homeowner that has a federally backed mortgage (Fannie Mae, Freddie Mac, FHA or USDA), and are experiencing financial hardship due to the coronavirus pandemic, you may request a forbearance for up to 180 days. You will not incur fees, penalties or interest due during this period. Additionally many private lenders are putting together packages that offer suspending payments or special terms. Some states (New York for example) have waived mortgage payments for 90 days.

Action Step – Contact your lender to find out what program you qualify for. If you do not have a federally backed mortgage, see if there are any special terms that your lender is offering for borrowers affected by the pandemic.

There are many more components to this legislation, but our goal was to highlight some of the most applicable that we see. Many have been impacted and hopefully some of these provisions will help get us through this pandemic. For more details or to discuss your personal situation, we encourage you to contact PDS Planning to review the best course of action.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.