Economic and Investment News Bits

- Applied Materials, Boeing, Coach, Ford, Intel, McDonalds, Nike, Pfizer, and Procter & Gamble. What do those household-name companies have in common? Not much, other than that a huge part of their sales come from outside the U.S. Collectively, the 500 companies that make up the S&P 500 Index get 46% of their sales and roughly 50% of their profits from outside the U.S. They are truly multi-national giants. But doing business overseas is not without peril, and one of the perils is the impact of currency movements. A stronger dollar can hurt these companies, since sales translate back into fewer dollars.

- “No continent is as small and fragmented as Europe. Only Australia is smaller, yet Europe today consists of fifty independent nations. Crowded with nations, it is also crowded with people. Europe’s population density is 72.5 people per square kilometer. The European Union’s density is 112 people per square kilometer. Asia has 86 people per square kilometer. Europe is crowded and fragmented,” (Source: George Friedman, Stratfor Global Intelligence).

- “There are a growing number of academic studies which suggest that a portfolio structured to take advantage of global growth is appropriate for most investors,” (Source: John Mauldin).

- Has oil already bottomed? As of last Friday, West Texas Intermediate (WTI) crude oil was trading nearly 19% above the late-January lows.

- The average interest rate paid by the U.S. government on the nation’s debt has fallen by more than half over the last 8 years, dropping from 5.03% in 2006 to 2.37% in 2014. Sustained low interest rates by the Fed have been a huge help to the country’s interest payments. (Source: Treasury Department)

- “Those looking for a major deflationary bust in Europe could be proven wrong,” (Source: Jawad Mian, editor Stray Reflections).

Thought for the week

“All you need is love. But a little chocolate now and then doesn’t hurt.”

Charles Schulz, American cartoonist (1922-2000) – in honor of Valentine’s Day, February 14th

Wealth Idea for the Week

We have all read about numerous studies showing the average mutual fund managers underperform their benchmark indexes. Active Share indicates what percentage of a fund’s portfolio differs from the fund’s benchmark. Research by the Yale School of Management indicates that managers with high Active Share [have a higher probability to] outperform their benchmark indexes and that Active Share significantly predicts future performance. PDS is undertaking a review of actively-managed funds, with the goal of identifying those managers who run portfolios that are truly different from their benchmark indexes. We believe that combining broad-based index funds with high Active Share funds potentially offers investors lower overall expenses and stronger returns than a portfolio of managed funds alone. Active Share is also useful in identifying closet indexers, or managers who claim to be active but whose holdings are very similar to the benchmark index. The study concludes that it is ok to pay for active management as long as it is truly Active Share.

Graph of the Week (CLICK TO ENLARGE)

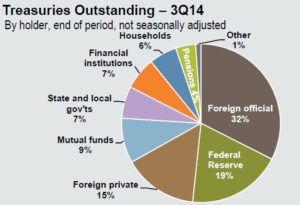

The above chart from J.P. Morgan Asset Management is from data supplied by the Federal Reserve Board as to who owns our country’s outstanding government bonds. Contrary to ‘common knowledge’ China does not own all of our bonds. In fact, the Fed is the largest single holder of these bonds. China’s amount is only about 8% and dropping, as that country reduces foreign bonds and increases its gold bullion holdings.

This material is distributed by PDS Planning, Inc. and is for information purposes only. Although information has been obtained from and is based upon sources PDS Planning believes to be reliable, we do not guarantee its accuracy. It is provided with the understanding that no fiduciary relationship exists because of this report. Opinions expressed in this report are not necessarily the opinions of PDS Planning and are subject to change without notice. PDS Planning assumes no liability for the interpretation or use of this report. Investment conclusions and strategies suggested in this report may not be suitable for all investors and consultation with a qualified investment advisor is recommended prior to executing any investment strategy. All rights reserved.