Welcome to our October 2023 Viewpoints, a monthly bulletin from PDS Planning to our valued clients and friends. Our goal with each issue of Viewpoints is to provide you with a wide variety of perspectives on life and wealth. Feel free to share with others.

Lackluster 3rd Quarter

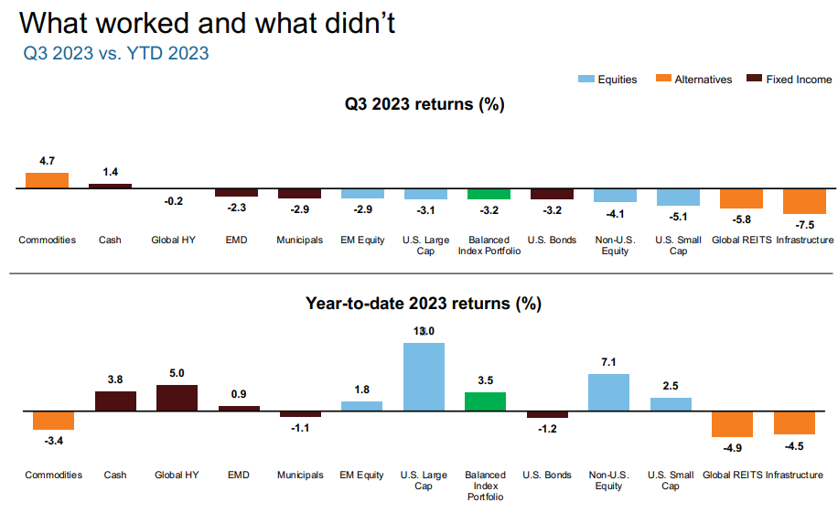

Across the board, all but two asset classes were down in the 3rd quarter. Commodities and cash were king, but only barely. Although there was no place to hide those three months, year to date returns are still doing okay – some up, some down. Which is what we’d expect to see and why investing in a diversified portfolio can be important!

Quick Update on Inflation

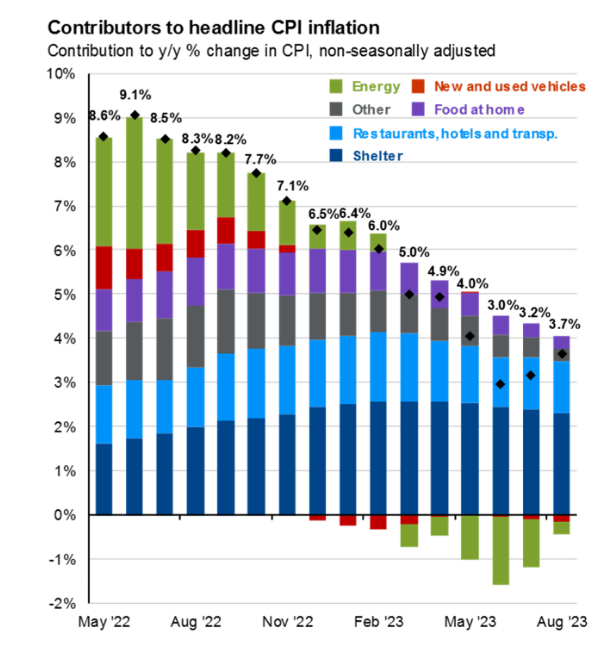

The most recent reading of the Consumer Price Index was higher than expected, but the next 12 months could see continual easing, especially in the shelter category. For a more detailed look, read our latest market commentary.

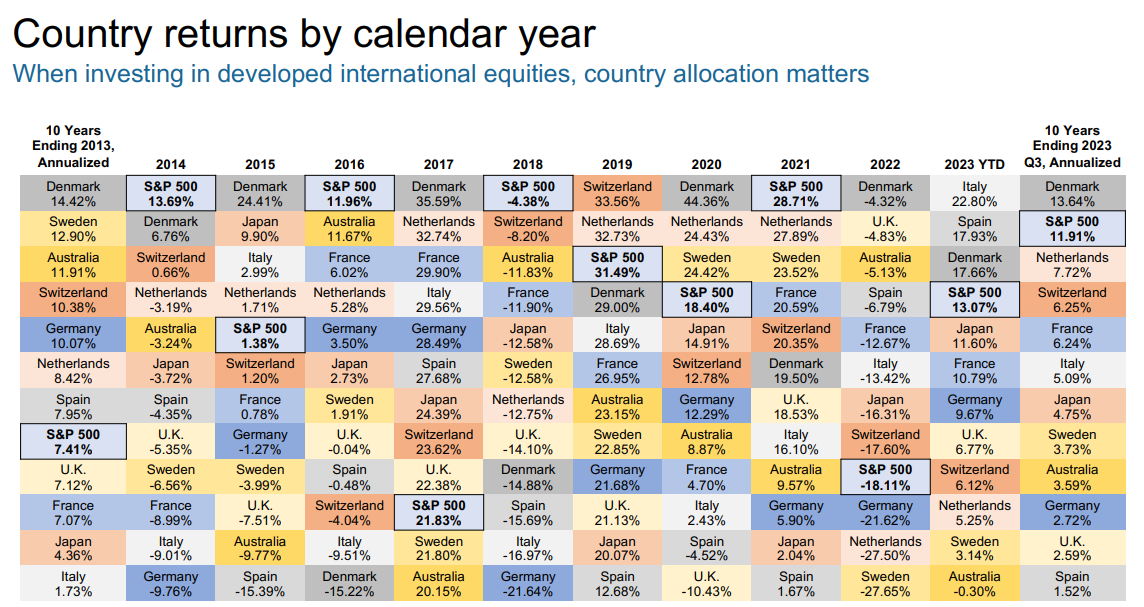

Speaking of Diversification

Diversification talks a big game, but can it back it up? Let’s look at developed country returns over the last 10 years and compare to the previous 10 years to help answer it. Where the S&P 500 is representative of the United States, the implied dominance the index has had isn’t the far and away winner some may think. The column on the far rights is the annualized return from 2013 to 2023 and the column on the far left is the annualized return from 2003 to 2013. Each country has their ups and their downs, but that’s exactly the point. We can’t consistently correctly predict any country will fair better or worse than another any given year, which lends to the argument investor’s should consider owning bits and pieces of all of them to take advantage of the up years when others are down.

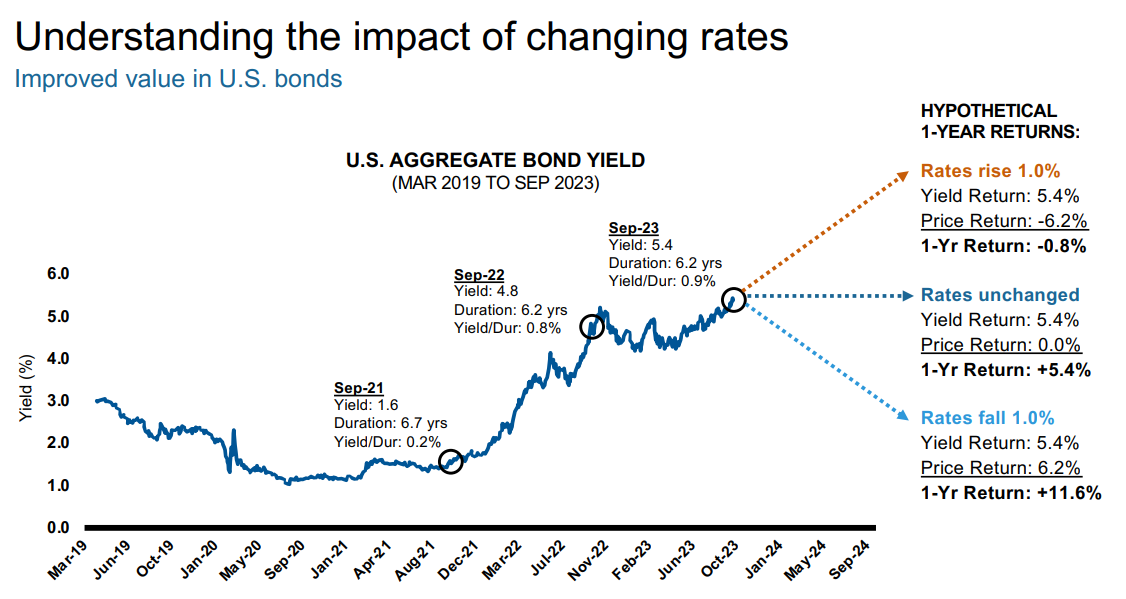

The Impact of Rates on Aggregate Bond

Interest rates and bond prices have an inverse relationship. When rates go up, bond prices go down, with the opposite being true as well. So as the Fed has hiked interest rates with breakneck speed to try and counter inflation, bond prices have fallen. The chart below is a look at the US Aggregate bond index as of September with forward charting estimates based on potential rate changes. Based on current duration and yield, if rates increase 1.0%, we can expect the yield to return 5.4% (current) while experiencing a negative price return of -6.2%. The middle hypothetical shows a 5.4% 1-year return, all earned from the yield. Should rates fall by 1.0%, investors would expect to earn the yield return of 5.4% along with the positive price return of 6.2% for a total 1-year return of 11.6%.

Careful Who you Root For

What do the years 1929, 1930, 1980, and 2008 have in common? There was a financial crisis AND the Philadelphia Phillies won the world series. Yup, numbers don’t lie – if the Phillies win a world series, a recession follows. And this year could be the year for the Fighting Phils. They’ve looked nearly unbeatable these playoffs and are now 2 games away from reaching the World Series. Of course these two events are unrelated; correlation does not equal causation. Leading indicators are still pointing towards a recession at some point, so maybe it’s best to cheer on the Diamondbacks or the Rangers this year because, like Michael Scott from The Office says, “I’m not superstitious, but I am a little sticious.”

IMPORTANT DISCLOSURE INFORMATION: Please remember that past performance is no guarantee of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by PDS Planning, Inc. [“PDS”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from PDS. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. PDS is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the PDS’ current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.pdsplanning.com. Please Note: PDS does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to PDS’ web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Remember: If you are a PDS client, please contact PDS, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Please Also Remember to advise us if you have not been receiving account statements (at least quarterly) from the account custodian.