Published: 4/5/2024

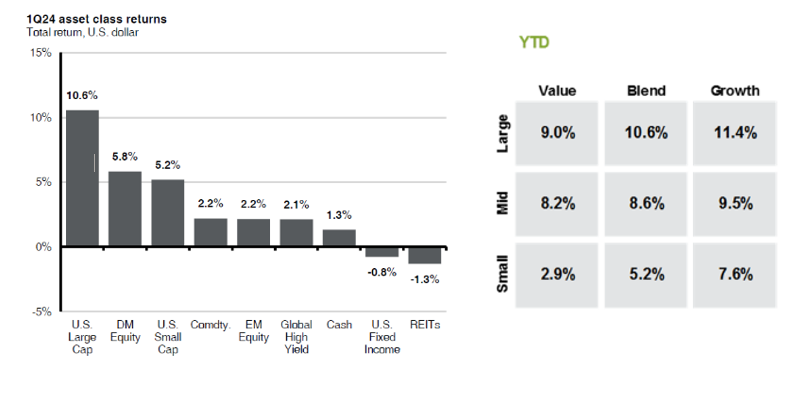

Spring is in the air! The trees are blossoming and we’re finally reminded of what the sun looks like! It also means the first quarter of 2024 is officially in the books. Below and to the left is a look at how the major asset classes performed to start the year.

For US Large cap stocks (the S&P 500), their run of dominance that began in 2023 has continued through the first three months of 2024 returning 10.6%. About double the performance of international developed markets and US small cap stocks. The economy has continued to show strength which has extended the interest rate pause and, as a result, fixed income was one of the two asset classes to decline – albeit slightly – during Q1.

Above and on the right is a slightly more detailed look at the US stock market performance for the first quarter. Large cap performance is shown in the top row, followed by mid-cap and small cap below. Then, the left most column shows the performance of the value stocks, the right shows growth stocks, and the middle is a blend of the two. Again, the story from 2023 has continued with growth stocks leading the charge.

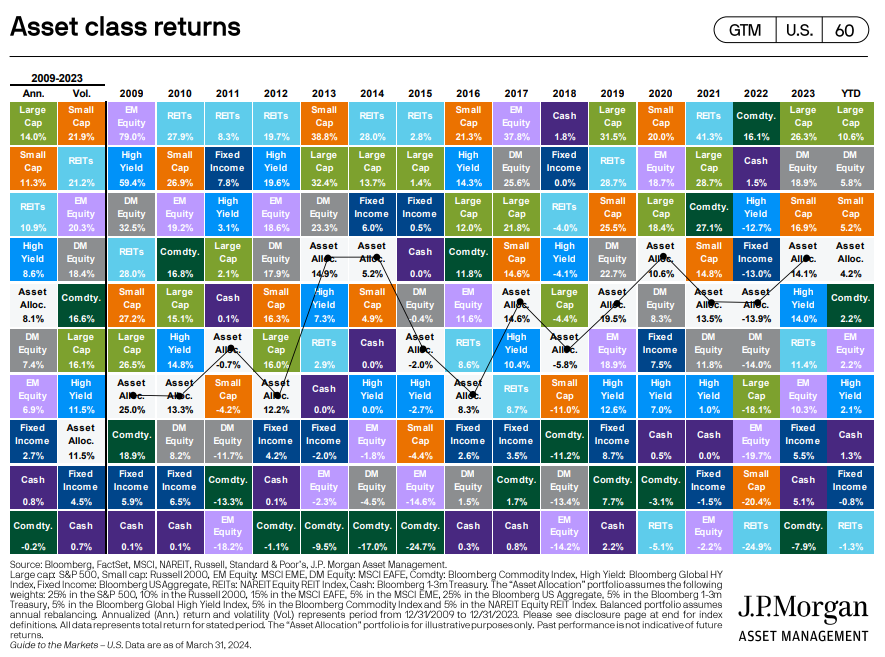

US Large cap stocks have been the story for stock market returns for some time now, but it hasn’t always been the case. And it may not stay that way either. Below is an asset class quilt. It shows the performance of different asset classes by year.

From year to year the order of ‘best to worst’ is rarely the same. The ever-changing ranking is a reason why a diversified portfolio can be beneficial. The investment risk is spread across different investment types all over the world. If one area is performing particularly poorly, chances are another is doing better. As US stocks continue to outpace other areas of the market, a portfolio rebalance could be necessary in the near future. It’s something PDS is watching very closely.

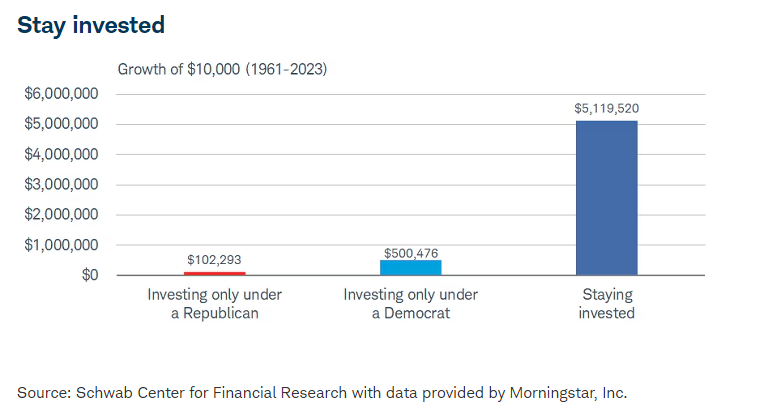

The Presidential election is another topic that will begin gaining more traction in the months ahead. There are a whole host of data looking at market performance for every scenario of Presidential and Congress party combinations; Republican President and a split congress, Democrat President and Republican congress… ultimately, it doesn’t matter. More data isn’t always better. We can’t say it any better than this, so here is the importance of staying investing, explained by Liz Ann Sonders, Chief Investment Strategist and Kevin Gordon, Senior Investment Strategist at Charles Schwab.

“The final chart comes from Schwab’s own chart library and frankly sends the most appropriate message for investors who think trading around election outcomes makes sense. Covering the modern period for the S&P 500, investing only when a Republican was in the White House, a $10K initial investment in 1961 would have grown to more than $102K by 2023. On the other hand, the same $10K initial investment would have grown to more than $500K, investing only when a Democrat was in the White House. Some might stop the analysis there and conclude that staying out under Republican presidents and being in under Democratic presidents is a winning strategy. But the real moral of the story is told with the final bar. The same $10K initially invested in 1961 would have grown to more than $5.1M by just staying invested, without regard for the political party in power.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.