Behavioral Finance: Loss Aversion

In theory, financial markets are efficient. All necessary information is available to the public and logical decisions can be made by rational, unemotional investors. However, theory and reality are often quite different, and investing is no exception.

The study of investor behavior is called Behavioral Finance. For more information on the basics, see our post “Behavioral Finance: Intro”. Research shows that people are not nearly as rational when making investment decisions as traditional finance theory suggests. Our decision-making is influenced by our own psychological biases.

What is “Loss Aversion”?

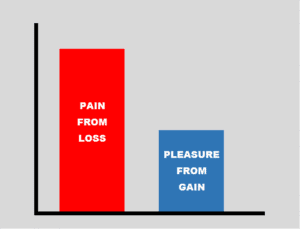

Loss aversion, also known as “prospect theory”, refers to our tendency to prefer avoiding losses over acquiring equivalent gains. In other words, it is better to not lose $5 than to find $5. In fact, many studies have shown the pain of loss is twice as powerful as the pleasure of an equal gain.

But this isn’t just a finance or investment-specific driver of decision-making, it is a hard-wired facet of human emotion. Negative emotions have a greater impact than positive emotions. I can remember my English teacher from my freshman year of high school. While one of my favorite teachers, the most vivid memory from that class is failing the Shakespeare test! Thinking in terms of interpersonal relationships, numerous studies have found the “magic ratio” of praise to criticism is 5 to 1, meaning for every negative comment, high-performing business teams and happy marriages require five positive interactions for every negative one.

How Loss Aversion Can Impact Your Portfolio

Experiencing any portfolio loss can be stressful. In fact, it feels two times worse to lose money than the happiness you feel from an equivalent gain. Notice the difference in media coverage during a falling market compared to a rising market. When headlines are bad, it’s all anyone wants to talk about. When things are good, it’s business as usual. In investors’ own portfolios loss aversion can lead to selling winners early and holding onto losers too long. Since no one wants to admit a mistake and realize a loss, they may continue holding an investment in hopes of it recovering value.

The Value of a Professional Advisor

It is important to understand the connection between your investments and the long-term goals of your financial plan. One of the primary benefits of working with a professional advisor such as PDS Planning is our ability to provide discipline and guidance to manage our innate psychological biases. According to research by Vanguard, “Behavioral coaching may add 1% to 2% in net return”. As they explain, “Having emotions isn’t a “rational or irrational investor issue; it’s a human issue.” While most investors have the best intentions when making financial decisions, in the heat of the moment when emotions are elevated, they may have a hard time sticking to their plan.

Since 1985, PDS Planning has worked with clients to eliminate the stress often associated with planning your financial future. With over 30 years of experience helping clients plan their investments, we’re experts at optimizing an investment plan to each individual’s highly specific needs. We’ll work to understand your vision for the short and long-term. And we will provide objective guidance on the proper path to help reach your goals.

To learn more about PDS Planning, please contact us.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment, strategy, or product or any non-investment related content, made reference to directly or indirectly in this newsletter, will be suitable for your individual situation, or prove successful. This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Consultation with a qualified investment advisor is recommended prior to executing any investment strategy. No portion of this publication should be construed as legal or accounting advice. If you are a client of PDS Planning, please remember to contact PDS Planning, Inc., in writing, if there are any changes in your personal/financial situation or investment objectives. All rights reserved.